NJ Division of Taxation ANCHOR Program 2024-2026

Understanding the HI 144 Form

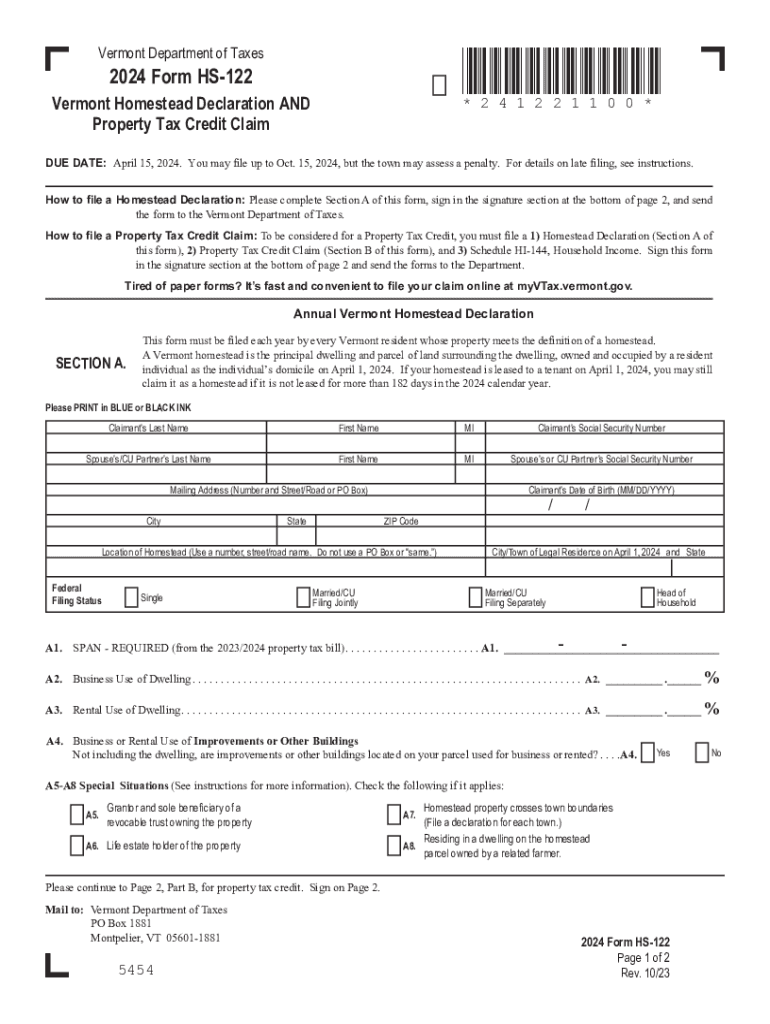

The HI 144 form, also known as the Vermont Homestead Declaration, is a crucial document for Vermont residents. It allows homeowners to declare their primary residence and potentially qualify for property tax benefits. This form is essential for those who wish to take advantage of the state's homestead property tax reduction program, which can significantly lower property taxes for eligible homeowners.

Steps to Complete the HI 144 Form

Filling out the HI 144 form involves several steps. First, gather necessary information, including your property address, the date you purchased the home, and details about any co-owners. Next, accurately complete all sections of the form, ensuring that you declare the property as your primary residence. After filling out the form, review it for accuracy before submitting it to your local tax authority. It is important to keep a copy for your records.

Eligibility Criteria for the HI 144 Form

To qualify for the benefits associated with the HI 144 form, homeowners must meet specific eligibility criteria. The property must be the primary residence of the applicant, and the homeowner must be a Vermont resident. Additionally, any co-owners must also be listed on the form. It is essential to ensure that the property is not used for rental purposes, as this could disqualify the homeowner from receiving tax benefits.

Required Documents for Submission

When submitting the HI 144 form, certain documents may be required to verify eligibility. Homeowners should be prepared to provide proof of residency, such as a utility bill or driver's license with the current address. Additionally, any documentation that supports ownership, like a deed or mortgage statement, may also be necessary. Having these documents ready can streamline the submission process.

Filing Deadlines for the HI 144 Form

It is important to be aware of the filing deadlines for the HI 144 form to ensure that homeowners do not miss out on potential tax benefits. Typically, the form must be filed by April 15 of the tax year to qualify for the upcoming property tax year. Homeowners should check for any specific local deadlines or extensions that may apply to their situation.

Form Submission Methods

The HI 144 form can be submitted in various ways to accommodate different preferences. Homeowners have the option to file the form online through their local tax authority's website, which is often the fastest method. Alternatively, the form can be mailed to the appropriate tax office or submitted in person. It is advisable to confirm the submission method that best suits individual needs and to ensure that the form is sent to the correct address.

Create this form in 5 minutes or less

Find and fill out the correct nj division of taxation anchor program

Create this form in 5 minutes!

How to create an eSignature for the nj division of taxation anchor program

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is hi 144 and how does it relate to airSlate SignNow?

Hi 144 refers to a specific feature set within airSlate SignNow that enhances document management and eSigning capabilities. This feature allows users to streamline their workflows, making it easier to send and sign documents efficiently.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs. The plans are designed to provide flexibility and value, ensuring that users can access the hi 144 features at a cost-effective rate.

-

What features does airSlate SignNow offer with hi 144?

With hi 144, airSlate SignNow provides features such as customizable templates, advanced security options, and real-time tracking of document status. These features are designed to enhance user experience and improve efficiency in document handling.

-

How can airSlate SignNow benefit my business?

By utilizing airSlate SignNow, businesses can signNowly reduce the time spent on document management. The hi 144 features allow for quick eSigning and document sharing, which can lead to faster transaction times and improved customer satisfaction.

-

Is airSlate SignNow easy to integrate with other tools?

Yes, airSlate SignNow is designed for seamless integration with various third-party applications. The hi 144 functionality ensures that users can connect their existing tools, enhancing productivity without disrupting current workflows.

-

Can I try airSlate SignNow before committing to a plan?

Absolutely! airSlate SignNow offers a free trial that allows prospective users to explore the hi 144 features without any commitment. This trial period is a great way to assess how the platform can meet your document management needs.

-

What security measures does airSlate SignNow implement?

airSlate SignNow prioritizes security with features like encryption and secure access controls. The hi 144 capabilities include compliance with industry standards, ensuring that your documents are protected throughout the signing process.

Get more for NJ Division Of Taxation ANCHOR Program

- Air filtration contractor agreement self employed form

- Fireplace contractor agreement self employed form

- Concrete agreement contract form

- Stone contractor agreement self employed form

- Agreement independent contractor sample form

- Window contractor agreement self employed form

- Framework contractor agreement self employed form

- Cabinet contract form

Find out other NJ Division Of Taxation ANCHOR Program

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple