Beneficiary Account Form

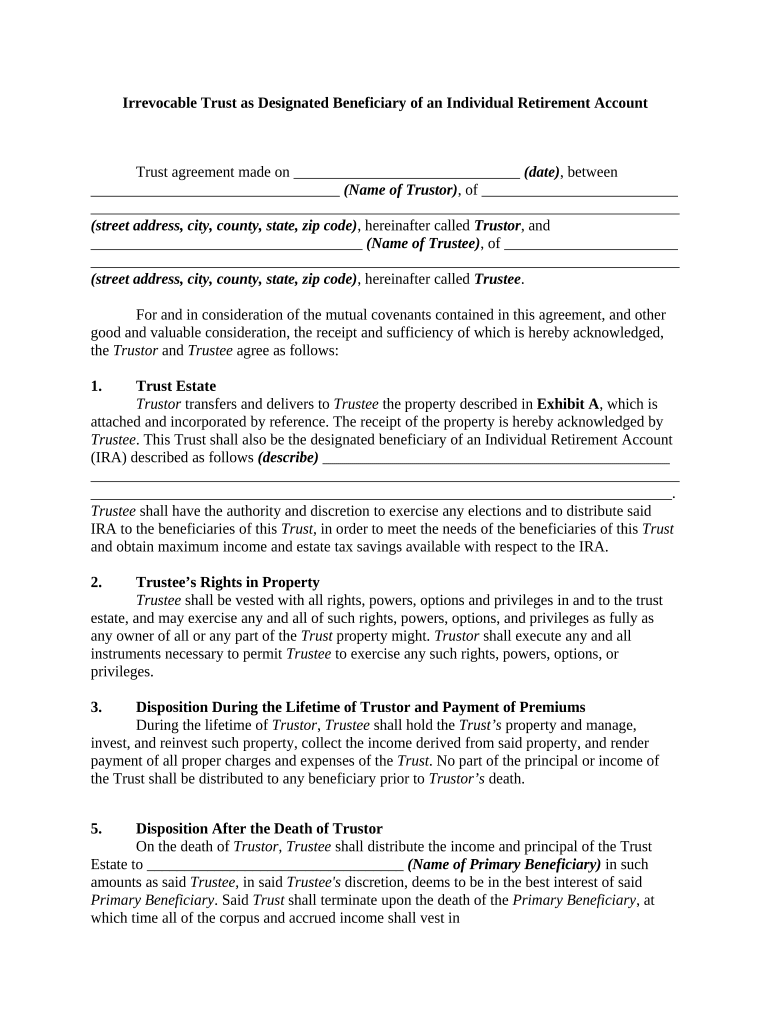

What is the Beneficiary Account

A beneficiary account is a financial account that designates a specific individual or entity to receive the assets upon the account holder's death. This arrangement ensures that the designated beneficiary can access the funds directly, bypassing the probate process. An irrevocable beneficiary is one who cannot be changed or removed without their consent, providing them with a guaranteed right to the assets in the account. This type of account is often used in estate planning to ensure that beneficiaries receive their intended inheritance efficiently and securely.

Steps to Complete the Beneficiary Account

Completing a beneficiary account involves several important steps to ensure that the account is set up correctly and legally binding. Here is a clear outline of the process:

- Gather necessary information, including the full name, address, and Social Security number of the designated beneficiary.

- Fill out the beneficiary account form accurately, ensuring all details are correct.

- Choose the type of beneficiary designation, such as revocable or irrevocable, based on your estate planning needs.

- Sign the form electronically using a reliable eSignature solution, ensuring compliance with legal standards.

- Submit the completed form to the financial institution managing the account.

Legal Use of the Beneficiary Account

The legal use of a beneficiary account is governed by various regulations and laws that ensure its validity. In the United States, the account must comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). These laws establish that electronic signatures have the same legal standing as handwritten ones, provided certain conditions are met. Additionally, using an irrevocable beneficiary designation can provide legal assurance that the assets will be distributed according to the account holder's wishes, protecting the beneficiary's rights.

Required Documents

To successfully set up a beneficiary account, certain documents are typically required. These may include:

- A completed beneficiary account form with accurate details.

- Proof of identity for both the account holder and the designated beneficiary, such as a driver's license or passport.

- Any supporting documentation that may be required by the financial institution, such as trust documents if applicable.

Who Issues the Form

The beneficiary account form is generally issued by the financial institution where the account is held. This could be a bank, credit union, or investment firm. Each institution may have its own specific form and requirements, so it is essential to obtain the correct version from the relevant provider. Additionally, some institutions may offer the option to complete the form electronically, streamlining the process for users.

Examples of Using the Beneficiary Account

Beneficiary accounts can be utilized in various scenarios, including:

- Life insurance policies, where the policyholder designates a beneficiary to receive the death benefit.

- Retirement accounts, such as IRAs, where individuals can name beneficiaries to inherit the funds.

- Bank accounts that allow for a payable-on-death (POD) designation, ensuring the funds are transferred to the beneficiary upon the account holder's passing.

Quick guide on how to complete beneficiary account 497330405

Complete Beneficiary Account effortlessly on any device

Digital document management has become widely accepted by companies and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and store it securely online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without interruptions. Manage Beneficiary Account on any platform using airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

The easiest way to modify and eSign Beneficiary Account seamlessly

- Obtain Beneficiary Account and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize key sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate reprinting copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Beneficiary Account and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an irrevocable beneficiary?

An irrevocable beneficiary is a person or entity that cannot be changed or removed from a policy without their consent. This means that the benefits from the policy are guaranteed to the irrevocable beneficiary, making it a reliable option for those who want to secure a specific beneficiary's financial future.

-

How does SignNow handle documents for irrevocable beneficiary designations?

SignNow allows users to easily create and manage documents that designate an irrevocable beneficiary. With our user-friendly interface, you can securely eSign and send these important documents, ensuring that your beneficiary’s rights are protected throughout the process.

-

Are there any costs associated with using SignNow for creating irrevocable beneficiary documents?

SignNow offers cost-effective plans that include the ability to create, send, and eSign documents, including those for irrevocable beneficiaries. By choosing our solution, you simplify the process without incurring high fees, ensuring that you can manage your important documents efficiently.

-

What features does SignNow provide for managing irrevocable beneficiary documents?

SignNow offers a range of features, such as document templates, custom workflows, and reminders to manage documents related to irrevocable beneficiaries. These tools help you streamline the process, keep track of important paperwork, and ensure that everything stays organized and accessible.

-

Can I integrate SignNow with other applications for managing irrevocable beneficiaries?

Yes, SignNow offers integrations with popular applications, making it easier to manage documents related to irrevocable beneficiaries. Whether you use CRM systems, cloud storage, or productivity tools, our integration capabilities allow seamless workflow across your platforms.

-

What are the benefits of designating an irrevocable beneficiary?

Designating an irrevocable beneficiary ensures that your chosen recipient will receive the benefits of your policy without risk of changes. This can be particularly beneficial for estate planning, as it provides clarity and certainty regarding asset distribution, especially in complex family situations.

-

How does SignNow ensure the security of documents related to irrevocable beneficiaries?

SignNow prioritizes security by employing advanced encryption protocols to protect documents for irrevocable beneficiaries. Our platform ensures that all data is securely stored and transmitted, giving you peace of mind that your sensitive information remains confidential and safeguarded against unauthorized access.

Get more for Beneficiary Account

Find out other Beneficiary Account

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free