8995 2019

What is the 8995?

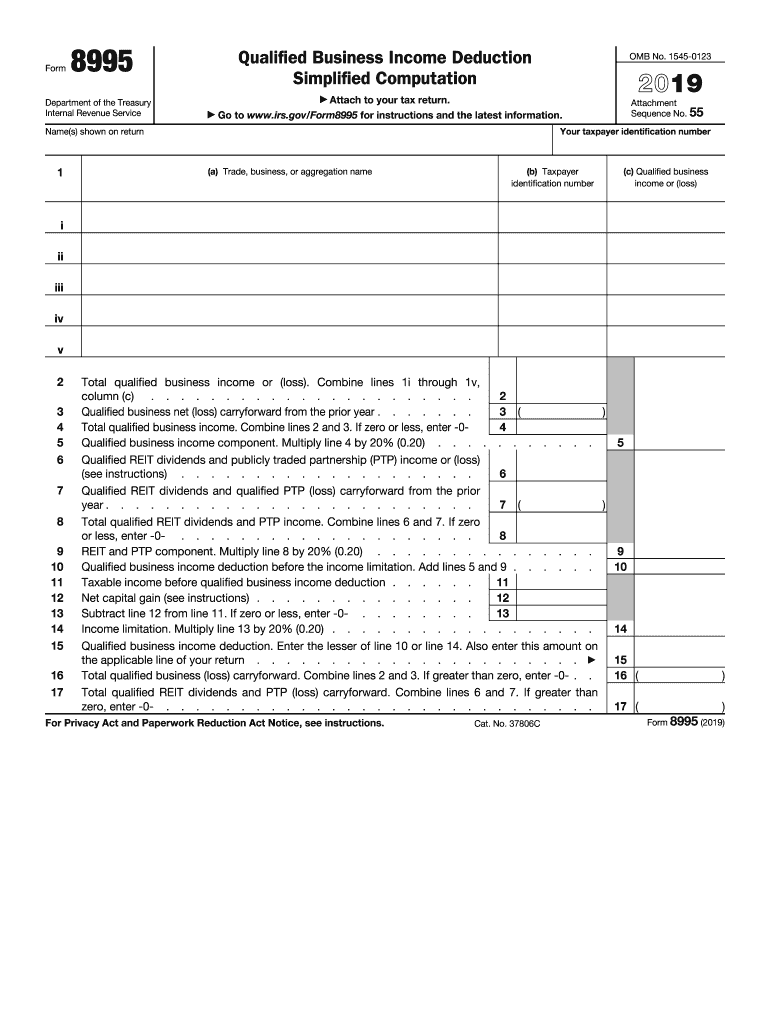

The 8995 qualified business income deduction form is a tax document used by eligible taxpayers to calculate and claim the qualified business income (QBI) deduction. This deduction allows certain business owners to deduct a portion of their income from qualified businesses, which can significantly reduce their taxable income. The form is specifically designed for taxpayers with simpler tax situations, making it easier to complete compared to more complex alternatives.

How to use the 8995

To use the 8995 form, taxpayers must first determine if they qualify for the QBI deduction. Eligible businesses include sole proprietorships, partnerships, S corporations, and some trusts and estates. Once eligibility is confirmed, the taxpayer should gather necessary financial information, such as income statements and expense records. The form guides users through the calculation process, allowing them to report their qualified business income and determine the deduction amount. It is essential to follow the instructions carefully to ensure accuracy and compliance with IRS regulations.

Steps to complete the 8995

Completing the 8995 involves several key steps:

- Gather all relevant income and expense documentation related to the qualified business.

- Fill out the identification section of the form, including your name, Social Security number, and the tax year.

- Calculate your qualified business income by subtracting allowable deductions from your total income.

- Determine the QBI deduction amount, which is typically twenty percent of the qualified business income.

- Review the completed form for accuracy before submitting it with your tax return.

IRS Guidelines

The IRS provides specific guidelines for completing the 8995 form, including eligibility criteria and documentation requirements. Taxpayers should refer to the IRS instructions for the 8995 to understand the nuances of the deduction, including limitations based on income levels and the type of business. Staying updated with IRS guidelines is crucial for ensuring compliance and maximizing potential tax savings.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the 8995 form. Generally, the form is submitted along with the annual tax return, which is due on April fifteenth for most individuals. If additional time is needed, taxpayers can file for an extension, but it is essential to ensure that any taxes owed are paid by the original deadline to avoid penalties and interest.

Required Documents

To complete the 8995 form accurately, several documents are required:

- Income statements from the qualified business, including profit and loss statements.

- Records of any business expenses that can be deducted.

- Previous tax returns may be helpful for reference.

- Any additional documentation that supports the claim for the QBI deduction.

Eligibility Criteria

Eligibility for the QBI deduction outlined in the 8995 form is determined by several factors. Taxpayers must have qualified business income from eligible entities. Additionally, there are income thresholds that may limit the deduction for higher earners. Understanding these criteria is essential for determining whether to use the 8995 form or a more complex version, such as the 8995-A.

Quick guide on how to complete 8995

Complete 8995 effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your paperwork swiftly without delays. Manage 8995 on any gadget with airSlate SignNow Android or iOS apps and enhance any document-driven process today.

The easiest way to modify and eSign 8995 seamlessly

- Obtain 8995 and click Access Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Finish button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you choose. Modify and eSign 8995 and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 8995

Create this form in 5 minutes!

How to create an eSignature for the 8995

How to create an eSignature for a PDF file in the online mode

How to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is the qbi deduction simplified?

The QBI deduction simplified refers to a tax deduction that allows some business owners to deduct up to 20% of their qualified business income. This simplified approach allows eligible taxpayers to lower their taxable income, making it easier to understand and calculate. Understanding how airSlate SignNow integrates with this deduction can streamline your document management.

-

How can airSlate SignNow help with qbi deduction simplified documentation?

airSlate SignNow provides an easy-to-use platform for preparing and sending documents related to the QBI deduction simplified. With its eSignature capabilities, businesses can quickly gather the necessary approvals and documentation, ensuring compliance and accuracy. This leads to a more efficient process for managing tax-related paperwork.

-

Are there any fees associated with using airSlate SignNow for qbi deduction simplified?

airSlate SignNow offers several pricing plans to accommodate different business needs, ensuring that using the platform for the QBI deduction simplified won't break the bank. Each plan provides access to essential features, making it a cost-effective solution for managing your documents and eSignatures. Check our website for detailed pricing information.

-

What features does airSlate SignNow offer for handling tax documents like qbi deduction simplified?

airSlate SignNow offers robust features for handling tax documents, including customizable templates, automated workflows, and secure storage. These features make it easy to create, send, and manage documents related to the QBI deduction simplified. With airSlate SignNow, you can simplify your documentation process signNowly.

-

Can I integrate airSlate SignNow with other software to manage my qbi deduction simplified documents?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax software solutions, allowing you to manage your QBI deduction simplified documents effortlessly. This integration will help ensure that all your tax-related documents are organized and easily accessible. Streamlining your workflow has never been easier.

-

What are the benefits of using airSlate SignNow for managing my qbi deduction simplified?

Using airSlate SignNow for managing your QBI deduction simplified provides numerous benefits, including increased efficiency, enhanced security, and improved accuracy in document handling. The platform's user-friendly interface allows for faster processing times, so you can focus on growing your business. Plus, with intuitive features, you can stay compliant with tax regulations.

-

Is airSlate SignNow suitable for small businesses looking to simplify qbi deductions?

Absolutely! AirSlate SignNow is designed with small businesses in mind, offering a cost-effective and straightforward solution for simplifying QBI deductions. By using our platform, small businesses can easily manage their documents and eSignatures, ensuring that tax processes are less cumbersome and more manageable.

Get more for 8995

- Members directory university of science ampamp technology bannu form

- Doc form i form of application for the use of candidates

- Allied bank limited annual report 2016 islamicmarketscom form

- Gtf usage form cdc

- Information required by the hec for endorsement of faculty appointments under tenure track statutes

- The provincial motor vehicles amendment bill 2015 form

- Fiedmc form

- Pakistan format power attorney

Find out other 8995

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now