Letter Collection Company Form

Understanding the Letter Collection Company

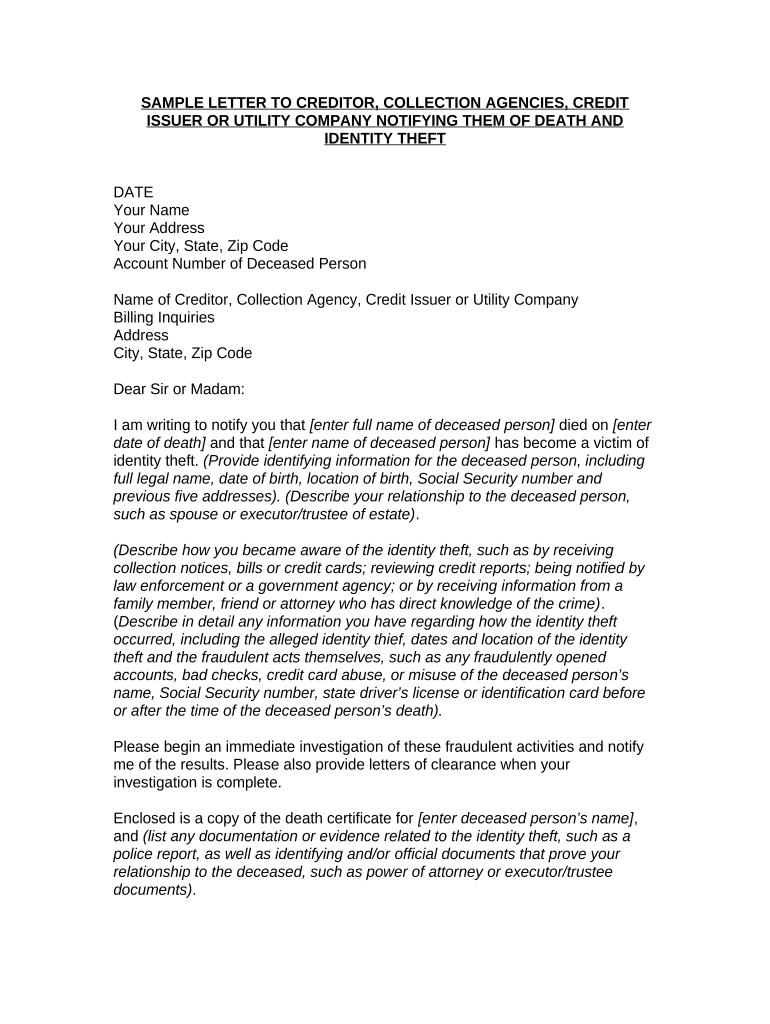

The Letter Collection Company is a formal document used to notify creditors about the death of an individual. This letter serves as an official communication to inform creditors of the deceased's passing, which is essential for managing any outstanding debts. It is crucial for the executor or administrator of the estate to provide accurate information in this letter to ensure that creditors are aware of the situation and can take appropriate actions regarding the debts owed.

Steps to Complete the Letter Collection Company

Completing the Letter Collection Company involves several important steps to ensure that the document is both effective and legally binding. Here are the key steps:

- Gather necessary information, including the deceased's full name, date of death, and any relevant account numbers.

- Clearly state the purpose of the letter, indicating that it serves to notify the creditor of the individual's death.

- Include a request for the creditor to cease any collection activities related to the deceased's accounts.

- Provide your contact information as the executor or administrator for any follow-up inquiries.

- Sign and date the letter to authenticate it.

Legal Use of the Letter Collection Company

The legal use of the Letter Collection Company is governed by various laws that protect the rights of deceased individuals and their estates. When properly executed, this letter can help prevent unauthorized collection activities. It is important to comply with applicable laws, such as the Fair Debt Collection Practices Act (FDCPA), which outlines the responsibilities of creditors regarding deceased debtors. Ensuring that the letter is sent promptly after the individual's death is also essential to uphold legal standards.

Key Elements of the Letter Collection Company

To ensure the effectiveness of the Letter Collection Company, several key elements must be included:

- Identification of the deceased: Full name and any known aliases.

- Date of death: Providing this information is crucial for the creditor's records.

- Account information: Include relevant account numbers or identifiers to assist the creditor in processing the notification.

- Your contact details: As the executor or administrator, providing your information allows creditors to reach you for any necessary follow-up.

- Signature: Your signature adds authenticity to the letter.

Examples of Using the Letter Collection Company

Examples of using the Letter Collection Company can vary based on the creditor and the specific circumstances. For instance, a letter may be sent to a credit card company to inform them of the death and request that they halt any collection efforts. Another example could involve notifying a mortgage lender about the deceased homeowner, ensuring that the estate is managed appropriately. Each example highlights the importance of clear communication and adherence to legal requirements.

Required Documents for the Letter Collection Company

When preparing the Letter Collection Company, certain documents may be required to support the notification. These can include:

- A certified copy of the death certificate to verify the individual's passing.

- Any legal documentation that establishes your authority to act on behalf of the deceased, such as a will or letters of administration.

- Previous correspondence with the creditor, if applicable, to provide context.

Quick guide on how to complete letter collection company

Effortlessly Prepare Letter Collection Company on Any Device

The management of online documents has gained popularity among organizations and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly and without delays. Handle Letter Collection Company on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The easiest way to modify and electronically sign Letter Collection Company without hassle

- Obtain Letter Collection Company and then click Get Form to begin.

- Make use of the tools we provide to finalize your document.

- Highlight key sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it directly to your computer.

Eliminate concerns about lost or incorrectly filed documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Alter and electronically sign Letter Collection Company and maintain exceptional communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are creditor agencies and how can airSlate SignNow help?

Creditor agencies are organizations that manage debts on behalf of creditors. With airSlate SignNow, you can streamline document signing processes with these agencies by sending and eSigning contracts efficiently, which can enhance communication and expedite transactions.

-

How does airSlate SignNow simplify the process of working with creditor agencies?

AirSlate SignNow offers a user-friendly platform that allows you to send documents directly to creditor agencies for eSignature. This reduces paperwork, accelerates approval times, and ensures that you can manage your documents effectively without unnecessary delays.

-

What pricing options does airSlate SignNow offer for businesses dealing with creditor agencies?

AirSlate SignNow provides flexible pricing plans tailored to different business needs, including those that work closely with creditor agencies. Our cost-effective solutions ensure you only pay for features you need, making it affordable for businesses of all sizes.

-

Can airSlate SignNow integrate with other tools used by creditor agencies?

Yes, airSlate SignNow seamlessly integrates with various third-party applications commonly used by creditor agencies. This allows for a smooth workflow, enabling you to incorporate eSigning capabilities into your existing systems effortlessly.

-

What features does airSlate SignNow offer for enhancing communication with creditor agencies?

AirSlate SignNow includes features like real-time tracking, notifications, and reminders that improve communication with creditor agencies. These tools ensure that all parties are updated promptly, making the document management process more transparent and efficient.

-

Is airSlate SignNow secure for sensitive documents shared with creditor agencies?

Absolutely, airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect sensitive documents shared with creditor agencies. Our compliance with data protection regulations ensures that your information remains safe throughout the signing process.

-

How does using airSlate SignNow benefit businesses in terms of speeding up processes with creditor agencies?

Using airSlate SignNow signNowly speeds up the document signing process with creditor agencies. By eliminating the need for physical signatures, you can achieve quicker turnaround times, leading to faster resolutions and improved operational efficiency.

Get more for Letter Collection Company

Find out other Letter Collection Company

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template