Seller Disclosure Form

What is the Seller Disclosure Form

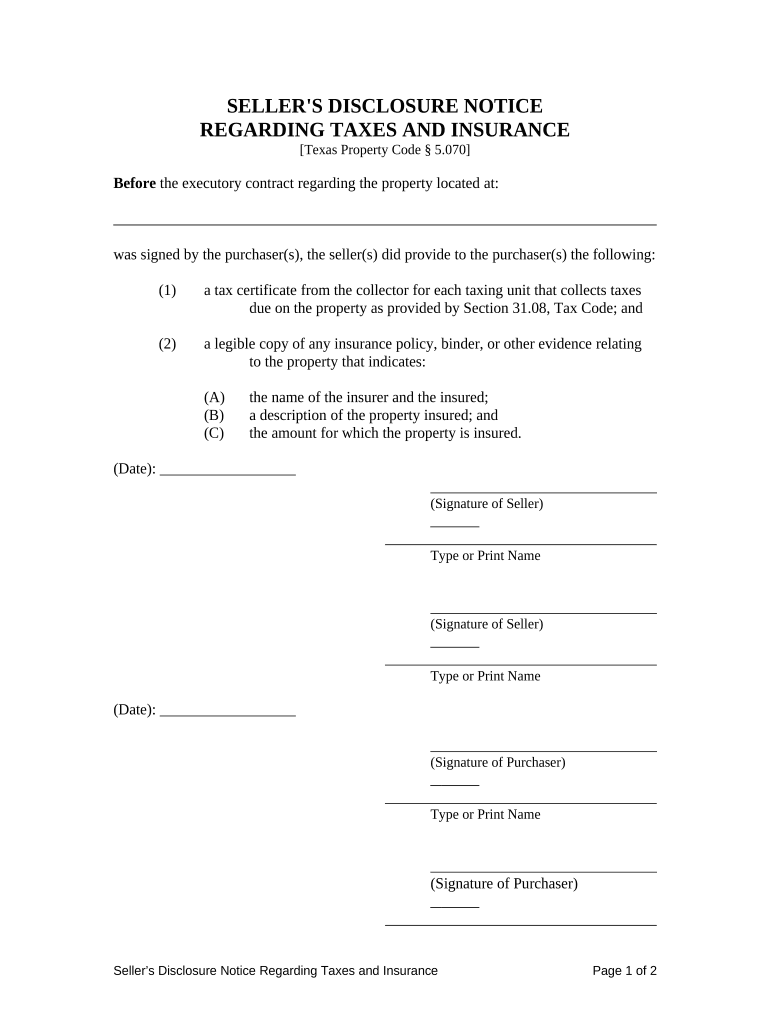

The Texas seller disclosure form is a legally required document that provides potential buyers with essential information about a property. This form outlines any known issues or defects that could affect the property's value or desirability. Sellers must disclose details regarding the condition of the property, including structural issues, plumbing, electrical systems, and any environmental hazards. The intent of this disclosure is to promote transparency in real estate transactions and protect both parties involved.

Steps to Complete the Seller Disclosure Form

Completing the Texas seller disclosure form involves several key steps to ensure accuracy and compliance. First, gather all relevant information about the property, including past repairs, maintenance records, and any known issues. Next, carefully fill out each section of the form, providing detailed descriptions where necessary. It is essential to be honest and thorough, as failing to disclose significant information can lead to legal repercussions. Once completed, the form should be signed and dated by the seller, ensuring that it is ready for presentation to potential buyers.

Legal Use of the Seller Disclosure Form

The seller disclosure form holds legal significance in Texas real estate transactions. It serves as a protective measure for buyers, allowing them to make informed decisions based on the property’s condition. By completing and providing this form, sellers fulfill their legal obligations under Texas law, which mandates that sellers disclose known defects. Failure to provide a completed seller disclosure form can result in legal penalties, including the potential for lawsuits from buyers who may feel misled or uninformed about the property's condition.

Key Elements of the Seller Disclosure Form

The Texas seller disclosure form includes several key elements that sellers must address. These elements typically cover various aspects of the property, such as:

- Structural integrity and foundation issues

- Roof condition and any past repairs

- Plumbing and electrical systems status

- Presence of pests or infestations

- Environmental hazards, such as lead paint or mold

Each section requires the seller to provide specific details, ensuring that buyers receive a comprehensive overview of the property's condition.

How to Obtain the Seller Disclosure Form

Sellers can obtain the Texas seller disclosure form through various channels. The form is often available from real estate agents, who can provide the most current version and guidance on how to complete it. Additionally, the form can be accessed through online resources, including state real estate commission websites or legal document providers. It is crucial to ensure that the correct and updated version of the form is used to comply with Texas regulations.

Disclosure Requirements

Disclosure requirements for the Texas seller disclosure form are designed to ensure transparency in real estate transactions. Sellers are required to disclose any known material defects that could affect the buyer's decision. This includes issues related to the property’s physical condition, legal encumbrances, and any other factors that might influence the property's value. Understanding these requirements is essential for sellers to avoid potential legal disputes and to foster trust with prospective buyers.

Quick guide on how to complete seller disclosure form 497327184

Easily Prepare Seller Disclosure Form on Any Device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage Seller Disclosure Form on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

Effortlessly Modify and eSign Seller Disclosure Form

- Locate Seller Disclosure Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate reprinting document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Seller Disclosure Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Texas seller disclosure?

The Texas seller disclosure is a legal document required by Texas law that informs potential buyers about the condition of a property. It must be filled out by the seller and includes details about the property's structural integrity, systems, and any known issues. Understanding the Texas seller disclosure is essential for buyers to make informed decisions.

-

How can airSlate SignNow help with Texas seller disclosures?

airSlate SignNow makes it easy to create, send, and eSign Texas seller disclosures digitally. With its user-friendly interface, you can customize disclosure forms to meet Texas requirements and have them signed quickly by all parties. This streamlines the process, ensuring compliance and timely documentation.

-

Is there a cost associated with using airSlate SignNow for Texas seller disclosures?

Yes, airSlate SignNow offers various pricing plans that are cost-effective for businesses needing to manage documents, including Texas seller disclosures. You can choose a plan that fits your needs, with options catering to different volumes and features. By simplifying document management, airSlate SignNow can save you time and money.

-

What features does airSlate SignNow offer for Texas seller disclosures?

airSlate SignNow offers features such as customizable templates, secure electronic signatures, and real-time document tracking for Texas seller disclosures. The platform also allows for collaboration, enabling multiple parties to review and sign documents seamlessly. These features enhance efficiency and ensure that all disclosures are handled properly.

-

Can airSlate SignNow integrate with other tools for managing Texas seller disclosures?

Yes, airSlate SignNow offers integrations with various tools such as CRM systems and cloud storage platforms that can enhance your workflow for managing Texas seller disclosures. This allows you to easily import and export documents, track transactions, and maintain organization. By integrating with your existing systems, airSlate SignNow increases overall productivity.

-

What are the benefits of using airSlate SignNow for real estate transactions involving Texas seller disclosures?

Using airSlate SignNow for real estate transactions ensures that your Texas seller disclosures are processed efficiently and securely. The digital signature process eliminates the hassle of physical paperwork, saving you time and effort. Additionally, airSlate SignNow provides a legal guarantee, ensuring that your documents meet Texas regulations.

-

How secure is the airSlate SignNow platform for Texas seller disclosures?

airSlate SignNow prioritizes security, implementing robust measures to protect your Texas seller disclosures. The platform uses advanced encryption, secure authentication methods, and compliance with industry standards to safeguard your data. You can confidently manage and store sensitive documents without worrying about unauthorized access.

Get more for Seller Disclosure Form

- Nics enrollment form

- Go ahead london application form

- Claimant request for appeal of unemployment insurance missouri labor mo form

- Dv 200 2013 form

- Table of heirs form osc state ny

- Sworn statement for contractor and subcontractor to owner and to the chicago insurance company form

- Special requirements information form carnival cruise lines

- Medical clearance to race form bausapbabbcombau

Find out other Seller Disclosure Form

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe