New York Estate Form

What is the New York Estate

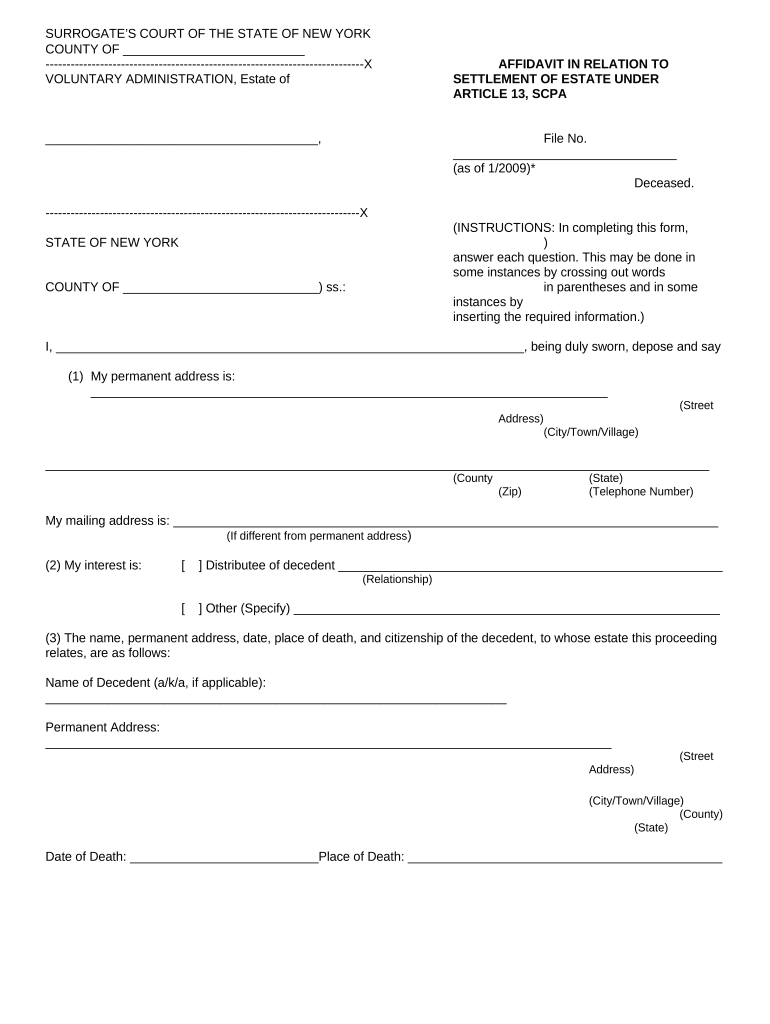

The term "New York estate" refers to the legal framework governing the distribution of a deceased person's assets in New York State. This process involves the management of the decedent's property, debts, and obligations, ensuring that their wishes are honored according to their will or state law if no will exists. The New York estate laws provide a structured approach to handle the transfer of assets, which can include real estate, personal property, and financial accounts.

Steps to Complete the New York Estate

Completing the New York estate process involves several key steps:

- Gather necessary documents: Collect the decedent's will, death certificate, and any relevant financial documents.

- File the will: Submit the will to the Surrogate's Court in the county where the decedent resided.

- Obtain letters testamentary: If the will is validated, the court issues letters testamentary, granting the executor authority to manage the estate.

- Notify beneficiaries and creditors: Inform all parties involved about the estate proceedings.

- Inventory assets: Compile a complete list of the decedent's assets and liabilities.

- Settle debts and distribute assets: Pay any outstanding debts and distribute the remaining assets according to the will or state law.

Legal Use of the New York Estate

The legal use of a New York estate encompasses the execution of a will or the administration of an estate under intestacy laws when no valid will exists. It is essential to comply with New York estate laws to ensure that the distribution of assets is done legally and fairly. This includes understanding the obligations of the executor, filing necessary documents with the court, and adhering to timelines for notifications and distributions.

Required Documents

To navigate the New York estate process, several key documents are required:

- Death certificate of the decedent

- Last will and testament, if available

- Petition for probate or administration

- Letters testamentary or letters of administration

- Inventory of the estate's assets and liabilities

State-Specific Rules for the New York Estate

New York has specific rules that govern estate administration, including the requirement for probate in most cases. The Surrogate's Court oversees the process, ensuring compliance with state laws. Additionally, New York imposes a filing fee based on the value of the estate, and there are specific timelines for filing documents and notifying interested parties. Understanding these rules is crucial for effective estate management.

Examples of Using the New York Estate

Examples of scenarios involving New York estates include:

- A family member managing the estate of a deceased relative who left a will.

- An individual navigating the intestacy process after a loved one passes without a will.

- A business owner ensuring their business assets are distributed according to their wishes after death.

Quick guide on how to complete new york estate 497321671

Prepare New York Estate effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage New York Estate on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign New York Estate without any hassle

- Obtain New York Estate and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or obscure confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional hand-written signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or mislaid files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign New York Estate and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the cost of using airSlate SignNow for managing my New York estate documents?

airSlate SignNow offers various pricing plans to accommodate different needs, starting at a competitive rate. The pricing is structured to be cost-effective, making it accessible for individuals and businesses managing a New York estate. You can choose a plan that fits your budget while enjoying all the essential features required for seamless document transactions.

-

How can airSlate SignNow help streamline the New York estate planning process?

With airSlate SignNow, you can easily send and eSign estate planning documents online, which helps speed up the New York estate planning process. The platform’s user-friendly interface and document templates simplify the creation of essential documents like wills and powers of attorney. This efficiency ultimately saves time and reduces stress for both clients and their advisors.

-

Does airSlate SignNow integrate with other tools for managing New York estates?

Yes, airSlate SignNow integrates seamlessly with various applications that are commonly used in managing a New York estate. Whether you're using CRM systems, cloud storage solutions, or other business applications, airSlate SignNow can enhance your workflow. Integration ensures that you can manage all aspects of your New York estate in one convenient location.

-

Are there any features specifically beneficial for handling New York estate documents?

Absolutely! airSlate SignNow includes features tailored for estate management, such as customizable templates for New York estate documents, secure cloud storage, and real-time tracking of document status. These features ensure that all necessary documents are handled efficiently and securely, protecting sensitive information throughout the process.

-

Is it safe to use airSlate SignNow for my New York estate documents?

Yes, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards, ensuring that your New York estate documents are fully protected. The platform also implements strict authentication measures to safeguard sensitive information. You can use airSlate SignNow with confidence, knowing that your documents are secure.

-

How can I get started with airSlate SignNow for my New York estate?

Getting started with airSlate SignNow for your New York estate is quick and easy. Simply sign up for an account, choose the pricing plan that fits your needs, and start uploading or creating your estate documents. The intuitive platform guides you through each step, ensuring a smooth experience from the beginning.

-

Can I access my New York estate documents on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is designed to be fully functional on mobile devices, allowing you to manage your New York estate documents wherever you are. The mobile app provides the same features as the desktop version, enabling you to send, sign, and track documents on the go. This flexibility is essential for busy clients and estate planners alike.

Get more for New York Estate

Find out other New York Estate

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile