Texas Notice Retainage Form

What is the Texas Notice Retainage

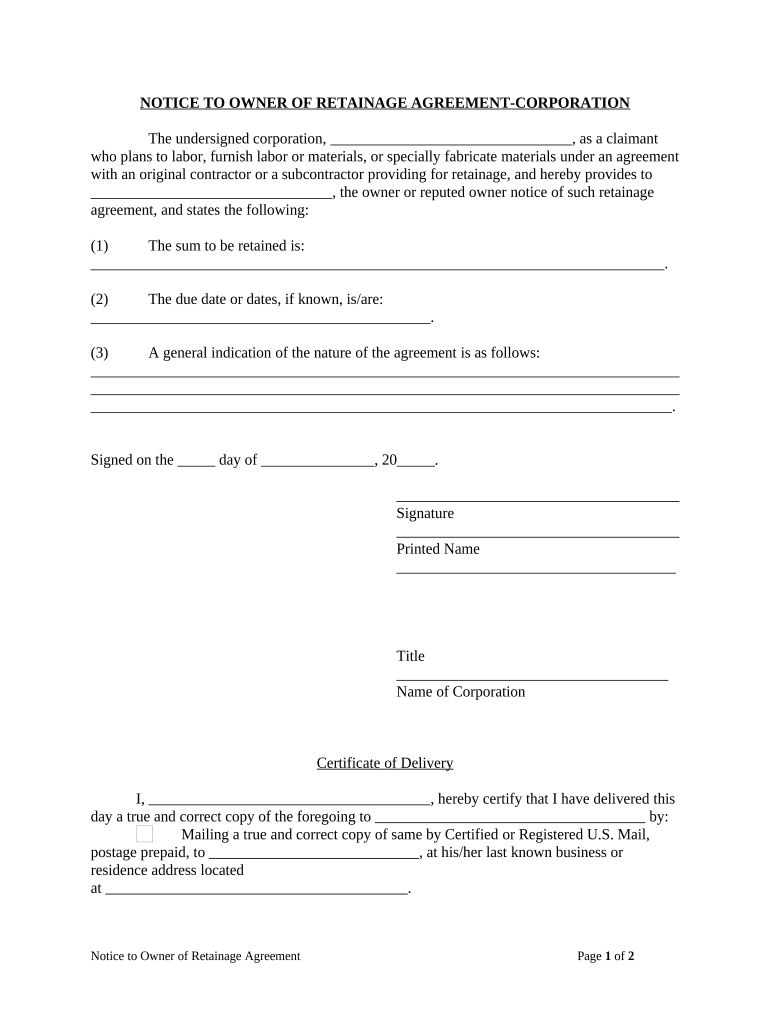

The Texas Notice Retainage is a legal document used in construction and contracting to inform parties about the retention of funds for project completion. It serves as a notification that a portion of the payment will be withheld until the project meets specified criteria, ensuring that contractors and subcontractors fulfill their obligations. This notice is crucial in protecting the interests of property owners and ensuring compliance with Texas law regarding construction payments.

How to Use the Texas Notice Retainage

Using the Texas Notice Retainage involves several steps to ensure it is executed correctly. First, identify the parties involved in the construction project, including the property owner, contractor, and subcontractors. Next, complete the notice by including essential details such as the project description, the amount being retained, and the reason for retention. Once filled out, the notice should be delivered to all relevant parties, typically via certified mail or electronic means, to ensure proper documentation and acknowledgment.

Key Elements of the Texas Notice Retainage

Several key elements must be included in the Texas Notice Retainage to ensure its validity. These elements include:

- Project Information: A clear description of the project, including its location and scope.

- Retention Amount: The specific amount of money being withheld from payment.

- Reason for Retention: A brief explanation of why the funds are being retained, such as incomplete work or unresolved disputes.

- Parties Involved: Names and contact information of all parties involved in the contract.

- Date of Notice: The date when the notice is issued to ensure compliance with legal timelines.

Steps to Complete the Texas Notice Retainage

Completing the Texas Notice Retainage requires careful attention to detail. Follow these steps:

- Gather all necessary information about the project and parties involved.

- Fill out the notice form, ensuring all key elements are included.

- Review the completed notice for accuracy and completeness.

- Distribute the notice to all relevant parties, ensuring it is sent via a method that provides proof of delivery.

- Keep a copy of the notice for your records, as it may be needed for future reference or legal purposes.

Legal Use of the Texas Notice Retainage

The legal use of the Texas Notice Retainage is governed by state laws that outline the rights and responsibilities of all parties involved in construction contracts. It is essential to follow the legal requirements to ensure that the notice is enforceable in case of disputes. Compliance with the Texas Property Code and other relevant statutes is critical to protecting the rights of property owners and contractors alike.

Filing Deadlines / Important Dates

Timeliness is crucial when dealing with the Texas Notice Retainage. Generally, the notice must be sent within a specific timeframe after the work is completed or payment is due. It is advisable to consult Texas law for exact deadlines, as failure to meet these timelines may result in the loss of the right to retain funds. Keeping track of important dates ensures that all parties are aware of their obligations and rights under the contract.

Quick guide on how to complete texas notice retainage

Prepare Texas Notice Retainage effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly substitute to traditional printed and signed documents, allowing you to obtain the accurate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without any delays. Manage Texas Notice Retainage on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Texas Notice Retainage with ease

- Locate Texas Notice Retainage and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and then click the Done button to record your changes.

- Choose how you prefer to send your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form hunting, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Texas Notice Retainage to ensure excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a tx notice retainage and why is it important?

A tx notice retainage is a formal notification that outlines the retention of a specified portion of payment in construction contracts. It is crucial for protecting the rights of contractors and ensuring that they are compensated for their work once conditions are met. Understanding tx notice retainage is essential for managing contracts effectively.

-

How does airSlate SignNow assist with tx notice retainage?

airSlate SignNow streamlines the process of sending and eSigning tx notice retainage documents. With its user-friendly interface, you can easily create, send, and manage retainage notices, ensuring that important documentation is organized and accessible. This efficiency helps in maintaining compliance and tracking payments securely.

-

What features of airSlate SignNow enhance tx notice retainage management?

Key features of airSlate SignNow that support effective tx notice retainage management include customizable templates, real-time tracking, and automated reminders. These tools simplify the management of retainage notices, ensuring timely communication and reducing the potential for disputes. By leveraging these features, businesses can maintain better control over their contracts.

-

Is airSlate SignNow cost-effective for handling tx notice retainage?

Yes, airSlate SignNow offers a cost-effective solution for managing tx notice retainage without compromising on quality. The pricing plans cater to various business sizes and needs, making it accessible for all. By investing in airSlate SignNow, businesses can save time and resources previously spent on traditional document handling.

-

Can airSlate SignNow integrate with other software for tx notice retainage processes?

Absolutely! airSlate SignNow integrates seamlessly with various software applications such as CRM systems, project management tools, and accounting software. These integrations enhance the efficiency of your tx notice retainage processes by synchronizing data and reducing manual entry, leading to streamlined operations.

-

What benefits does airSlate SignNow provide for creating tx notice retainage documents?

airSlate SignNow simplifies the creation of tx notice retainage documents by providing easy-to-use templates and a drag-and-drop editor. Users can quickly tailor these templates to fit their specific needs while ensuring compliance with legal requirements. This results in reduced turnaround times and improved accuracy for your retainage notifications.

-

How secure is airSlate SignNow in handling tx notice retainage forms?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption protocols to protect tx notice retainage forms and sensitive information during transmission and storage. Additionally, user authentication ensures that only authorized personnel can access and manage these critical documents.

Get more for Texas Notice Retainage

- Annual review of driving record certification of violations form

- Application packet fort campbell blanchfield army community campbell amedd army form

- Page 1 of 4 headaches residual functional capacity form

- Single tenant lease net 01 air commercial real estate form

- Printable waybill form

- Eviction packet manatee county clerk of circuit court amp comptroller form

- Waybill non negotiable form

- Urine initial drug screen result form cliawaivedcom

Find out other Texas Notice Retainage

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement