About Form 4952, Investment Interest Expense Deduction 2024-2026

Understanding Form 4952: Investment Interest Expense Deduction

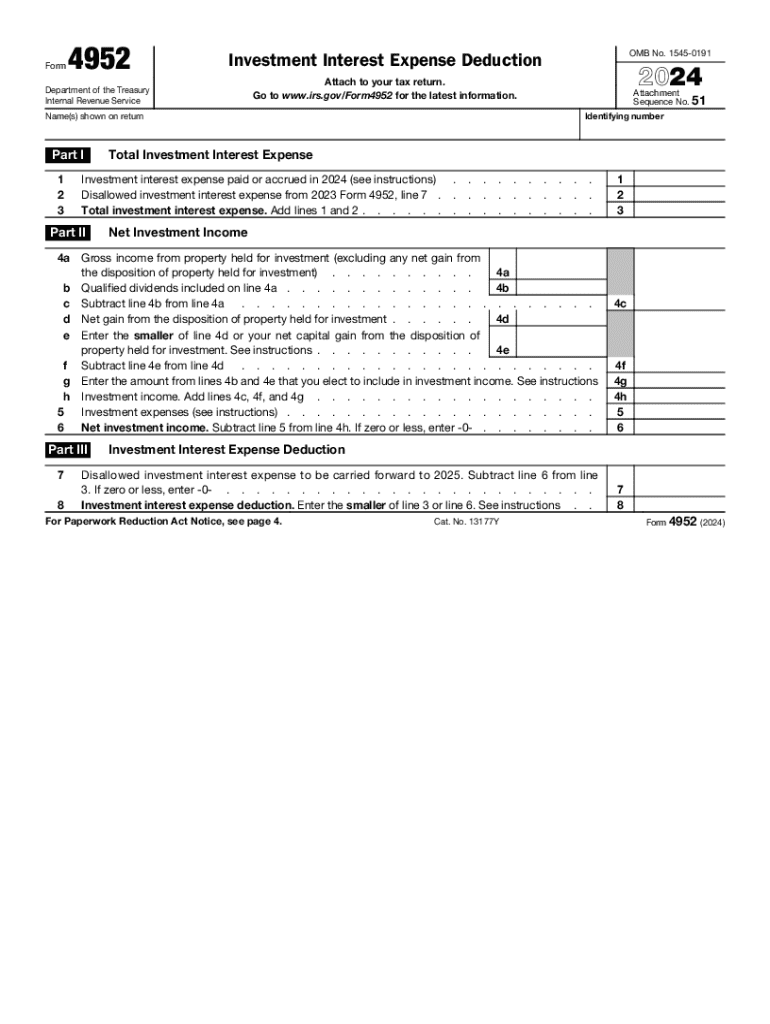

Form 4952 is designed for taxpayers who want to claim the investment interest expense deduction. This deduction allows individuals to deduct interest paid on loans used to purchase investments, such as stocks or bonds. To qualify, the interest must be related to investments that generate taxable income. It is essential to understand the specifics of this form to ensure compliance with IRS regulations and maximize potential deductions.

Steps to Complete Form 4952

Completing Form 4952 involves several key steps. First, gather all necessary documentation, including records of investment interest expenses and income. Next, calculate the total investment interest expense you wish to deduct. This amount should not exceed your net investment income for the year. You will then fill out the form, detailing your investment interest expenses and income. Finally, ensure that the completed form is attached to your tax return when filing.

Eligibility Criteria for Investment Interest Expense Deduction

To qualify for the investment interest expense deduction, taxpayers must meet specific eligibility criteria. The interest expense must be paid on a loan used to purchase investments that generate taxable income. Additionally, the deduction is limited to the amount of net investment income for the year. Taxpayers who do not have sufficient net investment income can carry forward the unused deduction to future tax years.

IRS Guidelines for Form 4952

The IRS provides detailed guidelines for completing Form 4952. These guidelines outline what constitutes deductible investment interest expenses and how to report them accurately. Taxpayers should refer to the IRS instructions for Form 4952 to understand the nuances of reporting investment income and expenses. Following these guidelines is crucial to avoid potential issues during tax filing and ensure compliance with tax laws.

Required Documents for Filing Form 4952

When filing Form 4952, taxpayers should prepare several documents to support their claims. These documents include records of interest payments made on loans used for investment purposes, statements detailing investment income, and any relevant brokerage statements. Having these documents organized and readily available will facilitate the completion of the form and help substantiate the deduction if questioned by the IRS.

Penalties for Non-Compliance with Form 4952

Failure to comply with the requirements associated with Form 4952 can result in penalties. If the IRS determines that a taxpayer has incorrectly claimed the investment interest expense deduction, they may face additional taxes, interest on unpaid amounts, and potential penalties. It is important to ensure accuracy and adherence to IRS guidelines when completing the form to avoid these consequences.

Filing Deadlines for Form 4952

Form 4952 must be filed along with your annual tax return, which is typically due on April fifteenth of each year. If you require additional time to prepare your return, you can file for an extension, but it is essential to ensure that Form 4952 is submitted by the extended deadline. Staying aware of these deadlines helps prevent late fees and ensures timely processing of your tax return.

Create this form in 5 minutes or less

Find and fill out the correct about form 4952 investment interest expense deduction

Create this form in 5 minutes!

How to create an eSignature for the about form 4952 investment interest expense deduction

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the investment interest expense deduction?

The investment interest expense deduction allows taxpayers to deduct interest paid on loans used to purchase investments. This deduction can help reduce taxable income, making it a valuable tax strategy for investors. Understanding how to properly claim this deduction is essential for maximizing your tax benefits.

-

How can airSlate SignNow help with managing investment interest expense deductions?

airSlate SignNow streamlines the process of signing and managing documents related to investment interest expense deductions. With our easy-to-use platform, you can quickly send and eSign necessary forms, ensuring you meet all deadlines. This efficiency can help you focus on maximizing your deductions.

-

What features does airSlate SignNow offer for tax documentation?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documentation. These features ensure that your investment interest expense deduction paperwork is organized and easily accessible. This can save you time and reduce the risk of errors.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow provides a cost-effective solution for small businesses looking to manage their investment interest expense deduction documents. Our pricing plans are designed to fit various budgets, allowing you to choose the best option for your needs. This affordability makes it easier for small businesses to stay compliant and organized.

-

Can I integrate airSlate SignNow with my existing accounting software?

Absolutely! airSlate SignNow offers integrations with popular accounting software, making it easy to manage your investment interest expense deduction documents alongside your financial records. This seamless integration helps ensure that all your financial data is synchronized and up-to-date.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including those for investment interest expense deductions, provides numerous benefits. You gain access to a secure platform that enhances document management and reduces turnaround times. This efficiency can lead to better tax outcomes and peace of mind.

-

How does airSlate SignNow ensure the security of my documents?

airSlate SignNow prioritizes the security of your documents with advanced encryption and compliance with industry standards. This ensures that your sensitive information related to investment interest expense deductions is protected. You can confidently manage your documents without worrying about data bsignNowes.

Get more for About Form 4952, Investment Interest Expense Deduction

Find out other About Form 4952, Investment Interest Expense Deduction

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure