Minimum Tax Form 2014

What is the Minimum Tax Form

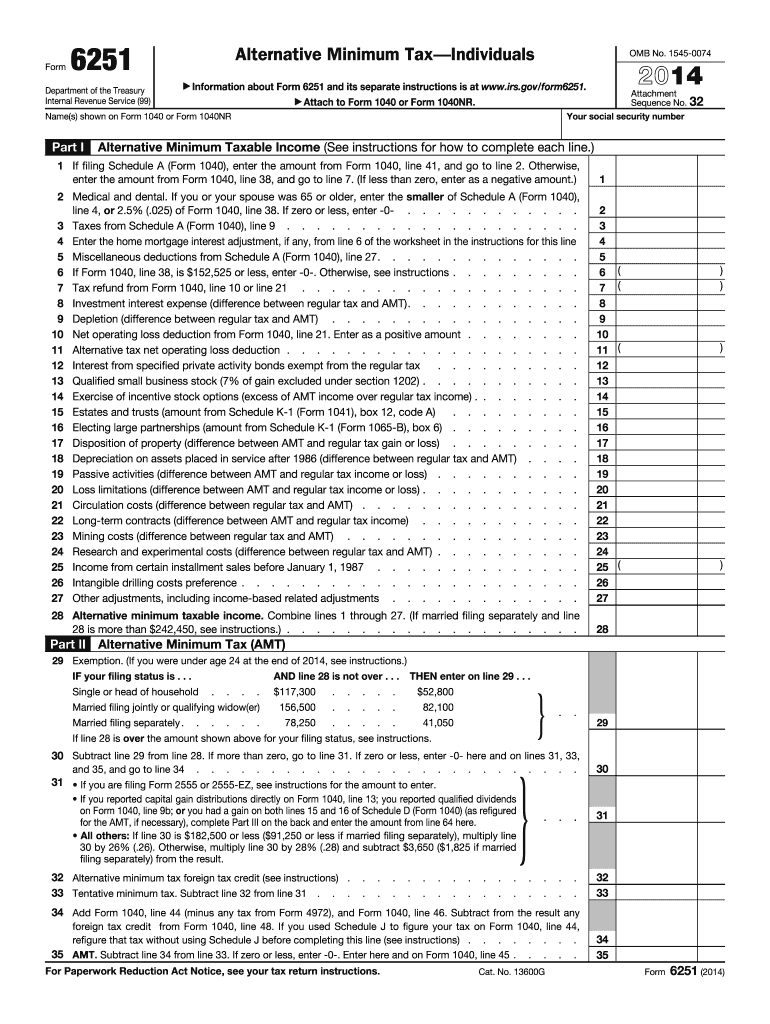

The Minimum Tax Form is a specific tax document used by individuals and businesses to report their minimum tax liability to the Internal Revenue Service (IRS). This form is essential for those who may not owe a significant amount of tax but are still required to file to comply with federal tax regulations. It ensures that all taxpayers contribute a minimum amount to the federal budget, regardless of their overall income or deductions.

How to use the Minimum Tax Form

Using the Minimum Tax Form involves several steps to ensure accurate reporting of your tax obligations. First, gather all necessary financial documents, including income statements and previous tax returns. Next, fill out the form with your personal information and financial details as required. Pay special attention to sections that ask for income, deductions, and credits. Once completed, review the form for accuracy before submitting it to the IRS. It is advisable to keep a copy for your records.

Steps to complete the Minimum Tax Form

Completing the Minimum Tax Form can be broken down into a few straightforward steps:

- Gather all relevant financial documents, such as W-2s, 1099s, and any other income statements.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income and any applicable deductions or credits.

- Calculate your minimum tax liability based on the provided instructions.

- Review your completed form for accuracy and completeness.

- Submit the form electronically or by mail to the IRS.

Legal use of the Minimum Tax Form

The Minimum Tax Form must be filled out and submitted in accordance with IRS regulations to be considered legally binding. This means that all information provided must be accurate and truthful. Failure to comply with tax laws can result in penalties or legal consequences. It is important to understand that digital signatures, when used, must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act to ensure their validity.

Filing Deadlines / Important Dates

Filing deadlines for the Minimum Tax Form typically align with the annual tax filing season. Generally, individual taxpayers must submit their forms by April 15 of each year, while businesses may have different deadlines depending on their entity type. It is crucial to stay informed about any changes to these deadlines, as extensions may be available under specific circumstances. Marking important dates on your calendar can help ensure timely submission and avoid penalties.

Who Issues the Form

The Minimum Tax Form is issued by the Internal Revenue Service (IRS), which is the U.S. government agency responsible for tax collection and enforcement of tax laws. The IRS provides detailed instructions on how to complete the form, as well as guidelines on eligibility and filing requirements. It is important to obtain the latest version of the form directly from the IRS to ensure compliance with current tax laws.

Quick guide on how to complete 2014 minimum tax form

Prepare Minimum Tax Form effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Handle Minimum Tax Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Minimum Tax Form effortlessly

- Obtain Minimum Tax Form and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about misplaced or lost files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign Minimum Tax Form and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 minimum tax form

Create this form in 5 minutes!

How to create an eSignature for the 2014 minimum tax form

The way to make an eSignature for your PDF document online

The way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the Minimum Tax Form and why is it important?

The Minimum Tax Form is a crucial document that identifies the minimum tax owed by individuals or businesses. Properly completing this form ensures compliance with tax regulations and helps avoid penalties. Understanding its significance can streamline your tax preparation process.

-

How can airSlate SignNow help me with my Minimum Tax Form?

airSlate SignNow offers a user-friendly platform for electronically signing and managing your Minimum Tax Form. With our eSignature solution, you can easily collaborate with tax professionals and securely finalize your documents. This streamlined process saves time and enhances accuracy.

-

What features does airSlate SignNow provide for the Minimum Tax Form?

airSlate SignNow includes features such as customizable templates, document sharing, and secure eSignatures for your Minimum Tax Form. These tools simplify the workflow, reduce paperwork, and improve collaboration. Our platform is designed to make tax season hassle-free.

-

What are the benefits of using airSlate SignNow for filing the Minimum Tax Form?

Using airSlate SignNow for your Minimum Tax Form helps ensure a seamless and efficient eSignature process. Our software enhances document security and allows real-time tracking of who signed and when. Additionally, it reduces the need for physical documents, promoting a more eco-friendly approach.

-

Is there a cost associated with using airSlate SignNow for the Minimum Tax Form?

Yes, there are affordable pricing plans available for airSlate SignNow that cater to various needs. We offer a free trial so you can explore our features before committing. Choose the plan that fits your requirements for managing your Minimum Tax Form effectively.

-

Can airSlate SignNow integrate with other software for the Minimum Tax Form?

Absolutely! airSlate SignNow supports integrations with popular accounting and financial software to help streamline the management of your Minimum Tax Form. This interoperability makes it easier to import data and maintain an organized workflow, enhancing productivity.

-

How secure is the airSlate SignNow platform for my Minimum Tax Form?

Security is a top priority for airSlate SignNow. Our platform complies with industry standards and employs advanced encryption to protect your Minimum Tax Form. You can sign documents with confidence, knowing that your sensitive information is well-guarded.

Get more for Minimum Tax Form

- Kansas prenuptial agreement form

- Amendment to prenuptial or premarital agreement kansas form

- Financial statements only in connection with prenuptial premarital agreement kansas form

- Kansas prenuptial form

- Kansas business incorporation package to incorporate corporation kansas form

- Ks corporation form

- Ks agreement contract form

- Bylaws 497307337 form

Find out other Minimum Tax Form

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application