Form 1098 E Student Loan Interest Statement 2022

What is the Form 1098 E Student Loan Interest Statement

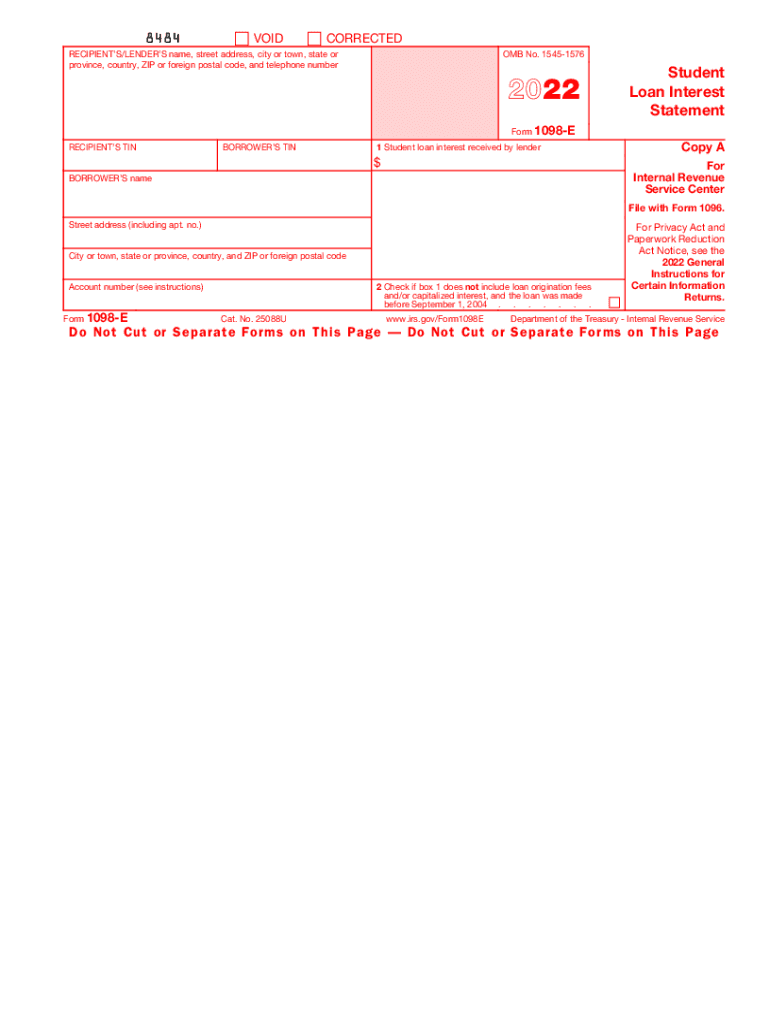

The Form 1098 E is a tax document issued by lenders to report the amount of interest paid on student loans during the tax year. This form is essential for borrowers who wish to claim a student loan interest deduction on their federal income tax returns. The form includes critical information such as the borrower’s name, the lender's details, and the total interest paid, which can help taxpayers reduce their taxable income. Understanding the significance of this form is vital for anyone managing student loans, as it can lead to potential savings on taxes.

How to use the Form 1098 E Student Loan Interest Statement

Using the Form 1098 E involves several steps to ensure that you can effectively claim your student loan interest deduction. First, review the form for accuracy, confirming that your name and Social Security number are correct. Next, locate the total interest paid, which will be reported in box one of the form. This amount can be entered on your tax return, specifically on Form 1040 or 1040A, allowing you to benefit from the deduction. It is important to keep this form with your tax records, as the IRS may request it for verification purposes.

Steps to complete the Form 1098 E Student Loan Interest Statement

Completing the Form 1098 E is straightforward, especially when using digital tools. Start by gathering your loan information, including the lender's name and your account details. If you have multiple loans, ensure you combine the interest amounts accurately. Next, fill out the required fields, including your personal information and the total interest paid. Once completed, review the form for any errors before submitting it to your lender or including it with your tax return. Utilizing eSignature solutions can streamline this process, ensuring that all submissions are secure and legally binding.

Key elements of the Form 1098 E Student Loan Interest Statement

Several key elements define the Form 1098 E, making it essential for taxpayers. The form typically includes the borrower’s name, address, and Social Security number, along with the lender’s information. Most importantly, it details the total interest paid on the student loan for the tax year, which is crucial for calculating deductions. Understanding these elements can help borrowers accurately report their interest payments and maximize their tax benefits.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Form 1098 E. Taxpayers must ensure that the interest claimed does not exceed the allowable deduction limits set by the IRS. For the tax year, the maximum deduction for student loan interest is typically up to two thousand five hundred dollars for eligible taxpayers. It is also important to verify that the loans qualify under IRS regulations, as only certain types of student loans are eligible for the deduction. Familiarizing yourself with these guidelines can help you navigate the tax filing process more effectively.

Filing Deadlines / Important Dates

Filing deadlines for tax returns, including those involving the Form 1098 E, are crucial for compliance. Typically, individual tax returns are due on April fifteenth of each year, although this date may vary slightly if it falls on a weekend or holiday. It is advisable to keep track of any updates from the IRS regarding filing extensions or changes to deadlines. Ensuring timely submission of your tax return, along with the Form 1098 E, can help you avoid penalties and interest charges.

Quick guide on how to complete 2022 form 1098 e student loan interest statement

Complete Form 1098 E Student Loan Interest Statement effortlessly on any device

Digital document management has gained signNow traction among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Form 1098 E Student Loan Interest Statement on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Form 1098 E Student Loan Interest Statement with ease

- Locate Form 1098 E Student Loan Interest Statement and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or mask sensitive information with tools that airSlate SignNow provides specifically for that aim.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Form 1098 E Student Loan Interest Statement to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 1098 e student loan interest statement

Create this form in 5 minutes!

People also ask

-

What is the 2018 1098 e form and why is it important?

The 2018 1098 e form is a tax document that provides essential information about your student loan interest payments. Filing this form accurately can help you claim beneficial tax deductions, making it an important item for your financial records. Using airSlate SignNow ensures that you can securely sign and send this document effortlessly.

-

How does airSlate SignNow simplify the process of managing the 2018 1098 e?

With airSlate SignNow, you can easily eSign, send, and store your 2018 1098 e securely in one platform. Our intuitive interface allows you to track document status and get real-time notifications, making it simpler than ever to manage your tax documents. This streamlines your workflow and reduces the risk of errors.

-

What are the pricing plans for using airSlate SignNow for 2018 1098 e documents?

airSlate SignNow offers flexible pricing plans that cater to both individuals and businesses. You can select a plan that fits your budget and needs, ensuring that managing your 2018 1098 e forms is cost-effective. Most plans include unlimited eSigning for a fixed monthly or annual fee.

-

Can I integrate airSlate SignNow with other software for managing my 2018 1098 e?

Yes, airSlate SignNow integrates seamlessly with various software solutions, including CRMs and accounting tools. These integrations help you streamline your document management process, allowing you to efficiently handle your 2018 1098 e along with other paperwork. This enhances productivity and keeps all your documents organized.

-

What features does airSlate SignNow offer for signing 2018 1098 e forms?

airSlate SignNow provides features designed for user convenience, such as reusable templates, custom branding, and in-person signing options. These features ensure that signing your 2018 1098 e forms is quick and hassle-free. You can easily customize templates to reflect your branding and save time on repetitive tasks.

-

Is airSlate SignNow secure for sending sensitive information like the 2018 1098 e?

Absolutely! airSlate SignNow employs advanced encryption protocols to ensure that your sensitive information, including the 2018 1098 e, is safeguarded. We take data security seriously, so you can send and eSign documents with peace of mind. Our platform is compliant with industry standards to keep your information private.

-

How can airSlate SignNow benefit small businesses dealing with the 2018 1098 e?

For small businesses, airSlate SignNow provides a cost-effective solution to manage important documents like the 2018 1098 e. Our platform streamlines the signing process, reducing time spent on paperwork and enhancing efficiency. This allows small businesses to focus more on growth and less on administrative tasks.

Get more for Form 1098 E Student Loan Interest Statement

- Nv landlord notice form

- Letter from tenant to landlord about sexual harassment nevada form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children nevada form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure nevada form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497320660 form

- Letter from tenant to landlord for failure of landlord to return all prepaid and unearned rent and security recoverable by 497320661 form

- Nevada codes form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497320663 form

Find out other Form 1098 E Student Loan Interest Statement

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form