Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children Massachusetts Form

Understanding the Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children in Massachusetts

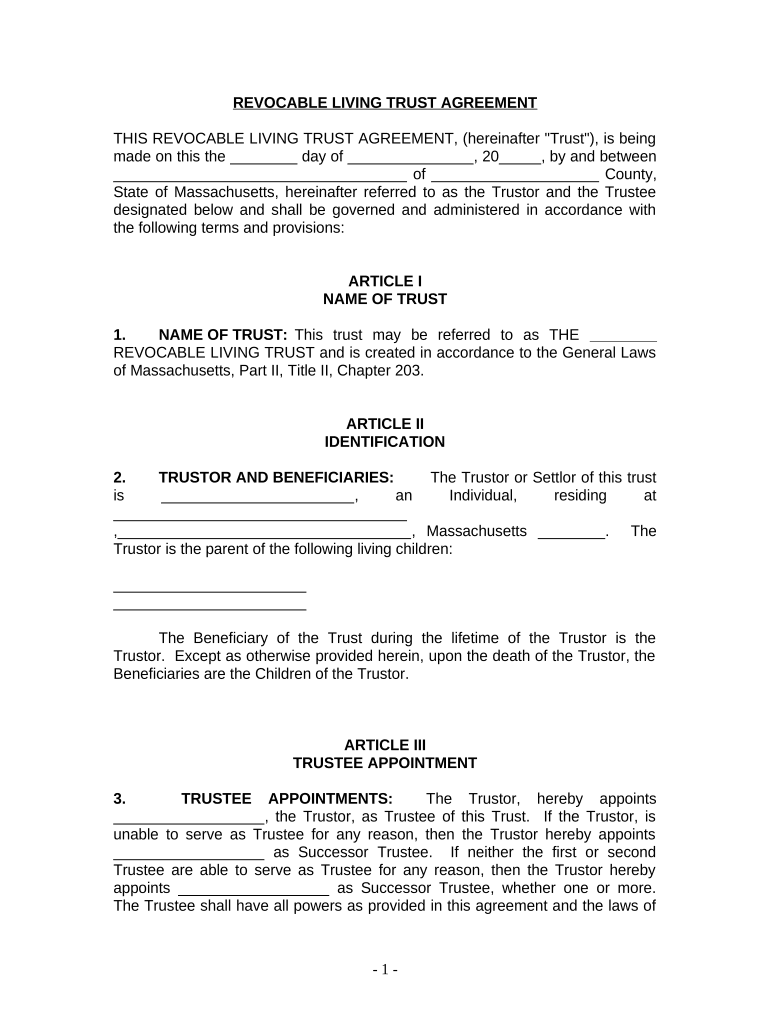

A living trust is a legal arrangement that allows an individual to place their assets into a trust during their lifetime. For those who are single, divorced, or widowed with children in Massachusetts, a living trust can be particularly beneficial. This type of trust helps in managing assets, avoiding probate, and ensuring that children are cared for according to the individual's wishes. The trust remains revocable, meaning the individual can modify or dissolve it at any time, providing flexibility as circumstances change.

Steps to Complete the Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children in Massachusetts

Completing a living trust involves several key steps:

- Identify your assets: List all properties, bank accounts, investments, and personal belongings you wish to include in the trust.

- Choose a trustee: Select a trustworthy individual or institution to manage the trust. This can be yourself or someone else.

- Draft the trust document: Outline the terms of the trust, including how assets will be managed and distributed. It’s advisable to consult a legal professional for this step.

- Sign the document: Execute the trust document in accordance with Massachusetts law, which may require witnesses or notarization.

- Fund the trust: Transfer ownership of your assets into the trust to ensure they are managed according to your wishes.

Legal Use of the Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children in Massachusetts

The living trust serves as a legally binding document that dictates how your assets are handled during your lifetime and after your death. In Massachusetts, this trust must comply with state laws governing trusts and estates. It is essential to ensure that the trust is properly executed and funded to be effective. The trust can help avoid the lengthy probate process, allowing for quicker distribution of assets to beneficiaries.

Key Elements of the Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children in Massachusetts

Several key elements define a living trust:

- Revocability: The trust can be altered or revoked at any time by the grantor.

- Trustee: The individual or entity responsible for managing the trust assets.

- Beneficiaries: Individuals or entities designated to receive the assets upon the grantor's death.

- Asset management: Guidelines for how the trustee should manage and distribute the assets.

State-Specific Rules for the Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children in Massachusetts

Massachusetts has specific regulations regarding living trusts, including requirements for creation, funding, and administration. It is important to adhere to state laws to ensure the trust is valid. This includes understanding the necessary legal language, execution requirements, and any tax implications that may arise from establishing a trust. Consulting a local attorney who specializes in estate planning can provide clarity on these regulations.

How to Obtain the Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children in Massachusetts

Obtaining a living trust typically involves consulting with an estate planning attorney who can help draft the trust document according to your specific needs and Massachusetts laws. You may also find templates and resources online, but professional guidance ensures that your trust is legally sound and tailored to your unique circumstances. Once the document is prepared, it must be executed properly to be effective.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with children massachusetts

Finalize Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Massachusetts effortlessly on any gadget

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without interruptions. Handle Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Massachusetts on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to modify and eSign Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Massachusetts with ease

- Obtain Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Massachusetts and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections of the documents or redact confidential information using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Decide how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs within a few clicks from your preferred device. Modify and eSign Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Massachusetts and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Massachusetts?

A Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Massachusetts is a legal document that allows you to manage your assets during your lifetime and specify how they should be distributed upon your death. This type of trust helps avoid probate, ensuring a smoother transfer of assets to your children.

-

How does a Living Trust benefit single parents in Massachusetts?

Creating a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Massachusetts provides essential benefits for single parents. It ensures that your children are taken care of financially, and you can designate guardianship within the trust, which protects your children's interests in case of your absence.

-

What are the costs associated with setting up a Living Trust in Massachusetts?

The costs for establishing a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Massachusetts can vary, but generally, legal fees range from $1,500 to $3,000. Factors influencing the cost include the complexity of your estate and additional services like document filing or revisions.

-

Can I change my Living Trust after it is created?

Yes, a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Massachusetts is revocable, meaning you can modify or revoke it at any time as your circumstances change. This flexibility ensures that your assets are always aligned with your wishes and family needs.

-

How does a Living Trust help with tax implications for widows and widowers?

A Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Massachusetts can be designed to minimize tax implications by strategically planning asset distribution. It may help in providing tax benefits during estate settlement and can ensure that your children receive the maximum benefit from your estate.

-

What are the key features of airSlate SignNow for creating a Living Trust?

airSlate SignNow offers a streamlined process for crafting a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Massachusetts. Key features include an easy-to-use interface, template personalization, electronic signing, and document storage, all in one cost-effective solution.

-

Is a Living Trust necessary if I have a will?

While a will is important, a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Massachusetts offers additional benefits such as avoiding probate and maintaining privacy. It’s advisable to have both to ensure comprehensive estate planning that caters to the best interests of your children.

Get more for Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Massachusetts

- Business information form

- Authorization agreement for direct deposit form

- Account application form template nz

- Universiteit aansoek vorm form

- Manulife group benefits extended health care claim form

- State tax registration application the payroll center form

- Freight dispatch agreement template form

- Franchise purchase agreement template form

Find out other Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Massachusetts

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online