Nevada Trust Form

What is the Nevada Trust

The Nevada Trust is a legal arrangement that allows individuals to manage their assets during their lifetime and dictate how these assets will be distributed after their death. This type of trust is particularly popular due to Nevada's favorable trust laws, which offer privacy and asset protection. The trust can hold various assets, including real estate, bank accounts, and investments, providing flexibility in estate planning.

Key elements of the Nevada Trust

Several key elements define the Nevada Trust, making it a unique option for estate planning:

- Revocability: Most Nevada trusts are revocable, meaning the trust creator can modify or dissolve the trust at any time while they are alive.

- Privacy: Unlike wills, trusts do not go through probate, allowing for greater privacy regarding asset distribution.

- Asset Protection: Nevada offers strong protections against creditors, making it difficult for creditors to access trust assets.

- Tax Advantages: A Nevada Trust may provide certain tax benefits, particularly regarding estate taxes.

Steps to complete the Nevada Trust

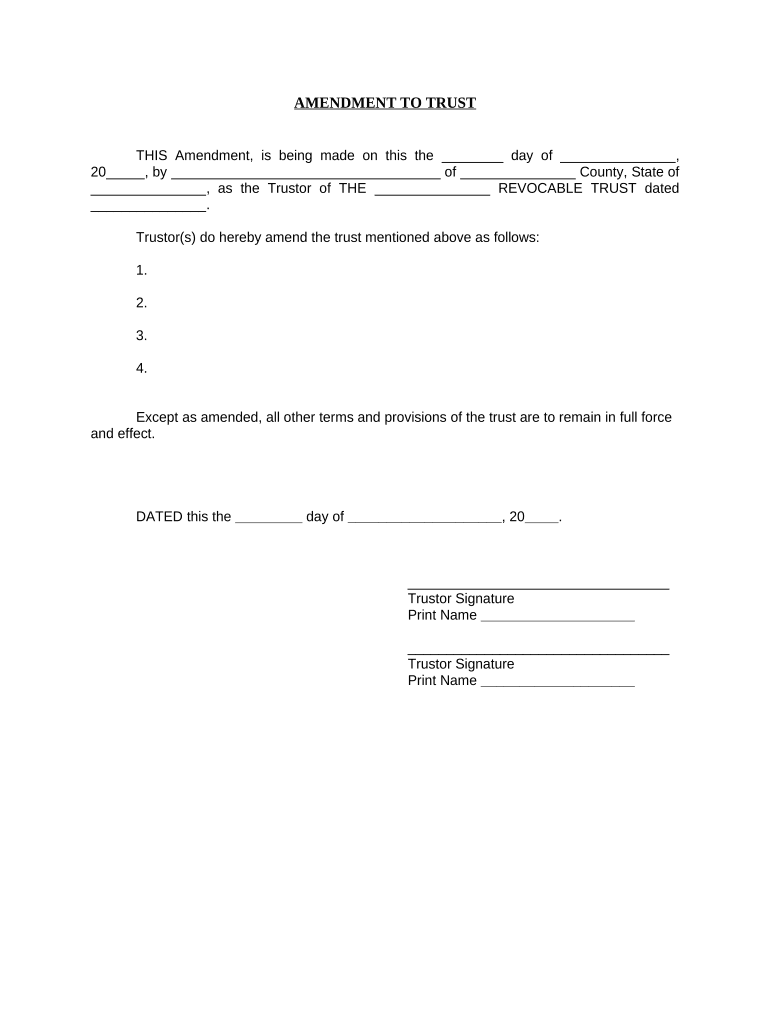

Completing the Nevada Trust involves several essential steps:

- Determine the type of trust: Decide whether a revocable or irrevocable trust best suits your needs.

- Draft the trust document: This document outlines the terms of the trust, including the trustee, beneficiaries, and specific instructions for asset distribution.

- Fund the trust: Transfer assets into the trust to ensure they are managed according to your wishes.

- Sign and notarize: Execute the trust document in the presence of a notary public to ensure its legality.

Legal use of the Nevada Trust

The legal use of the Nevada Trust is governed by state laws, which provide a framework for establishing and managing trusts. It is crucial to comply with these laws to ensure that the trust is valid and enforceable. Legal requirements include proper documentation, adherence to fiduciary duties, and ensuring that the trust's purpose aligns with state regulations.

Required Documents

To establish a Nevada Trust, specific documents are required:

- Trust Agreement: The primary document outlining the terms of the trust.

- Asset Deeds: Documentation proving ownership of assets being transferred into the trust.

- Identification: Valid identification for the trust creator and trustee.

- Tax Identification Number: If applicable, to manage tax obligations related to the trust.

Who Issues the Form

The Nevada Trust does not have a specific issuing authority like other forms; instead, it is created by the individual establishing the trust. However, legal professionals often assist in drafting the trust document to ensure compliance with state laws and regulations. It is advisable to consult an attorney experienced in estate planning to navigate the complexities of trust creation.

Quick guide on how to complete nevada trust 497320842

Complete Nevada Trust effortlessly on any device

Web-based document management has become favored by organizations and individuals alike. It offers a perfect eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage Nevada Trust on any device using the airSlate SignNow Android or iOS applications and enhance your document-driven processes today.

The simplest way to modify and eSign Nevada Trust effortlessly

- Locate Nevada Trust and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact confidential information with the tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Decide how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid files, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Edit and eSign Nevada Trust and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Nevada living trust documents?

Nevada living trust documents are legal instruments that allow individuals to set up a trust in Nevada, enabling the management and distribution of assets during their lifetime and after their death. These documents help avoid probate and ensure a smoother transfer of wealth according to your wishes.

-

How can airSlate SignNow help me with Nevada living trust documents?

airSlate SignNow provides a seamless platform to create, send, and eSign Nevada living trust documents quickly and securely. With its user-friendly interface, you can easily customize your trust documents and ensure they are legally binding with electronic signatures.

-

What are the benefits of using airSlate SignNow for Nevada living trust documents?

Using airSlate SignNow for your Nevada living trust documents offers several benefits, including cost-effectiveness, enhanced security, and convenience. You can complete the process online, reducing the need for physical visits and paper documents, which streamlines your estate planning.

-

Are there any pricing plans for using airSlate SignNow for Nevada living trust documents?

Yes, airSlate SignNow offers various pricing plans tailored to fit different needs when handling Nevada living trust documents. Whether you are an individual looking for a simple solution or a business requiring bulk eSigning capabilities, you can select a plan that aligns with your budget.

-

Is airSlate SignNow compliant with Nevada laws regarding living trust documents?

Absolutely! airSlate SignNow is designed to comply with Nevada's legal framework, ensuring that your living trust documents are valid and enforceable. This compliance gives you peace of mind when managing your estate planning needs.

-

Can I integrate airSlate SignNow with other applications for managing Nevada living trust documents?

Yes, airSlate SignNow integrates seamlessly with a variety of applications and services, allowing you to manage your Nevada living trust documents efficiently. Whether you need to sync with cloud storage or CRM systems, integrations are available to enhance your workflow.

-

What features does airSlate SignNow offer for Nevada living trust documents?

airSlate SignNow includes features such as customizable templates, advanced security options, and electronic signature capabilities for Nevada living trust documents. These features make it easier to create and manage your trust documents while ensuring they meet all legal requirements.

Get more for Nevada Trust

- Notice hearing 495366908 form

- Nueces county divorce forms

- Annual report on location condition and well being of ward form

- Hr 028 child abuse registry check consent form revised september

- Pa parent consent form

- Mv 70s 1 10vertical form

- Monthly statistical report for west ohio food bank for the form

- Ignition interlock limited license ampquotthe lawampquot faqs fact sheet form

Find out other Nevada Trust

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed