Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children Michigan Form

What is the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Michigan

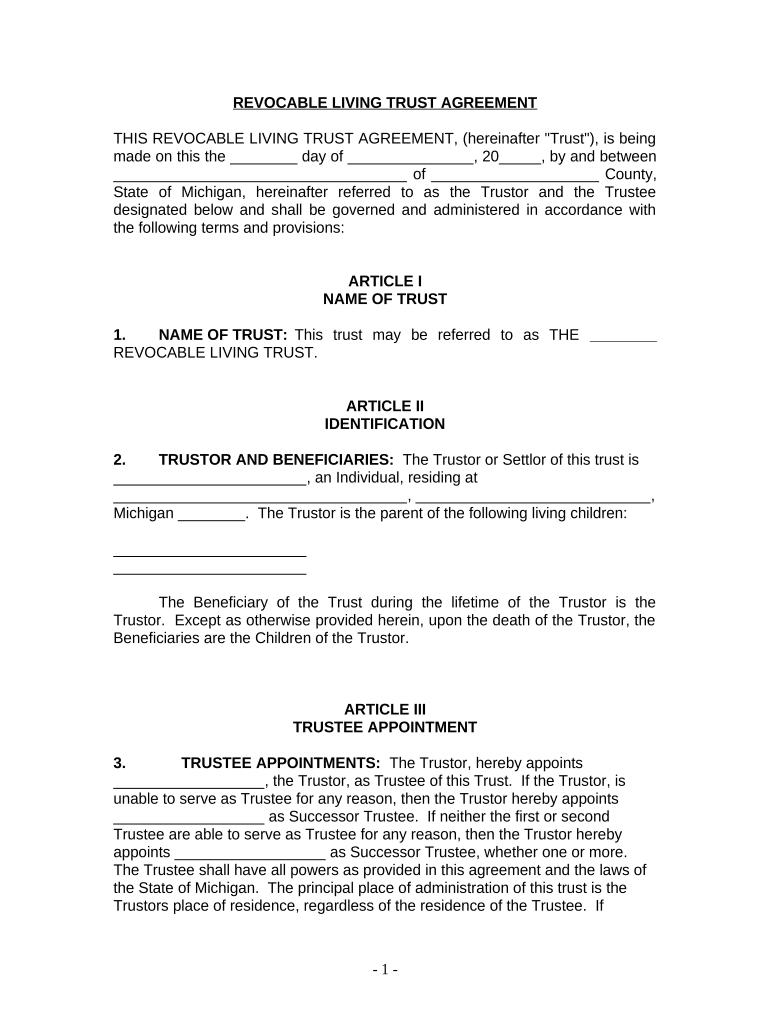

A living trust for individuals who are single, divorced, or widowed with children in Michigan is a legal document that allows a person to manage their assets during their lifetime and specify how those assets will be distributed after their death. This type of trust is particularly beneficial for parents, as it helps ensure that children are cared for and that assets are passed on according to the individual's wishes. Unlike a will, a living trust can help avoid probate, making the transfer of assets more efficient and private.

How to use the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Michigan

Using a living trust involves several steps. First, the individual must create the trust document, which outlines the terms of the trust, including the assets included and the beneficiaries. Next, assets must be transferred into the trust, a process known as funding the trust. This can include real estate, bank accounts, and investments. Once established, the individual can manage the trust assets during their lifetime, and upon their passing, the assets will be distributed according to the trust's instructions, bypassing the probate process.

Steps to complete the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Michigan

Completing a living trust involves the following steps:

- Determine the assets to include in the trust.

- Draft the trust document, specifying the terms and beneficiaries.

- Sign the trust document in accordance with Michigan state laws.

- Transfer ownership of assets into the trust.

- Review and update the trust as necessary, particularly after major life events.

Key elements of the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Michigan

Key elements of a living trust include:

- Trustee: The individual or institution responsible for managing the trust.

- Beneficiaries: Individuals or entities who will receive the trust assets.

- Trust document: The legal document outlining the terms of the trust.

- Funding: The process of transferring assets into the trust.

State-specific rules for the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Michigan

In Michigan, specific rules govern the creation and execution of living trusts. The trust document must be signed and dated by the grantor, and it is advisable to have it notarized. Michigan law allows for the creation of revocable living trusts, which can be modified or revoked by the grantor at any time. Additionally, the assets must be properly transferred into the trust to ensure they are protected and managed according to the grantor's wishes.

Legal use of the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Michigan

The legal use of a living trust in Michigan includes managing assets during the grantor's lifetime and ensuring a smooth transition of those assets upon death. It is essential for the trust to comply with state laws to be considered valid. This includes following the proper procedures for creating and funding the trust, as well as ensuring that the trust document clearly outlines the grantor's intentions regarding asset distribution. Legal representation is often recommended to navigate the complexities of trust law.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with children michigan

Manage Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Michigan effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely archive them online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents promptly without any holdups. Handle Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Michigan on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to modify and eSign Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Michigan with ease

- Locate Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Michigan and click on Get Form to begin.

- Make use of the tools available to complete your document.

- Emphasize signNow sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically designed for this purpose.

- Generate your eSignature using the Sign tool, which only takes a few seconds and carries the same legal validity as a conventional ink signature.

- Verify the details and click on the Done button to store your modifications.

- Choose your preferred method to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Michigan and secure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Michigan?

A Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Michigan is a legal document that allows you to manage and distribute your assets during your lifetime and after your death. It helps ensure that your children are taken care of and that your wishes are fulfilled without the complications of probate.

-

How can a Living Trust benefit a single, divorced, or widowed parent in Michigan?

A Living Trust can protect your children's inheritance, ensure they receive their assets when they are ready, and help you avoid the lengthy probate process. By establishing a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Michigan, you gain peace of mind knowing your estate is managed according to your wishes, even if you are no longer around.

-

What is the cost of setting up a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Michigan?

The cost varies based on the complexity of your estate and the service providers you choose. Generally, establishing a Living Trust can range from a few hundred to a few thousand dollars, which is a worthwhile investment for the long-term benefits it provides to your children and heirs.

-

What features are included in a Living Trust For Individuals Who Are Single, Divorced, or Widowed with Children in Michigan?

Features typically include the ability to manage and allocate your assets, designate guardians for your children, and specify how and when your assets should be distributed. This tailored approach is vital for individuals looking to secure their children’s future without going through probate.

-

Can airSlate SignNow help me create a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Michigan?

Yes, airSlate SignNow offers user-friendly tools and templates that can assist you in creating a Living Trust tailored to your specific situation. Our document templates are designed to ensure you cover all necessary legal aspects while making the process efficient and straightforward.

-

How does a Living Trust differ from a will for single, divorced, or widowed parents in Michigan?

While both a Living Trust and a will manage the distribution of your assets, a Living Trust allows for quicker distribution without probate, provides privacy, and can be managed if you become incapacitated. This makes a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Michigan particularly beneficial for ensuring a smooth transition for your children.

-

Is it necessary to have an attorney to create a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Michigan?

While it's not legally required to have an attorney, consulting one can be beneficial to ensure your Living Trust meets all legal requirements and accurately reflects your wishes. However, airSlate SignNow provides resources that make it easier to draft your trust document without extensive legal knowledge.

Get more for Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Michigan

- Monthly inventory record fuel form

- Child 20attendance 20record 20by 20family 20unit form

- Travel expense form t17c the sea cadets

- Application for a refund of ontario retail sales tax for used vehicles purchased privately form

- Nysna forms 45456182

- Instructions graduate readmission applies to students who have attended the university of florida as a graduate student but form

- School of law students can use this form to request a letter that verifies enrollment

- Hkgeac master list form of documents number forms

Find out other Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Michigan

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation