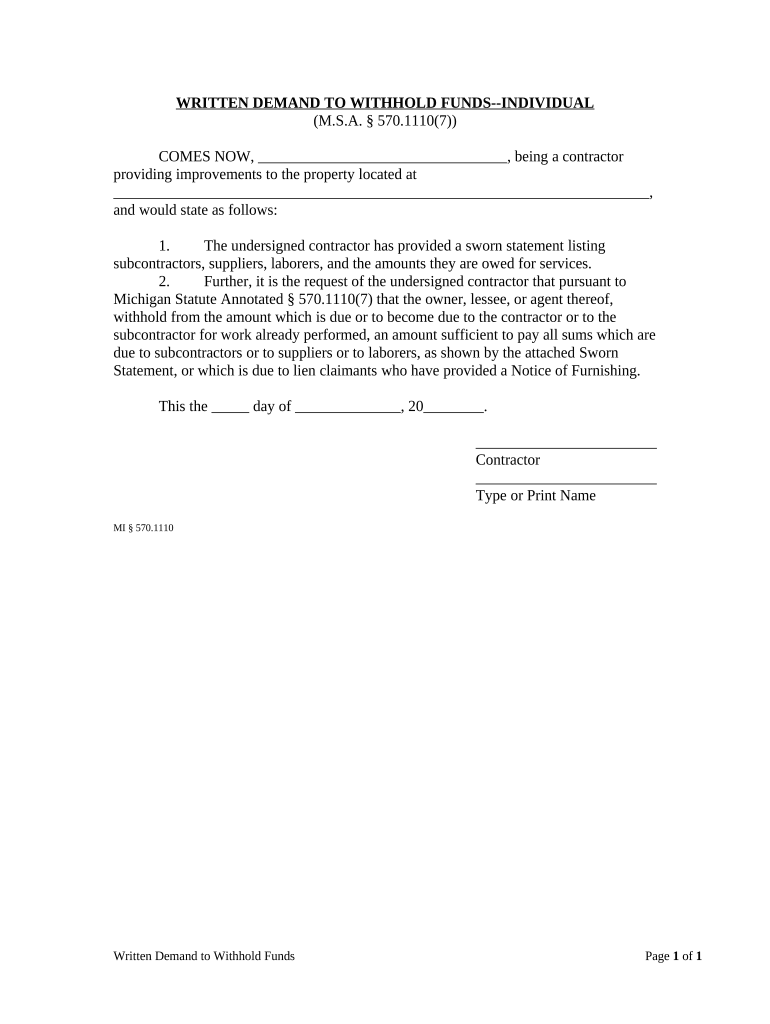

Michigan Withhold Form

What is the Michigan Withhold

The Michigan Withhold form is a crucial document used for tax purposes in the state of Michigan. It is primarily utilized by employers to report and remit state income tax withheld from employees' wages. This form ensures compliance with state tax laws and helps maintain accurate records of tax contributions made by employees throughout the year.

Steps to complete the Michigan Withhold

Completing the Michigan Withhold form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the employee's name, Social Security number, and wage details. Next, calculate the amount of state tax to withhold based on the employee's earnings and the applicable tax rates. Once the calculations are complete, fill out the form carefully, ensuring all fields are accurately completed. Finally, submit the form according to state guidelines, keeping a copy for your records.

Legal use of the Michigan Withhold

The legal use of the Michigan Withhold form is governed by state tax regulations. To be considered valid, the form must be filled out correctly and submitted on time. Employers are responsible for withholding the correct amount of state tax from employee wages and remitting it to the state. Failure to comply with these regulations can result in penalties and interest charges. It is essential for employers to stay informed about any changes in tax laws that may affect their withholding obligations.

Key elements of the Michigan Withhold

Several key elements are essential when dealing with the Michigan Withhold form. These include the employee's personal information, the employer's identification details, and the specific amounts withheld for state income tax. Additionally, the form may require information about exemptions or adjustments that could affect the withholding amount. Understanding these elements is critical for ensuring the form is completed accurately and complies with state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Michigan Withhold form are critical for compliance. Employers must submit the form by the designated due dates to avoid penalties. Typically, the form is due quarterly, but specific deadlines may vary based on the employer's tax filing schedule. It is important to stay updated on these dates to ensure timely submissions and avoid any potential issues with the Michigan Department of Treasury.

Form Submission Methods (Online / Mail / In-Person)

The Michigan Withhold form can be submitted through various methods, providing flexibility for employers. Submissions can be made online via the Michigan Department of Treasury's e-filing system, which offers a streamlined process. Alternatively, employers may choose to mail the completed form to the appropriate address or submit it in person at designated state offices. Each method has its own guidelines and timelines, so it is important to select the one that best suits your needs.

Penalties for Non-Compliance

Non-compliance with the Michigan Withhold regulations can lead to significant penalties for employers. These may include fines, interest on unpaid taxes, and potential legal action by the state. It is crucial for employers to adhere to all filing requirements and deadlines to avoid these consequences. Regular audits and reviews of withholding practices can help ensure compliance and mitigate risks associated with non-compliance.

Quick guide on how to complete michigan withhold

Effortlessly Prepare Michigan Withhold on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Michigan Withhold on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

Effortless Editing and eSigning of Michigan Withhold

- Find Michigan Withhold and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with the tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, exhausting form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Michigan Withhold to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the purpose of michigan withhold forms?

The 'michigan withhold' forms are essential for employers to withhold the correct amount of state income tax from employee wages. Utilizing airSlate SignNow enables businesses to easily fill, sign, and manage these forms digitally, ensuring compliance while streamlining the process.

-

How can airSlate SignNow help with michigan withhold document management?

airSlate SignNow offers a user-friendly platform for managing michigan withhold documents efficiently. You can create, send, and eSign these forms, reducing the time spent on paperwork and enhancing workflow efficiency in your organization.

-

Is airSlate SignNow cost-effective for handling michigan withhold forms?

Yes, airSlate SignNow is a cost-effective solution for managing michigan withhold forms. With various pricing plans available, businesses can choose the one that best fits their needs while benefiting from features that streamline the signing process.

-

What features does airSlate SignNow provide for michigan withhold forms?

airSlate SignNow includes features like customizable templates, automated reminders, and secure cloud storage specifically designed to handle michigan withhold forms. These features help ensure you never miss filing deadlines and maintain organized records.

-

Can airSlate SignNow integrate with other tools for michigan withhold processes?

Absolutely! airSlate SignNow integrates with popular applications like Google Drive and Dropbox, allowing seamless management of michigan withhold forms and other documents. This integration simplifies document sharing and keeps your workflows connected.

-

What are the benefits of using airSlate SignNow for michigan withhold documentation?

Using airSlate SignNow for michigan withhold documentation offers various benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that your documents are always accessible and easy to manage, providing peace of mind for your business.

-

Is there customer support available for michigan withhold related inquiries?

Yes, airSlate SignNow offers robust customer support for any michigan withhold related inquiries. Our team is always ready to help you navigate any issues or answer questions to ensure your experience with the platform is smooth and successful.

Get more for Michigan Withhold

- Tgr attestation de salaire form

- Uk finance disclosure form

- Health new england here to there form

- Hair transplant consent form 346812466

- 1 8 incident report form services for people with disabilities dspd utah

- Instructions to student ucr uceap academic planning form

- Judicial title forms 27315829

- Dswd authorization letter form

Find out other Michigan Withhold

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast