Form 940 Schedule AInstructions & Filing Guide 2024-2026

Understanding Form 940 Schedule A

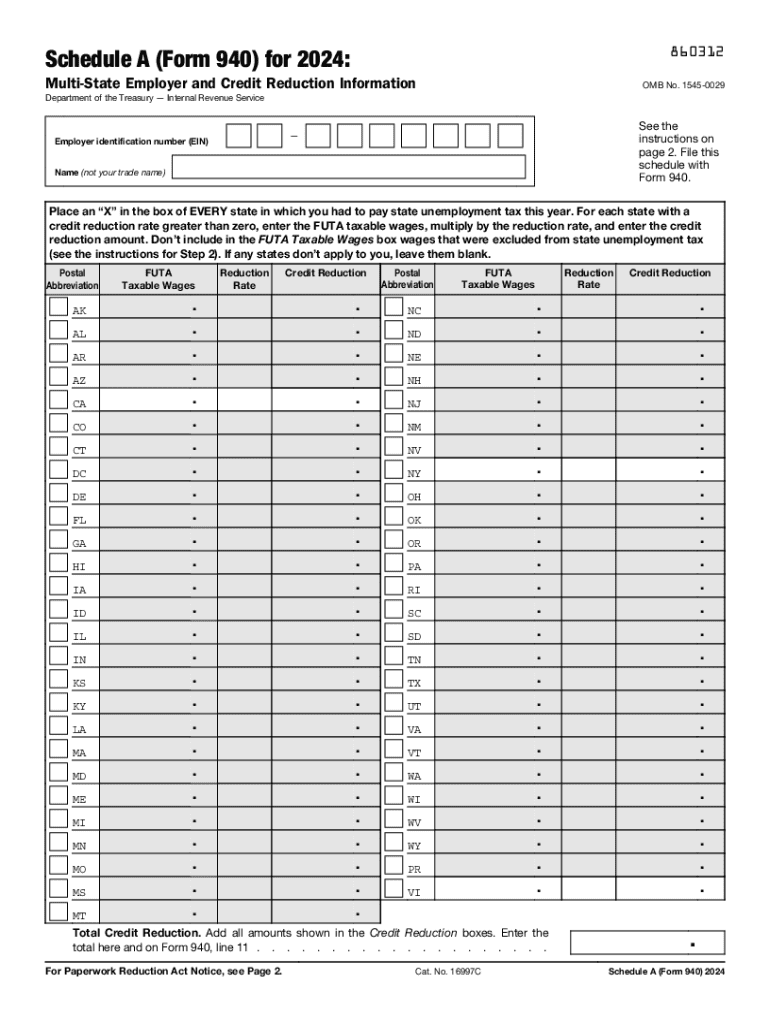

Form 940 Schedule A is a crucial document for employers who need to report their Federal Unemployment Tax Act (FUTA) liability. This form helps determine the amount of unemployment tax owed to the federal government. Employers must complete this schedule if they have had a credit reduction in their state due to borrowing from the federal government to pay unemployment benefits. Understanding the requirements and implications of this form is essential for accurate tax reporting.

Steps to Complete Form 940 Schedule A

Completing Form 940 Schedule A involves several key steps:

- Gather necessary information, including your business details and any state unemployment tax information.

- Determine if your state has a credit reduction. This is crucial as it affects your overall tax liability.

- Fill out the form accurately, ensuring all required sections are completed, particularly those related to your state’s unemployment tax situation.

- Review the form for accuracy before submission to avoid potential penalties.

Filing Deadlines for Form 940 Schedule A

It is important to be aware of filing deadlines to ensure compliance. Generally, Form 940 and its Schedule A are due on January 31 of the year following the tax year being reported. If you are unable to meet this deadline, you may file for an extension, but be aware that any taxes owed must still be paid on time to avoid penalties and interest.

Legal Use of Form 940 Schedule A

The legal use of Form 940 Schedule A is essential for employers to report any credit reductions accurately. This form must be filed in accordance with IRS regulations, and failure to do so can lead to significant penalties. Employers should ensure they are familiar with both federal and state requirements to maintain compliance.

Examples of Using Form 940 Schedule A

Employers may encounter various scenarios when using Form 940 Schedule A. For instance, a business in a state that has borrowed from the federal government may need to report a credit reduction. This can occur if the state has not repaid its loans for unemployment benefits. Understanding how to fill out this form correctly in such situations is vital for accurate tax reporting.

IRS Guidelines for Form 940 Schedule A

The IRS provides specific guidelines for completing Form 940 Schedule A. These guidelines include instructions on how to calculate credit reductions and what information is required. It is advisable for employers to refer to the latest IRS publications to ensure compliance and accuracy when completing this form.

Create this form in 5 minutes or less

Find and fill out the correct form 940 schedule ainstructions amp filing guide

Create this form in 5 minutes!

How to create an eSignature for the form 940 schedule ainstructions amp filing guide

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow for managing PA tax forms 2024?

airSlate SignNow offers a user-friendly interface that simplifies the process of sending and eSigning PA tax forms 2024. Key features include customizable templates, real-time tracking, and secure cloud storage, ensuring that your documents are easily accessible and compliant with state regulations.

-

How does airSlate SignNow help with the completion of PA tax forms 2024?

With airSlate SignNow, you can easily fill out and eSign PA tax forms 2024 online. The platform allows you to collaborate with team members, ensuring that all necessary information is accurately captured and submitted on time, reducing the risk of errors.

-

Is airSlate SignNow cost-effective for businesses needing PA tax forms 2024?

Yes, airSlate SignNow is a cost-effective solution for businesses looking to manage PA tax forms 2024. With flexible pricing plans, you can choose the option that best fits your needs, allowing you to save money while ensuring compliance and efficiency.

-

Can I integrate airSlate SignNow with other software for PA tax forms 2024?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, making it easy to manage PA tax forms 2024 alongside your existing tools. This integration capability enhances workflow efficiency and ensures that all your documents are in one place.

-

What benefits does airSlate SignNow provide for eSigning PA tax forms 2024?

Using airSlate SignNow for eSigning PA tax forms 2024 provides numerous benefits, including faster turnaround times and enhanced security. The platform ensures that your documents are signed quickly and securely, helping you meet deadlines without compromising on safety.

-

How secure is airSlate SignNow when handling PA tax forms 2024?

Security is a top priority for airSlate SignNow. When handling PA tax forms 2024, the platform employs advanced encryption and compliance with industry standards to protect your sensitive information, giving you peace of mind while managing your documents.

-

What support options are available for users of airSlate SignNow for PA tax forms 2024?

airSlate SignNow provides comprehensive support options for users managing PA tax forms 2024. You can access a knowledge base, live chat, and email support to ensure that any questions or issues are promptly addressed, helping you maximize the platform's capabilities.

Get more for Form 940 Schedule AInstructions & Filing Guide

- Rebus stories pdf form

- Nexus letter 100000714 form

- Notice of privacy practices pdf form

- Mutualofomaharx com form

- Usarec forms

- Bof 8016rr request for live scan service bof 8016rr request for live scan service form

- Ip market hmo standard expanded bronze pd form

- Hazel green high school student parking permit application 786954588 form

Find out other Form 940 Schedule AInstructions & Filing Guide

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template