Form 8027 Employer's Annual Information Return of Tip Income and Allocated Tips 2024-2026

What is the Form 8027 Employer's Annual Information Return Of Tip Income And Allocated Tips

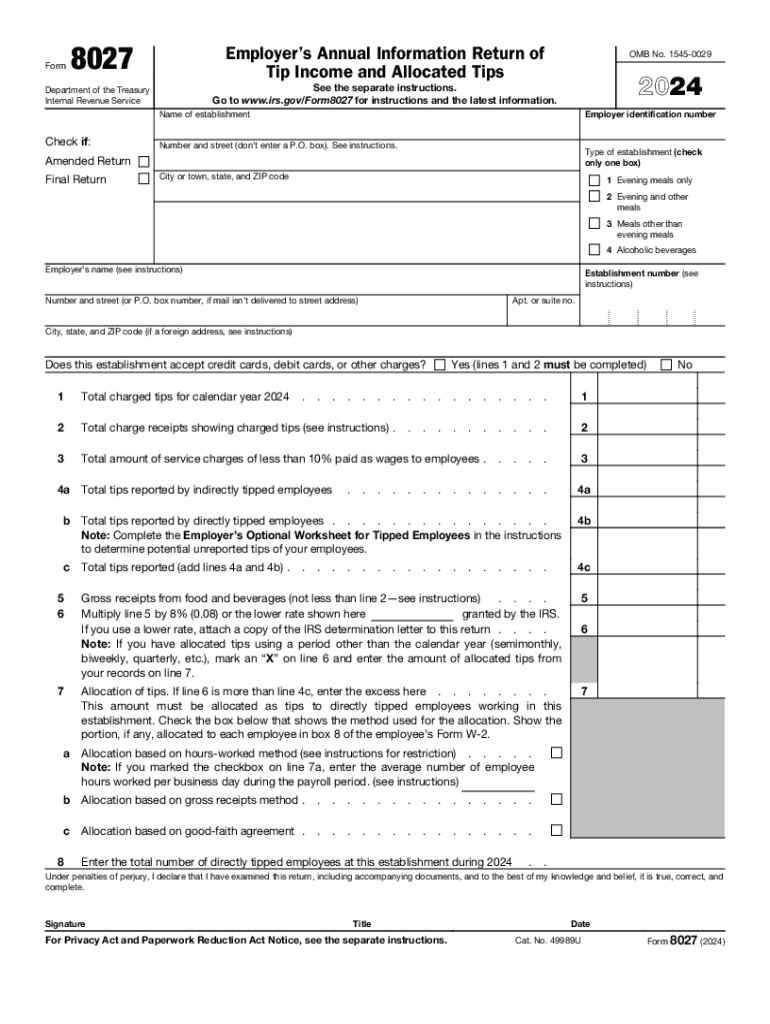

The Form 8027 is a crucial document used by employers in the United States to report tip income and allocated tips for their employees. This form is specifically designed for businesses in the food and beverage industry, where tipping is a common practice. By filing this form, employers provide the IRS with essential information regarding the total tips received by employees, ensuring compliance with federal tax regulations.

Employers who are required to file Form 8027 must do so if they operate a large food or beverage establishment, defined as one that has more than ten employees who receive tips. This form helps the IRS track tip income and ensures that employees report their earnings accurately on their tax returns.

How to use the Form 8027 Employer's Annual Information Return Of Tip Income And Allocated Tips

Using Form 8027 involves several steps to ensure accurate reporting of tip income. First, employers must gather all relevant data regarding tips received by employees during the reporting period. This includes both cash tips and tips received through credit card transactions.

Next, employers should complete the form by providing necessary details such as the establishment's name, address, and employer identification number (EIN). The total tip income must be reported, along with any allocated tips. It is important to follow the IRS instructions carefully to avoid errors that could lead to penalties.

Once completed, the form must be submitted to the IRS by the specified deadline, typically by the end of February of the following year. Employers should keep a copy of the form for their records, as it serves as proof of compliance.

Steps to complete the Form 8027 Employer's Annual Information Return Of Tip Income And Allocated Tips

Completing Form 8027 requires a systematic approach to ensure all information is accurately reported. Here are the key steps:

- Gather all necessary information about the establishment and employees.

- Calculate the total tip income received by employees during the reporting period.

- Determine the allocated tips based on the IRS guidelines.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or missing information.

- Submit the completed form to the IRS by the deadline.

Key elements of the Form 8027 Employer's Annual Information Return Of Tip Income And Allocated Tips

Form 8027 includes several key elements that employers must be aware of when filing. These elements include:

- Establishment Information: Name, address, and EIN of the business.

- Total Tip Income: The total amount of tips received by employees during the reporting period.

- Allocated Tips: The amount of tips allocated to employees based on IRS guidelines.

- Employee Count: The number of employees who received tips during the reporting period.

- Signature: The form must be signed by an authorized representative of the establishment.

Filing Deadlines / Important Dates

Filing deadlines for Form 8027 are critical for compliance. Employers must submit the form to the IRS by the last day of February for the previous calendar year. If the deadline falls on a weekend or holiday, it is extended to the next business day. Employers should also be aware of any state-specific deadlines that may apply.

It is advisable for employers to plan ahead and gather all necessary information well in advance of the deadline to avoid last-minute issues.

Penalties for Non-Compliance

Failure to file Form 8027 on time or providing inaccurate information can result in significant penalties. The IRS imposes fines for late filings, which can increase depending on how late the form is submitted. Additionally, if an employer fails to report tip income accurately, employees may face tax liabilities for unreported earnings.

To avoid these penalties, it is essential for employers to ensure timely and accurate completion of the form, as well as to maintain thorough records of tip income and allocations.

Create this form in 5 minutes or less

Find and fill out the correct form 8027 employers annual information return of tip income and allocated tips

Create this form in 5 minutes!

How to create an eSignature for the form 8027 employers annual information return of tip income and allocated tips

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are some essential IRS tips for businesses using airSlate SignNow?

When using airSlate SignNow, it's crucial to keep IRS tips in mind, such as ensuring all electronic signatures comply with IRS regulations. Additionally, maintain organized records of signed documents for tax purposes, as this can simplify your filing process. Utilizing our platform can help streamline these tasks efficiently.

-

How does airSlate SignNow help with IRS compliance?

airSlate SignNow is designed to support IRS compliance by providing secure electronic signatures that meet legal standards. Our platform ensures that all signed documents are stored securely and can be easily retrieved for audits or tax filings. Following IRS tips for document management can enhance your compliance efforts.

-

What pricing options are available for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Our plans are designed to be cost-effective while providing essential features that align with IRS tips for document management. You can choose a plan that fits your budget and requirements, ensuring you get the best value.

-

What features does airSlate SignNow offer to enhance document signing?

Our platform includes features such as customizable templates, real-time tracking, and secure storage, all of which are essential for effective document management. These features align with IRS tips by ensuring that your documents are not only signed but also organized and easily accessible. This can signNowly improve your workflow.

-

Can airSlate SignNow integrate with other software for better efficiency?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your overall efficiency. By connecting with tools you already use, you can streamline your document signing process while adhering to IRS tips for maintaining organized records. This integration helps reduce manual work and errors.

-

What are the benefits of using airSlate SignNow for eSigning documents?

Using airSlate SignNow for eSigning documents offers numerous benefits, including increased speed, security, and convenience. By following IRS tips for electronic signatures, you can ensure that your documents are legally binding and compliant. This not only saves time but also enhances your business's professionalism.

-

How does airSlate SignNow ensure the security of signed documents?

airSlate SignNow prioritizes the security of your signed documents through advanced encryption and secure storage solutions. This is particularly important when considering IRS tips for document retention and security. Our platform ensures that your sensitive information remains protected while being easily accessible when needed.

Get more for Form 8027 Employer's Annual Information Return Of Tip Income And Allocated Tips

Find out other Form 8027 Employer's Annual Information Return Of Tip Income And Allocated Tips

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free