Form 433 a OIC Collection Information Statement for Wage Earners and 2022

What is the Form 433 A OIC Collection Information Statement For Wage Earners

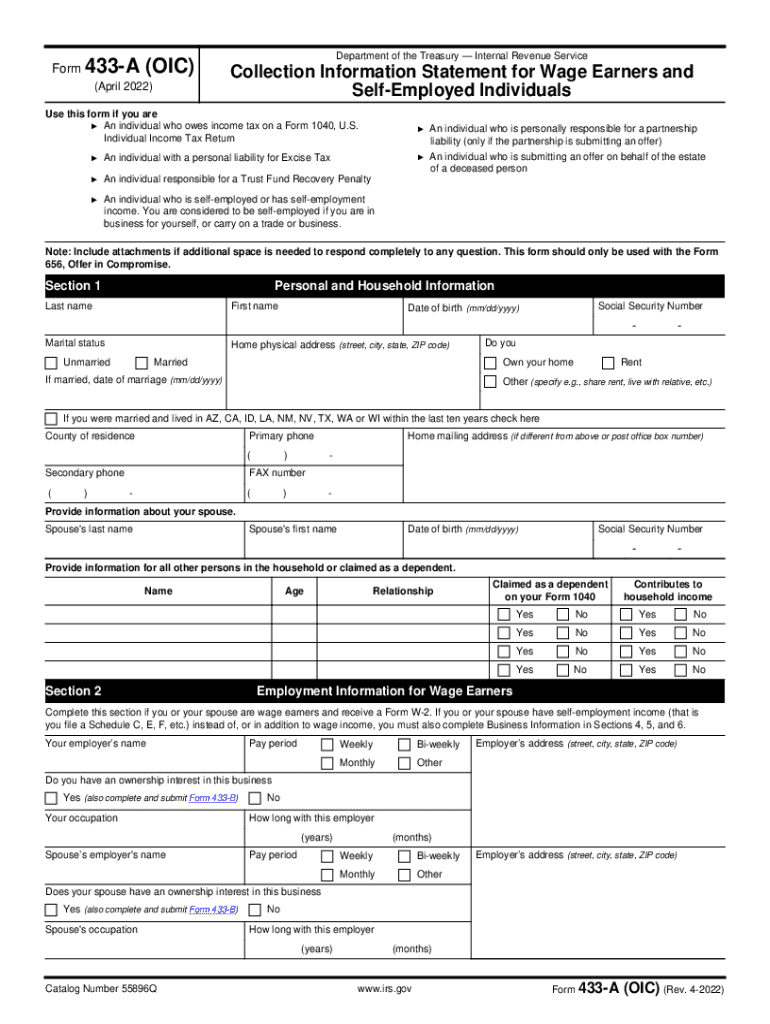

The Form 433 A OIC, or Collection Information Statement for Wage Earners and Self-Employed Individuals, is a crucial document used by taxpayers who are seeking an Offer in Compromise (OIC) with the IRS. This form provides the IRS with detailed information about an individual's financial situation, including income, expenses, assets, and liabilities. The purpose of the form is to help the IRS determine whether a taxpayer qualifies for a settlement that allows them to pay less than the full amount of their tax debt. Understanding this form is essential for anyone considering an OIC, as it plays a significant role in the evaluation process.

How to use the Form 433 A OIC Collection Information Statement For Wage Earners

Using the Form 433 A OIC involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents, including pay stubs, bank statements, and records of monthly expenses. Next, fill out the form by providing details about your income sources, such as wages and self-employment earnings. You will also need to list your monthly living expenses, including housing costs, utilities, and transportation. After completing the form, review it for accuracy and completeness before submitting it to the IRS as part of your OIC application. Properly using this form can significantly impact the outcome of your offer.

Steps to complete the Form 433 A OIC Collection Information Statement For Wage Earners

Completing the Form 433 A OIC requires careful attention to detail. Follow these steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Document your income by listing all sources, such as wages, bonuses, and any self-employment income.

- Outline your monthly expenses, categorizing them into necessary living costs like housing, food, and transportation.

- Include information about your assets, such as bank accounts, vehicles, and real estate, along with their estimated values.

- Provide details about your liabilities, including credit card debts and loans.

- Review the completed form for accuracy and ensure all required signatures are included.

Eligibility Criteria

To qualify for an Offer in Compromise using the Form 433 A OIC, certain eligibility criteria must be met. Taxpayers must demonstrate that they cannot pay their full tax liability or that doing so would create a financial hardship. Additionally, individuals must be current with all tax filings and payments to be considered for an OIC. The IRS evaluates each application based on the taxpayer's financial situation, including income, expenses, and overall ability to pay. Meeting these criteria is essential for a successful application.

Required Documents

When submitting the Form 433 A OIC, several supporting documents are necessary to substantiate the information provided. These documents typically include:

- Recent pay stubs or proof of income.

- Bank statements for all accounts.

- Documentation of monthly expenses, such as bills and receipts.

- Asset valuations, including appraisals for real estate and vehicle titles.

- Proof of any liabilities, such as loan agreements or credit card statements.

Providing comprehensive documentation helps the IRS assess your financial situation accurately and can facilitate the OIC process.

IRS Guidelines

The IRS has established specific guidelines for completing and submitting the Form 433 A OIC. These guidelines outline the necessary information required for the form, as well as the procedures for submitting an OIC application. Taxpayers should familiarize themselves with these guidelines to ensure compliance and increase the chances of acceptance. The IRS emphasizes the importance of accuracy and completeness in the information provided, as any discrepancies may lead to delays or denials in the application process.

Quick guide on how to complete form 433 a oic collection information statement for wage earners and

Complete Form 433 A OIC Collection Information Statement For Wage Earners And effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely preserve it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any holdups. Manage Form 433 A OIC Collection Information Statement For Wage Earners And on any device using the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign Form 433 A OIC Collection Information Statement For Wage Earners And effortlessly

- Obtain Form 433 A OIC Collection Information Statement For Wage Earners And and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to finalize your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Modify and eSign Form 433 A OIC Collection Information Statement For Wage Earners And to ensure excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 433 a oic collection information statement for wage earners and

Create this form in 5 minutes!

People also ask

-

What is the 2020 433a tax form and why is it important?

The 2020 433a tax form is used to report financial status to the IRS, helping taxpayers to qualify for various tax relief programs. Understanding this form is crucial for ensuring accurate reporting and compliance with tax obligations.

-

How can airSlate SignNow assist in completing the 2020 433a tax form?

airSlate SignNow provides an efficient platform to fill out and eSign the 2020 433a tax form electronically. This feature simplifies the process, allowing users to manage their forms quickly and securely.

-

What are the pricing options for using airSlate SignNow for the 2020 433a tax form?

AirSlate SignNow offers competitive pricing plans suited to different business needs, ensuring access to essential features for managing documents like the 2020 433a tax form. Customers can choose from monthly or yearly subscriptions to fit their budget.

-

Does airSlate SignNow integrate with other tax software when completing the 2020 433a tax?

Yes, airSlate SignNow integrates seamlessly with various tax software platforms, enhancing your ability to complete the 2020 433a tax form alongside your existing tools. This integration streamlines the workflow, ensuring no data is lost.

-

What features does airSlate SignNow offer for managing the 2020 433a tax documents?

airSlate SignNow offers features like customizable templates, secure eSigning, and document tracking specifically for the 2020 433a tax. These features boost efficiency and accuracy in managing important tax paperwork.

-

How secure is airSlate SignNow for submitting the 2020 433a tax form?

AirSlate SignNow prioritizes security, implementing advanced encryption to protect the information on the 2020 433a tax form. Users can confidently submit sensitive documents, knowing their data is secure.

-

Can I access my 2020 433a tax form on mobile devices using airSlate SignNow?

Absolutely! airSlate SignNow is optimized for mobile use, allowing users to access and complete the 2020 433a tax form anytime, anywhere. This flexibility ensures you can manage your documents on the go.

Get more for Form 433 A OIC Collection Information Statement For Wage Earners And

- Marital legal separation and property settlement agreement no children parties may have joint property or debts where divorce 497307037 form

- Marital legal separation and property settlement agreement no children parties may have joint property or debts effective 497307038 form

- Marital legal separation and property settlement agreement adult children parties may have joint property or debts where 497307039 form

- Marital legal separation and property settlement agreement adult children parties may have joint property or debts effective 497307040 form

- Dissolution corporation form

- Indiana dissolution package to dissolve limited liability company llc electronic version indiana form

- Living trust for husband and wife with no children indiana form

- Indiana divorced form

Find out other Form 433 A OIC Collection Information Statement For Wage Earners And

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors