Form 3800 2013

What is the Form 3800

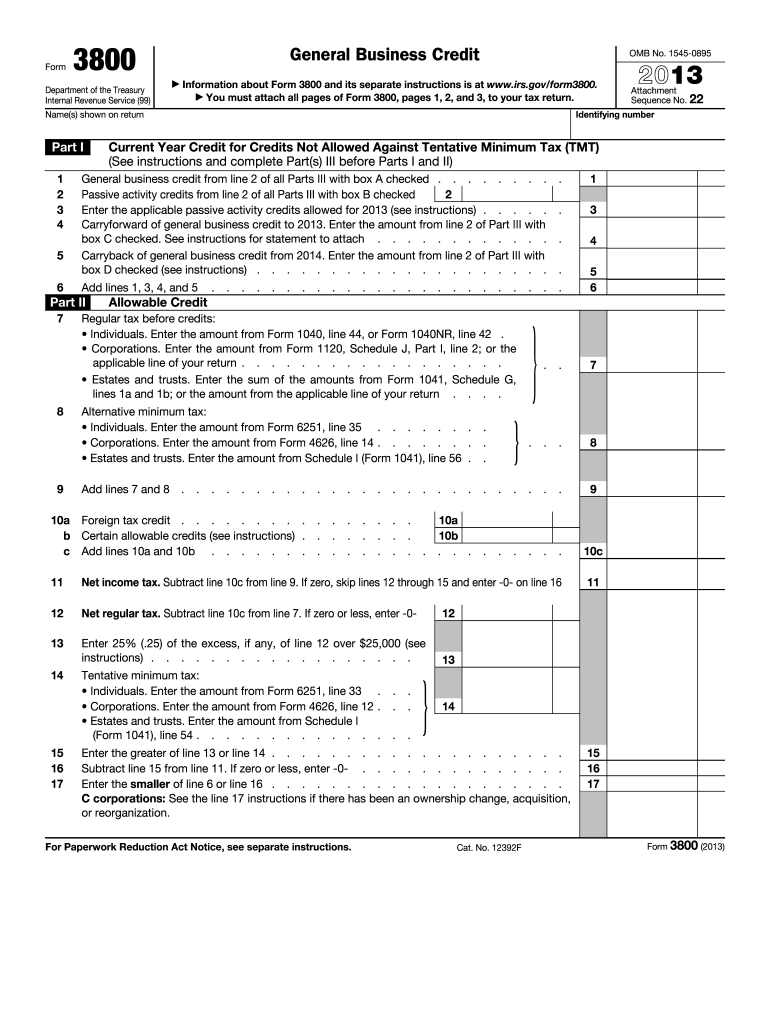

The Form 3800, officially known as the General Business Credit, is utilized by businesses to claim various tax credits. This form allows taxpayers to report their eligibility for credits that can reduce their overall tax liability. The credits included can vary widely, encompassing areas such as investment in renewable energy, low-income housing, and research activities. Understanding the purpose of Form 3800 is essential for businesses looking to maximize their tax benefits and ensure compliance with IRS regulations.

How to use the Form 3800

Using Form 3800 involves several key steps to ensure accurate reporting of tax credits. First, businesses must determine which credits they qualify for by reviewing the IRS guidelines associated with the form. Next, gather any necessary documentation that supports the eligibility for these credits. After completing the form, it should be attached to the business's tax return for the year in which the credits are being claimed. Properly utilizing Form 3800 can lead to significant tax savings for eligible businesses.

Steps to complete the Form 3800

Completing Form 3800 requires careful attention to detail. Follow these steps for accurate submission:

- Identify eligible credits: Review the credits listed on the form and determine which ones apply to your business.

- Gather documentation: Collect all relevant records that substantiate your claims, such as receipts and tax records.

- Fill out the form: Complete each section of the form, ensuring that all information is accurate and complete.

- Review: Double-check all entries for errors or omissions before finalizing the form.

- Submit: Attach Form 3800 to your tax return and file it by the designated deadline.

Legal use of the Form 3800

The legal use of Form 3800 is governed by IRS regulations, which stipulate that the form must be completed accurately to ensure compliance. Misreporting or failing to provide necessary documentation can result in penalties or disallowance of credits. Businesses should maintain thorough records and ensure that all claims made on the form are substantiated by appropriate evidence. Understanding the legal implications of Form 3800 is crucial for businesses to avoid potential issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for Form 3800 align with the overall tax filing deadlines for businesses. Typically, the form must be submitted along with the annual tax return, which is generally due on April fifteenth for most businesses. However, if a business operates on a fiscal year, the deadline may differ. It is important to stay informed about any changes to these deadlines to ensure timely submission and avoid penalties.

Key elements of the Form 3800

Form 3800 consists of several key elements that businesses must understand to complete it effectively:

- Identification Information: Basic information about the business, including name, address, and Employer Identification Number (EIN).

- Credit Categories: Sections that detail the specific credits being claimed, including the amount for each credit.

- Carryforward and Carryback: Provisions that allow businesses to apply unused credits to future or past tax years.

- Signature: A declaration that the information provided is accurate and complete, requiring a signature from an authorized individual.

Quick guide on how to complete form 3800

Complete Form 3800 effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without hassles. Handle Form 3800 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The simplest way to modify and eSign Form 3800 with ease

- Find Form 3800 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to finalize your changes.

- Choose how to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced forms, tedious document searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Form 3800 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 3800

Create this form in 5 minutes!

How to create an eSignature for the form 3800

How to create an electronic signature for a PDF in the online mode

How to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

The way to create an eSignature for a PDF on Android OS

People also ask

-

What is form 3800 and how does it relate to airSlate SignNow?

Form 3800 is a tax form used to claim various credits. airSlate SignNow simplifies the process of completing and eSigning Form 3800, streamlining your workflow and ensuring accurate submissions.

-

How can I integrate form 3800 with airSlate SignNow?

Integrating form 3800 with airSlate SignNow is seamless. You can easily upload the form into the platform, customize it for your needs, and share it for eSigning, making document management efficient.

-

What features does airSlate SignNow offer for handling form 3800?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for form 3800. These tools help ensure compliance and enhance the efficiency of your tax filing process.

-

Is airSlate SignNow cost-effective for submitting form 3800?

Yes, airSlate SignNow is a cost-effective solution for submitting form 3800. With various pricing plans available, you can choose one that fits your business size and budget while benefiting from unlimited document eSigning.

-

How long does it take to complete form 3800 using airSlate SignNow?

Using airSlate SignNow, completing form 3800 can take just minutes. The intuitive interface allows users to fill out the form quickly and send it for eSignature, signNowly reducing processing time.

-

Can multiple users eSign form 3800 through airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to eSign form 3800 simultaneously. This feature is particularly valuable for businesses needing approvals from various stakeholders.

-

What security measures does airSlate SignNow have for form 3800?

airSlate SignNow prioritizes security, implementing encryption and secure access protocols to protect your form 3800 data. Compliance with industry standards ensures that your sensitive information remains safe.

Get more for Form 3800

- Quitclaim deed from corporation to corporation kansas form

- Warranty deed from corporation to corporation kansas form

- Quitclaim deed from corporation to two individuals kansas form

- Warranty deed from corporation to two individuals kansas form

- Warranty deed from individual to a trust kansas form

- Warranty deed from husband and wife to a trust kansas form

- Kansas husband form

- Quitclaim deed from husband to himself and wife kansas form

Find out other Form 3800

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form