Instructions for Form 990 PF Instructions for Form 990 PF, Return of Private Foundation or Section 4947a1 Trust Treated as Priva 2024-2026

Understanding Form 990-PF Instructions

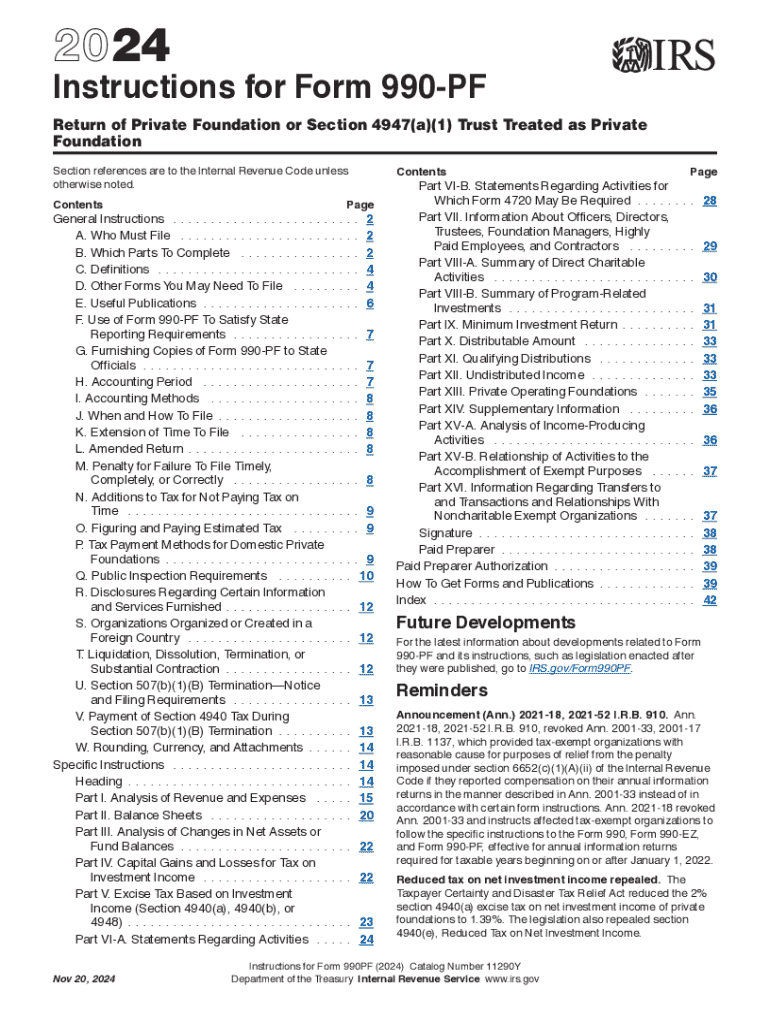

The 2019 990-PF instructions provide essential guidance for private foundations and certain trusts that are treated as private foundations under Section 4947(a)(1) of the Internal Revenue Code. This form is crucial for reporting financial information, including income, expenses, and distributions, to the Internal Revenue Service (IRS). It ensures compliance with federal tax laws and helps maintain transparency in charitable activities.

Steps to Complete the 2019 990-PF Instructions

Completing the 2019 Form 990-PF involves several key steps:

- Gather necessary financial records, including income statements, balance sheets, and prior year tax returns.

- Review the specific sections of the form, ensuring that all required information is accurately reported.

- Calculate the foundation's minimum distribution requirement, which is crucial for compliance.

- Complete the form, ensuring that all fields are filled out correctly and clearly.

- Review the completed form for accuracy before submission.

Key Elements of the 2019 990-PF Instructions

The 2019 990-PF instructions outline several critical components that must be addressed:

- Income and Expenses: Report all sources of income and categorize expenses accurately.

- Assets: Provide a detailed account of the foundation's assets, including investments and real estate.

- Distributions: Document distributions made to charitable organizations, ensuring compliance with the minimum distribution requirement.

- Governance: Include information about the foundation's governing body and any changes in leadership.

Filing Deadlines for Form 990-PF

The filing deadline for the 2019 Form 990-PF is typically the fifteenth day of the fifth month after the end of the foundation's fiscal year. For most foundations operating on a calendar year, this means the form is due by May fifteenth. Extensions may be requested, but it is essential to file on time to avoid penalties.

Obtaining the 2019 990-PF Instructions

The 2019 990-PF instructions can be obtained directly from the IRS website or through various tax preparation software. These instructions provide detailed guidance on how to fill out the form accurately and comply with all relevant regulations. It is advisable to refer to the most current version to ensure all updates and changes are incorporated.

Penalties for Non-Compliance

Failure to file the 2019 Form 990-PF on time or inaccuracies in reporting can result in significant penalties. The IRS may impose fines based on the size of the foundation and the length of the delay. Understanding these penalties emphasizes the importance of timely and accurate filing to maintain compliance and avoid unnecessary financial repercussions.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 990 pf instructions for form 990 pf return of private foundation or section 4947a1 trust treated as

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 990 pf instructions for form 990 pf return of private foundation or section 4947a1 trust treated as

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the 2019 990 pf instructions?

The 2019 990 pf instructions provide detailed guidance on how to complete the Form 990-PF, which is required for private foundations. These instructions cover eligibility, reporting requirements, and specific line item explanations to ensure compliance with IRS regulations.

-

How can airSlate SignNow help with the 2019 990 pf instructions?

airSlate SignNow simplifies the process of preparing and signing documents related to the 2019 990 pf instructions. With our platform, you can easily upload, edit, and eSign your forms, ensuring that all necessary information is accurately captured and submitted on time.

-

Are there any costs associated with using airSlate SignNow for 2019 990 pf instructions?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions ensure that you can efficiently manage your document signing process while adhering to the 2019 990 pf instructions without breaking the bank.

-

What features does airSlate SignNow offer for managing 2019 990 pf instructions?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, all of which are essential for managing the 2019 990 pf instructions. These tools help streamline your workflow and enhance collaboration among team members.

-

Can I integrate airSlate SignNow with other software for 2019 990 pf instructions?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage your 2019 990 pf instructions alongside your existing tools. This integration enhances productivity and ensures that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for 2019 990 pf instructions?

Using airSlate SignNow for your 2019 990 pf instructions offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, making compliance easier than ever.

-

Is airSlate SignNow user-friendly for completing 2019 990 pf instructions?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate and complete the 2019 990 pf instructions. Our intuitive interface allows users to quickly upload documents, add signatures, and manage their workflows without any technical expertise.

Get more for Instructions For Form 990 PF Instructions For Form 990 PF, Return Of Private Foundation Or Section 4947a1 Trust Treated As Priva

Find out other Instructions For Form 990 PF Instructions For Form 990 PF, Return Of Private Foundation Or Section 4947a1 Trust Treated As Priva

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form