Instructions for Schedule I Form 1041 InternalInstructions for Schedule I Form 1041 InternalIRS 1041 Schedule I Fill and Sign Pr 2022

Understanding Schedule I Form 1041

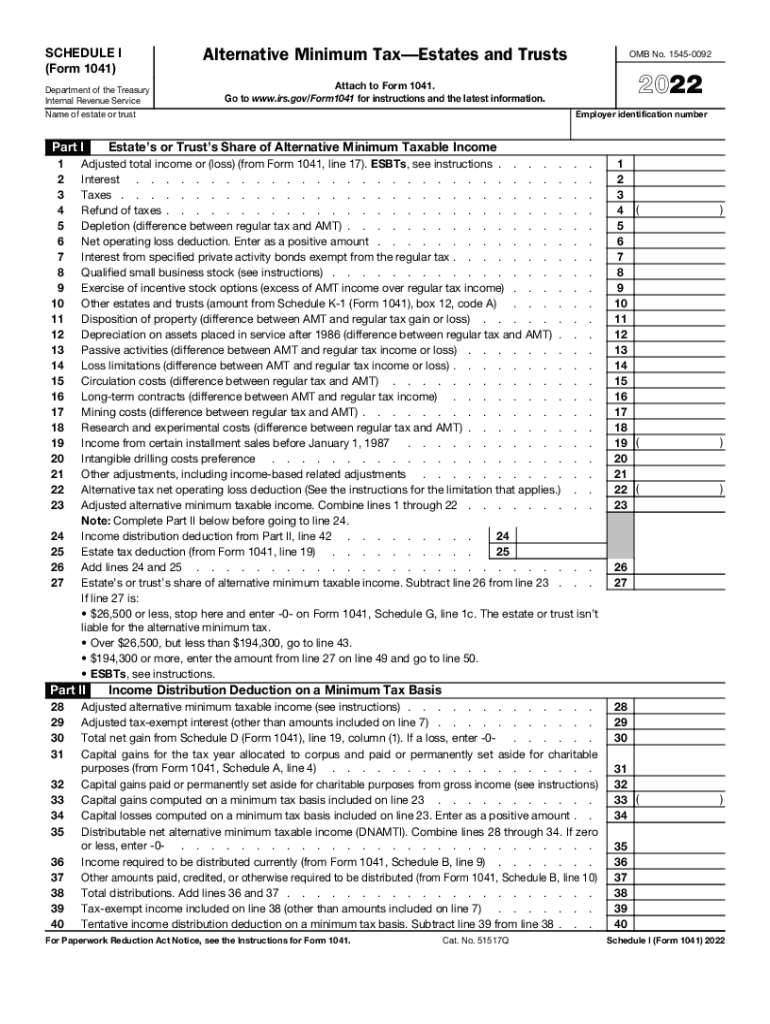

The Schedule I Form 1041 is a crucial document used for reporting income, deductions, and credits related to estates and trusts. This form is part of the IRS Form 1041, which is specifically designed for fiduciaries managing estates or trusts. It allows the fiduciary to report the income that is distributed to beneficiaries, ensuring that the tax obligations are met appropriately. By accurately completing Schedule I, fiduciaries can provide a clear picture of the estate or trust's financial activities, which is essential for compliance with IRS regulations.

Steps to Complete Schedule I Form 1041

Filling out Schedule I Form 1041 involves several important steps to ensure accuracy and compliance. First, gather all necessary documentation related to the estate or trust's income and deductions. This includes bank statements, investment income reports, and any other relevant financial records. Next, follow the form's instructions carefully, entering the required information in the designated fields. Pay special attention to the calculations for income distributions to beneficiaries, as these figures will impact both the estate's and the beneficiaries' tax obligations. Finally, review the completed form for accuracy before submission.

Legal Use of Schedule I Form 1041

The legal validity of Schedule I Form 1041 hinges on its proper completion and submission. To ensure that the form is recognized by the IRS, it must be filled out accurately and submitted by the required deadlines. Additionally, the use of digital signatures through platforms like signNow can enhance the form's legitimacy, as electronic signatures are legally binding when compliant with eSignature laws. This is particularly important for fiduciaries, as they are responsible for maintaining accurate records and ensuring that all tax obligations are fulfilled.

Filing Deadlines for Schedule I Form 1041

Timely filing of Schedule I Form 1041 is essential to avoid penalties and interest on unpaid taxes. Generally, the form is due on the same date as the Form 1041, which is the 15th day of the fourth month following the end of the estate or trust's tax year. For estates and trusts operating on a calendar year, this typically means the deadline is April 15. However, if the fiduciary requires additional time, they may file for an extension, which can provide an additional six months to complete the filing.

Required Documents for Schedule I Form 1041

To complete Schedule I Form 1041 accurately, several documents are necessary. These include financial statements that detail income earned by the estate or trust, records of distributions made to beneficiaries, and any documentation related to deductions claimed. This may also encompass receipts for expenses incurred in managing the estate or trust. Collecting these documents in advance can streamline the process and help ensure that all required information is reported accurately.

Examples of Using Schedule I Form 1041

Schedule I Form 1041 is often utilized in various scenarios involving estates and trusts. For instance, if an estate generates rental income, the fiduciary must report this income on Schedule I, along with any expenses associated with property management. Similarly, if a trust distributes dividends to its beneficiaries, those amounts must be accurately reported to ensure proper tax treatment. These examples illustrate the form's role in maintaining transparency and compliance in fiduciary responsibilities.

Quick guide on how to complete instructions for schedule i form 1041 2020internalinstructions for schedule i form 1041 2020internalirs 1041 schedule i 2021

Complete Instructions For Schedule I Form 1041 InternalInstructions For Schedule I Form 1041 InternalIRS 1041 Schedule I Fill And Sign Pr effortlessly on any device

Online document management has gained popularity among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Instructions For Schedule I Form 1041 InternalInstructions For Schedule I Form 1041 InternalIRS 1041 Schedule I Fill And Sign Pr on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Instructions For Schedule I Form 1041 InternalInstructions For Schedule I Form 1041 InternalIRS 1041 Schedule I Fill And Sign Pr hassle-free

- Locate Instructions For Schedule I Form 1041 InternalInstructions For Schedule I Form 1041 InternalIRS 1041 Schedule I Fill And Sign Pr and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that function.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your preferred device. Modify and eSign Instructions For Schedule I Form 1041 InternalInstructions For Schedule I Form 1041 InternalIRS 1041 Schedule I Fill And Sign Pr and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for schedule i form 1041 2020internalinstructions for schedule i form 1041 2020internalirs 1041 schedule i 2021

Create this form in 5 minutes!

People also ask

-

What is schedule 1 2022 in relation to airSlate SignNow?

Schedule 1 2022 refers to the IRS form that outlines specific financial details for your business. Using airSlate SignNow, you can efficiently complete and eSign your Schedule 1 2022 forms, ensuring compliance and accuracy in your submissions.

-

How can airSlate SignNow help with my Schedule 1 2022 filings?

With airSlate SignNow, you can streamline the process of preparing and signing your Schedule 1 2022. Our platform allows for easy document management and secure electronic signatures, making tax filing less stressful and more efficient.

-

What are the pricing plans for using airSlate SignNow to manage Schedule 1 2022?

airSlate SignNow offers flexible pricing plans tailored for businesses of all sizes. Whether you need occasional access for Schedule 1 2022 filings or a comprehensive solution for multiple documents, our pricing plans are designed to be cost-effective.

-

Does airSlate SignNow integrate with accounting software for Schedule 1 2022?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software. This integration helps you efficiently manage and eSign your Schedule 1 2022 along with your other financial documents in one platform.

-

What features does airSlate SignNow offer for Schedule 1 2022 document management?

airSlate SignNow includes features like customizable templates, automated workflows, and secure cloud storage, which are incredibly useful for managing your Schedule 1 2022 documents. These features ensure that your documents are both organized and easily accessible.

-

Is airSlate SignNow secure for signing Schedule 1 2022 documents?

Absolutely! airSlate SignNow prioritizes the security of your data with industry-leading encryption and compliance measures. This ensures that your Schedule 1 2022 and other sensitive documents are protected throughout the signing process.

-

Can I access my Schedule 1 2022 documents from anywhere using airSlate SignNow?

Yes, airSlate SignNow is a cloud-based platform that allows you to access your Schedule 1 2022 documents from any device, anywhere, at any time. This flexibility is ideal for busy professionals who need to manage documents on the go.

Get more for Instructions For Schedule I Form 1041 InternalInstructions For Schedule I Form 1041 InternalIRS 1041 Schedule I Fill And Sign Pr

- Ny demand notice form

- Ny individual form

- Quitclaim deed by two individuals to corporation new york form

- Warranty deed corporation 497321250 form

- Assignment of lien by corporation or llc new york form

- Renunciation and disclaimer of property received by intestate succession new york form

- New york discharge form

- Quitclaim deed from individual to corporation new york form

Find out other Instructions For Schedule I Form 1041 InternalInstructions For Schedule I Form 1041 InternalIRS 1041 Schedule I Fill And Sign Pr

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online