Quitclaim Deed from Corporation to Husband and Wife Texas Form

What is the Quitclaim Deed From Corporation To Husband And Wife Texas

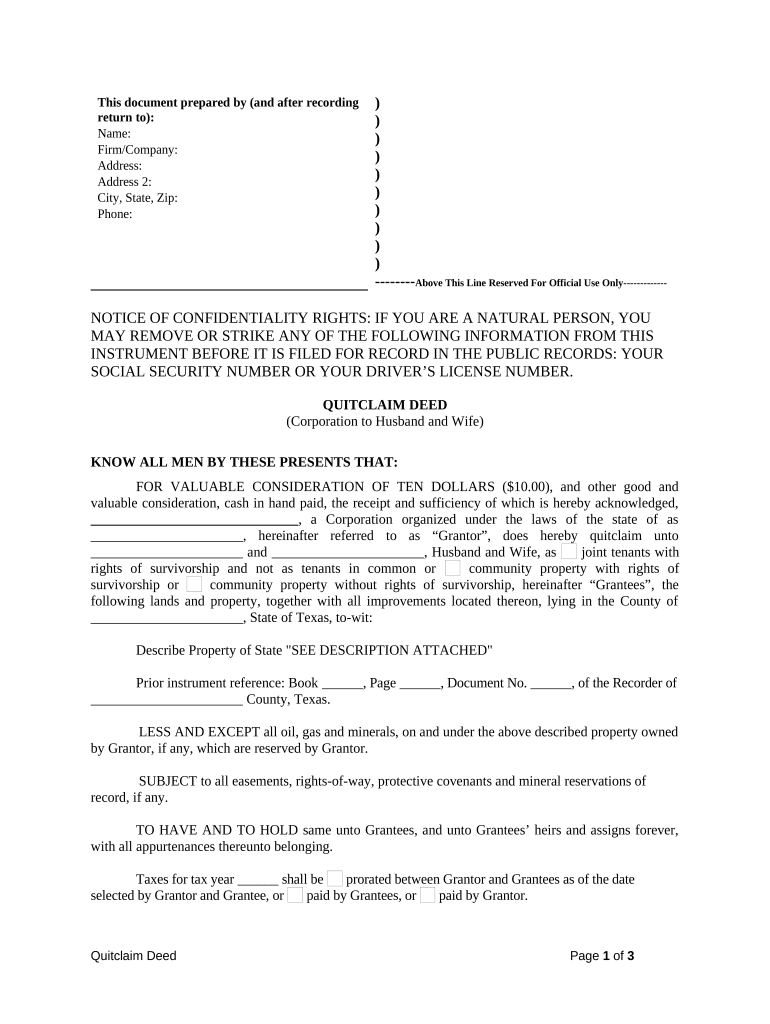

A quitclaim deed from a corporation to a husband and wife in Texas is a legal document that transfers ownership of property from a corporate entity to a married couple. This type of deed does not guarantee that the corporation holds clear title to the property; instead, it conveys whatever interest the corporation may have. It is often used in situations where property is being transferred among family members or for estate planning purposes. The quitclaim deed is particularly useful for simplifying the transfer process without the need for extensive legal formalities.

Key Elements of the Quitclaim Deed From Corporation To Husband And Wife Texas

Several key elements must be included in a quitclaim deed to ensure its validity in Texas:

- Grantor and Grantee Information: The names and addresses of the corporation (grantor) and the husband and wife (grantees) must be clearly stated.

- Property Description: A legal description of the property being transferred is essential. This should include the lot number, block number, and any relevant subdivision information.

- Consideration: The deed should mention the consideration, which is the value exchanged for the property, even if it is nominal.

- Signature and Notarization: The deed must be signed by an authorized representative of the corporation and notarized to be legally binding.

- Date of Execution: The date on which the deed is executed should be included.

Steps to Complete the Quitclaim Deed From Corporation To Husband And Wife Texas

Completing a quitclaim deed from a corporation to a husband and wife involves several important steps:

- Gather the necessary information, including the legal description of the property and the names of the parties involved.

- Obtain a quitclaim deed form, which can be found online or through legal stationery stores.

- Fill out the form with accurate details, ensuring all required elements are included.

- Have the deed signed by an authorized representative of the corporation in the presence of a notary public.

- File the completed deed with the county clerk's office in the county where the property is located to ensure public record.

Legal Use of the Quitclaim Deed From Corporation To Husband And Wife Texas

The quitclaim deed is legally recognized in Texas and can be used for various purposes, including:

- Transferring property ownership between family members.

- Facilitating estate planning by transferring property to heirs.

- Clearing up title issues by transferring any interest the corporation may have.

However, it is important to note that this type of deed does not provide warranties or guarantees regarding the title, which means the grantees assume any risks associated with the property.

State-Specific Rules for the Quitclaim Deed From Corporation To Husband And Wife Texas

In Texas, specific rules govern the execution and filing of quitclaim deeds:

- The deed must be in writing and signed by the grantor.

- Notarization is required to validate the document.

- It must be filed with the county clerk's office to be effective against third parties.

- Texas law does not require a quitclaim deed to be recorded, but recording is advisable for public notice.

Quick guide on how to complete quitclaim deed from corporation to husband and wife texas

Complete Quitclaim Deed From Corporation To Husband And Wife Texas smoothly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Handle Quitclaim Deed From Corporation To Husband And Wife Texas on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Quitclaim Deed From Corporation To Husband And Wife Texas with ease

- Locate Quitclaim Deed From Corporation To Husband And Wife Texas and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and eSign Quitclaim Deed From Corporation To Husband And Wife Texas and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Quitclaim Deed From Corporation To Husband And Wife Texas?

A Quitclaim Deed From Corporation To Husband And Wife Texas is a legal document used to transfer property ownership between a corporation and a married couple. This type of deed relinquishes any claims the corporation has on the property, ensuring the couple holds full ownership without warranty. It's a straightforward way to facilitate property transfers in Texas.

-

How can airSlate SignNow help with my Quitclaim Deed From Corporation To Husband And Wife Texas?

airSlate SignNow offers an easy-to-use platform to create, edit, and eSign your Quitclaim Deed From Corporation To Husband And Wife Texas. With customizable templates and an intuitive interface, you can streamline the document process, ensuring all necessary details are addressed efficiently. Get your deed signed securely and quickly.

-

What are the benefits of using airSlate SignNow for a Quitclaim Deed From Corporation To Husband And Wife Texas?

Using airSlate SignNow for a Quitclaim Deed From Corporation To Husband And Wife Texas offers time-saving benefits, such as instant eSigning and secure storage options. Additionally, our platform eliminates the need for physical paperwork and allows convenient access from any device, making the process simple and efficient for users.

-

Is there a cost associated with using airSlate SignNow for Quitclaim Deed From Corporation To Husband And Wife Texas?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective. Pricing varies based on your subscription plan, which can include features tailored for handling Quitclaim Deeds From Corporation To Husband And Wife Texas. We offer flexible pricing options to fit various business needs.

-

Can I integrate airSlate SignNow with other tools for my Quitclaim Deed From Corporation To Husband And Wife Texas?

Absolutely! airSlate SignNow supports integrations with numerous business tools, making it easier to manage your paperwork related to Quitclaim Deeds From Corporation To Husband And Wife Texas. Whether you use CRM systems or cloud storage solutions, our platform allows seamless connectivity for enhanced workflow.

-

Is it safe to use airSlate SignNow for my Quitclaim Deed From Corporation To Husband And Wife Texas?

Yes, airSlate SignNow prioritizes safety and security. When dealing with sensitive documents like a Quitclaim Deed From Corporation To Husband And Wife Texas, we utilize advanced encryption methods to protect your information. You can trust our platform to keep your documents safe and secure while ensuring compliance with legal standards.

-

How quickly can I complete a Quitclaim Deed From Corporation To Husband And Wife Texas using airSlate SignNow?

The time it takes to complete a Quitclaim Deed From Corporation To Husband And Wife Texas using airSlate SignNow is signNowly reduced. With our user-friendly platform, you can prepare, send for eSignature, and finalize your document in minutes rather than days. This efficiency allows you to handle property changes promptly.

Get more for Quitclaim Deed From Corporation To Husband And Wife Texas

- Appleton wi non profit food permit 2013 2019 form

- Idhs forms printable bid form 2016 2019

- Falsification of this form is grounds for disciplinary arsbn arkansas

- Contracting request form medical provider bluecross blueshield of arizona 2014 2019

- Rhb renewal online 2016 2019 form

- Fsp tay referral form 2017 2019

- Pacific islander check all that apply form

- Lmft experience verification in state option 2 lmft experience verification in state option 2 form

Find out other Quitclaim Deed From Corporation To Husband And Wife Texas

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT