Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children Illinois Form

What is the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children in Illinois

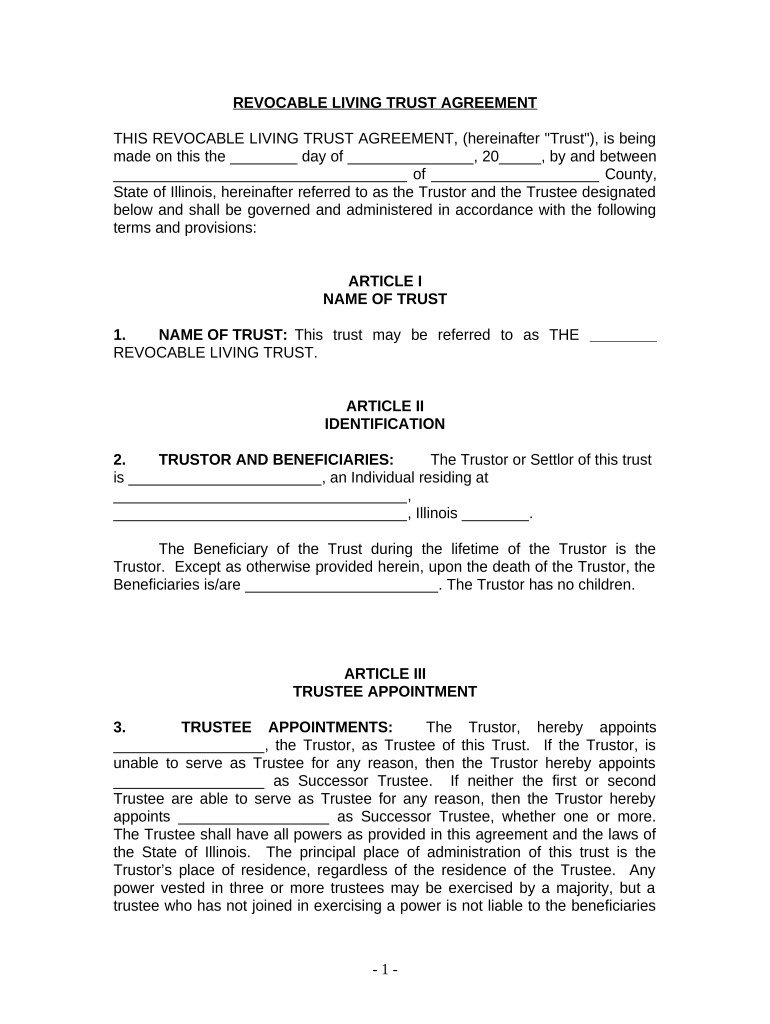

A living trust is a legal document that allows an individual to manage their assets during their lifetime and specify how those assets will be distributed after their death. For individuals who are single, divorced, or widowed without children in Illinois, a living trust can provide a clear framework for asset distribution, ensuring that personal wishes are honored. This type of trust can help avoid the probate process, which can be lengthy and costly, allowing for a more efficient transfer of assets to designated beneficiaries.

How to Use the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children in Illinois

Using a living trust involves several key steps. First, an individual must create the trust document, detailing the assets to be included and the beneficiaries. It is essential to designate a trustee, who will manage the trust according to the terms outlined in the document. Once the trust is established, assets must be transferred into the trust, which may include real estate, bank accounts, and personal property. This transfer ensures that the assets are managed within the trust framework and can be distributed according to the individual's wishes upon their passing.

Steps to Complete the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children in Illinois

Completing a living trust involves a series of methodical steps:

- Determine the assets to be included in the trust.

- Choose a reliable trustee to manage the trust.

- Draft the trust document, outlining the terms and conditions.

- Sign the document in accordance with Illinois state laws.

- Transfer ownership of the chosen assets into the trust.

Each step is crucial to ensure that the living trust is valid and functions as intended.

Legal Use of the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children in Illinois

In Illinois, a living trust is legally recognized and must comply with state laws to be considered valid. This includes proper execution, which typically requires the trustor's signature and, in some cases, the signatures of witnesses. The trust must also clearly outline the distribution of assets and the responsibilities of the trustee. By adhering to these legal requirements, individuals can ensure that their living trust will be enforceable and respected by courts and financial institutions.

State-Specific Rules for the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children in Illinois

Illinois has specific regulations regarding living trusts that individuals must follow. These include the requirement for the trust document to be in writing and signed by the trustor. Additionally, while Illinois does not mandate notarization, having the document notarized can provide an extra layer of protection. It is also important to note that Illinois law allows for the revocation or amendment of a living trust, giving individuals flexibility as their circumstances change.

Required Documents for the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With No Children in Illinois

To create a living trust, several documents are typically required:

- A completed trust agreement outlining the terms of the trust.

- Proof of ownership for assets to be included in the trust, such as deeds or account statements.

- Identification documents for the trustor and trustee.

Gathering these documents ahead of time can streamline the process of establishing a living trust.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with no children illinois

Complete Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Illinois effortlessly on any gadget

Online document management has gained more traction with businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Illinois on any platform using airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Illinois without hassle

- Obtain Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Illinois and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, SMS, or invite link, or download it to your computer.

Purge the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Edit and eSign Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Illinois and ensure effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in Illinois?

A Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in Illinois is a legal estate planning tool that allows individuals to manage and distribute their assets without the need for probate. It helps ensure your wishes are carried out while providing privacy regarding your estate.

-

What are the benefits of setting up a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in Illinois?

The benefits of a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in Illinois include avoiding probate, ensuring your assets are managed according to your wishes, and protecting your estate from potential legal challenges. It's particularly advantageous for those without children, as it allows for more customized asset distribution.

-

How much does it cost to create a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in Illinois?

The cost to create a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in Illinois can vary depending on the complexity of your estate and whether you choose to work with an attorney or utilize an online service. Typically, prices range from a few hundred to a couple of thousand dollars.

-

Can I manage my own Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in Illinois?

Yes, you can manage your own Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in Illinois. As the creator, you retain control over the assets in the trust until your passing or incapacity, allowing for flexibility in managing your estate.

-

What are the differences between a Living Trust and a Will for someone single, divorced, or widowed without children in Illinois?

A Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in Illinois bypasses probate and provides privacy, while a Will is a public document that is subject to probate. Trusts offer greater control over asset management during your life and after death, which can be advantageous for individuals without children.

-

How does a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in Illinois affect tax obligations?

Generally, a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in Illinois does not impact your tax obligations while you are alive and can help avoid estate taxes upon death. However, it's wise to consult a tax professional for guidance specific to your situation.

-

Can a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in Illinois include non-financial assets?

Yes, a Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children in Illinois can include both financial and non-financial assets, such as real estate, personal property, and intellectual property. It's important to properly title these assets in the name of the trust to ensure they are managed according to your wishes.

Get more for Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Illinois

- Professional organizer templates form

- Request letter for deduction amount form

- Nwb50011 form

- Fort lewis pov inspection checklist form

- Monthly attendance records texas department of family and vivacemusicacademy form

- Trade test application form

- Loading message card form

- B2010b mba research report r du toitpdf university of south africa uir unisa ac form

Find out other Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Illinois

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online