Offer of Settlement and Compromise Form

What is the offer of settlement and compromise?

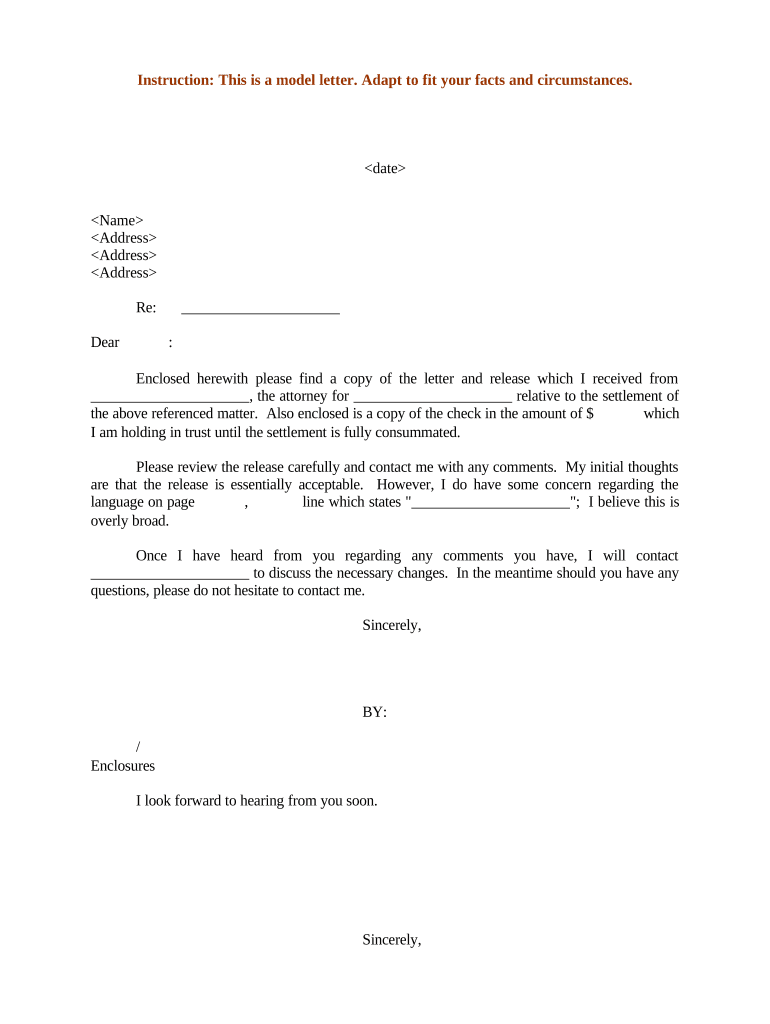

The offer of settlement and compromise is a legal document used in medical malpractice cases to propose a resolution between parties involved. This document outlines the terms under which one party agrees to settle a claim, often before it reaches litigation. The goal is to avoid the costs and uncertainties associated with a trial. It typically includes details such as the amount of compensation being offered, any conditions that must be met for the settlement to be valid, and the timeframe for acceptance. Understanding this document is crucial for both plaintiffs and defendants in navigating medical malpractice claims.

Key elements of the offer of settlement and compromise

When drafting an offer of settlement and compromise, several key elements must be included to ensure clarity and legality. These elements typically consist of:

- Identification of parties: Clearly state the names and roles of all parties involved in the settlement.

- Details of the claim: Provide a brief description of the medical malpractice claim being settled.

- Settlement amount: Specify the monetary compensation being offered to the claimant.

- Conditions of acceptance: Outline any conditions that must be met for the settlement to be accepted, such as signing a release of liability.

- Timeframe for acceptance: Indicate the period within which the offer must be accepted to remain valid.

Including these elements ensures that the offer is comprehensive and legally binding when accepted.

Steps to complete the offer of settlement and compromise

Completing an offer of settlement and compromise involves several important steps. Follow these guidelines to ensure that the document is properly prepared:

- Gather necessary information: Collect all relevant details about the claim, including medical records, evidence, and any previous communications.

- Draft the offer: Create the document, ensuring all key elements are included, as discussed earlier.

- Review for accuracy: Carefully review the draft for any errors or omissions that could affect the validity of the offer.

- Consult legal counsel: It is advisable to have a lawyer review the offer to ensure it complies with state laws and regulations.

- Send the offer: Deliver the offer to the opposing party, either through mail or electronically, ensuring you keep a record of the submission.

Following these steps can help facilitate a smoother negotiation process.

State-specific rules for the offer of settlement and compromise

Each state in the U.S. has its own rules and regulations governing the offer of settlement and compromise in medical malpractice cases. These rules may dictate specific requirements for the content of the offer, the timeframe for acceptance, and the legal implications of the settlement. It is essential to be aware of these state-specific rules to ensure compliance and maximize the chances of a successful resolution. Consulting with a legal expert familiar with the laws in your state can provide valuable guidance in this area.

Legal use of the offer of settlement and compromise

The legal use of an offer of settlement and compromise is critical in the context of medical malpractice claims. When properly executed, this document can serve as a binding agreement between the parties involved. It can help avoid lengthy court proceedings and provide a clear path to resolution. However, it is important to understand that once the offer is accepted, it typically requires the claimant to waive their right to pursue further legal action related to the claim. This underscores the importance of carefully considering the terms of the offer before acceptance.

Examples of using the offer of settlement and compromise

Examples of the offer of settlement and compromise can illustrate its practical application in medical malpractice cases. For instance, a patient who has experienced a surgical error may receive an offer from the healthcare provider's insurance company. The offer might propose a settlement amount to cover medical expenses and pain and suffering. Another example could involve a physician offering a settlement to a patient who claims negligence resulting in injury. These examples highlight how the offer can facilitate resolution and avoid the complexities of litigation.

Quick guide on how to complete offer of settlement and compromise

Complete Offer Of Settlement And Compromise effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers a seamless eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, adjust, and eSign your documents promptly without delays. Handle Offer Of Settlement And Compromise on any platform using airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to adjust and eSign Offer Of Settlement And Compromise without hassle

- Locate Offer Of Settlement And Compromise and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark signNow sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which only takes a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Adjust and eSign Offer Of Settlement And Compromise to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the states that have demand to settle or offer to settle in med mal?

The states that have demand to settle or offer to settle in med mal vary, but many states like California, Florida, and Texas have well-documented processes. Understanding the specific requirements and trends in these states can enhance your negotiation strategy and improve case outcomes.

-

How can airSlate SignNow assist in managing medical malpractice settlements?

airSlate SignNow streamlines the document signing and management process, making it easier to handle agreements related to settlements in states that have demand to settle or offer to settle in med mal. Our platform allows for fast and secure eSigning, reducing time spent on paperwork.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed for different business needs. By analyzing your specific requirements, you can choose a plan that optimally supports your operations in states that have demand to settle or offer to settle in med mal, ensuring a cost-effective solution.

-

Can I integrate airSlate SignNow with other tools?

Yes, airSlate SignNow seamlessly integrates with a variety of tools and software, allowing you to enhance your workflow. This is particularly beneficial for managing cases in states that have demand to settle or offer to settle in med mal, by linking with legal management and financial systems.

-

What features make airSlate SignNow a preferred choice for med mal settlements?

airSlate SignNow offers features like secure document storage, automated workflows, and customizable templates tailored for legal documents. These functionalities are particularly helpful for law firms and businesses dealing with states that have demand to settle or offer to settle in med mal.

-

How does eSigning expedite the settlement process in medical malpractice cases?

eSigning signNowly reduces the time required to finalize agreements, allowing quicker resolutions in medical malpractice cases. In states that have demand to settle or offer to settle in med mal, this efficiency can lead to enhanced client satisfaction and improved case management.

-

What security measures does airSlate SignNow provide?

airSlate SignNow prioritizes security with features like data encryption, secure cloud storage, and compliance with regulatory standards. These measures ensure that sensitive information related to settlements in states that have demand to settle or offer to settle in med mal remains protected.

Get more for Offer Of Settlement And Compromise

Find out other Offer Of Settlement And Compromise

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien

- eSign Florida Life-Insurance Quote Form Online

- eSign Louisiana Life-Insurance Quote Form Online

- How To eSign Michigan Life-Insurance Quote Form

- Can I eSign Colorado Business Insurance Quotation Form

- Can I eSign Hawaii Certeficate of Insurance Request

- eSign Nevada Certeficate of Insurance Request Now