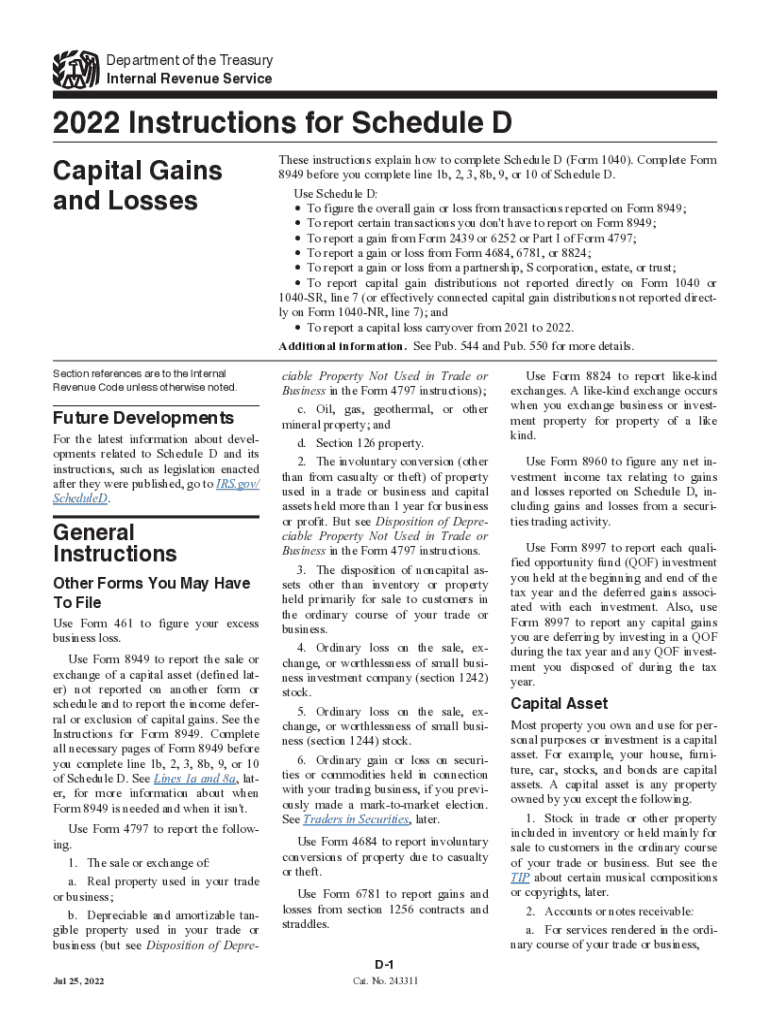

Instructions for Schedule D Instructions for Schedule D , Capital Gains and Losses 2022-2026

Understanding the IRS Schedule D Instructions

The IRS Schedule D instructions provide essential guidance for reporting capital gains and losses on your tax return. This form is crucial for individuals who have sold assets such as stocks, bonds, or real estate during the tax year. Understanding these instructions helps ensure accurate reporting and compliance with tax regulations. The Schedule D form is used to summarize your capital gains and losses, which directly impacts your overall tax liability.

Steps to Complete the IRS Schedule D Instructions

Completing the IRS Schedule D involves several key steps:

- Gather your financial documents, including records of asset purchases and sales.

- Determine your capital gains and losses by calculating the difference between the sale price and the purchase price of each asset.

- Fill out the appropriate sections of Schedule D, detailing each transaction.

- Transfer the totals to your IRS Form 1040, ensuring all calculations are accurate.

Following these steps carefully will help you avoid mistakes and ensure that your tax return is filed correctly.

Key Elements of the IRS Schedule D Instructions

The key elements of the IRS Schedule D instructions include:

- Types of Gains and Losses: Understanding short-term versus long-term gains is essential, as they are taxed at different rates.

- Reporting Requirements: Specific details about each transaction must be reported, including dates, amounts, and asset types.

- Tax Implications: The instructions outline how to calculate your tax liability based on your net capital gains or losses.

Familiarizing yourself with these elements will enhance your understanding and ensure compliance when filing your taxes.

Legal Use of the IRS Schedule D Instructions

The IRS Schedule D instructions are legally binding and must be followed to ensure compliance with federal tax laws. Accurate reporting of capital gains and losses is not only a requirement but also protects taxpayers from potential audits or penalties. Using the instructions correctly can help avoid legal issues and ensure that your tax filings are accepted without complications.

How to Obtain the IRS Schedule D Instructions

The IRS Schedule D instructions can be obtained directly from the IRS website or through tax preparation software. They are available in PDF format for easy access and printing. Additionally, many tax professionals provide guidance on completing this form and can assist in obtaining the necessary instructions.

Filing Deadlines for IRS Schedule D

Filing deadlines for the IRS Schedule D align with the standard tax return deadlines. Typically, individual tax returns must be filed by April 15 of each year, unless an extension is granted. It is important to adhere to these deadlines to avoid penalties and interest on unpaid taxes. Keeping track of these dates ensures timely submission of your tax returns.

Examples of Using the IRS Schedule D Instructions

Examples of using the IRS Schedule D instructions include scenarios such as selling stocks, real estate, or other investments. For instance, if an individual sells shares of stock for a profit, they must report the sale on Schedule D, detailing the purchase and sale dates, amounts, and any associated costs. These examples help clarify how to apply the instructions in real-life situations, ensuring accurate reporting of capital gains and losses.

Quick guide on how to complete 2022 instructions for schedule d 2022 instructions for schedule d capital gains and losses

Complete Instructions For Schedule D Instructions For Schedule D , Capital Gains And Losses effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without any holdups. Handle Instructions For Schedule D Instructions For Schedule D , Capital Gains And Losses on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Instructions For Schedule D Instructions For Schedule D , Capital Gains And Losses with ease

- Find Instructions For Schedule D Instructions For Schedule D , Capital Gains And Losses and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specially provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Instructions For Schedule D Instructions For Schedule D , Capital Gains And Losses and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 instructions for schedule d 2022 instructions for schedule d capital gains and losses

Create this form in 5 minutes!

People also ask

-

What are the IRS 1040 Schedule D instructions?

The IRS 1040 Schedule D instructions detail how to report capital gains and losses from the sale of assets. This schedule is a crucial part of your federal income tax return, and correctly filling it out is essential to avoid issues with the IRS. Following the IRS 1040 Schedule D instructions will help ensure that you claim the right amounts and pay the proper taxes.

-

How can airSlate SignNow assist with IRS 1040 Schedule D instructions?

AirSlate SignNow simplifies the process of signing and sending documents related to IRS 1040 Schedule D instructions. Our platform allows you to easily fill out, eSign, and securely send your completed forms, ensuring compliance and reducing errors. With our solution, managing your tax documents becomes hassle-free.

-

Are there any costs associated with using airSlate SignNow for IRS forms?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Each plan allows you to manage your IRS documents, including those that require IRS 1040 Schedule D instructions. The investment in our service pays off by saving time and effort when managing tax documentation.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow provides robust features such as eSignature, customizable templates, and automated workflows for your document management needs. These features streamline your processes for IRS 1040 Schedule D instructions, making it easier to track, edit, and finalize your forms. Utilizing our platform means more efficiency and less paperwork.

-

Can I integrate airSlate SignNow with my existing tools?

Absolutely! AirSlate SignNow integrates seamlessly with various applications, enabling you to manage your IRS 1040 Schedule D instructions alongside your favorite productivity tools. This integration helps centralize your document workflows and enhances productivity, making it easier to prepare your taxes.

-

What are the benefits of using airSlate SignNow for IRS tax forms?

Using airSlate SignNow for your IRS tax forms, including the IRS 1040 Schedule D instructions, offers multiple benefits such as reduced errors, enhanced compliance, and a quicker turnaround time. Our platform is designed to be user-friendly, allowing you to manage your documentation confidently. It transforms a typically complex process into an efficient experience.

-

Is there support available for IRS 1040 Schedule D instructions?

Yes, airSlate SignNow provides comprehensive customer support to assist you with questions about IRS 1040 Schedule D instructions. Our dedicated team is ready to help you understand the documentation process and ensure you're utilizing our platform effectively. We are here to support your tax preparation needs every step of the way.

Get more for Instructions For Schedule D Instructions For Schedule D , Capital Gains And Losses

- New york motion form

- Bargain sale deed with covenant form

- New york form 497321231

- Grantors form

- Ny three form

- Warranty deed from a joint trust hampw two an individual trust new york form

- New york husband wife 497321235 form

- Grant deed from an individual to two individuals or husband and wife new york form

Find out other Instructions For Schedule D Instructions For Schedule D , Capital Gains And Losses

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast