F2555ez Form 2002

What is the F2555ez Form

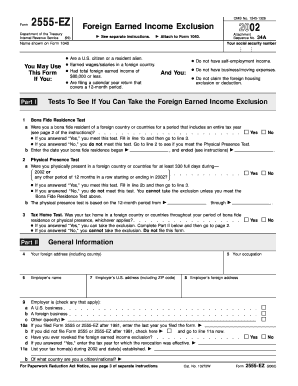

The F2555ez Form is a simplified version of the Form 2555, used by U.S. citizens and resident aliens to claim the foreign earned income exclusion. This form allows eligible taxpayers to exclude a portion of their income earned abroad from U.S. taxation. The F2555ez is specifically designed for individuals who meet certain criteria, making the filing process more straightforward and less burdensome. It is particularly useful for those who do not have housing expenses or who do not wish to claim the foreign housing exclusion.

How to use the F2555ez Form

Using the F2555ez Form involves several key steps. First, ensure you qualify for the foreign earned income exclusion. You must meet the bona fide residence test or the physical presence test. Next, gather necessary information, including your foreign earned income and the dates you were outside the United States. Fill out the form accurately, providing all required details, and ensure that you sign and date the form before submission. It is important to review IRS guidelines to confirm that you are eligible to use this simplified version.

Steps to complete the F2555ez Form

Completing the F2555ez Form requires careful attention to detail. Follow these steps:

- Confirm your eligibility based on the bona fide residence or physical presence tests.

- Collect your foreign earned income information and relevant dates.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions.

- Sign and date the form before submission.

By following these steps, you can ensure that your F2555ez Form is completed correctly and submitted on time.

Legal use of the F2555ez Form

The F2555ez Form is legally recognized by the IRS for claiming the foreign earned income exclusion. To ensure its legal validity, it must be completed in accordance with IRS guidelines and submitted by the appropriate deadlines. The form must be signed by the taxpayer, and it is essential to maintain accurate records of your foreign income and residency status. Failure to comply with IRS regulations can result in penalties or the denial of your exclusion claim.

Filing Deadlines / Important Dates

Filing deadlines for the F2555ez Form align with the general tax filing deadlines for U.S. citizens. Typically, the form must be submitted by April 15 of the following year. However, if you are living abroad, you may qualify for an automatic extension until June 15. It is important to keep track of these dates to avoid late filing penalties. If you need additional time, you can request an extension, but ensure that you file any taxes owed by the original deadline to avoid interest and penalties.

Eligibility Criteria

To use the F2555ez Form, you must meet specific eligibility criteria. These include:

- You must be a U.S. citizen or a resident alien.

- Your foreign earned income must be below the exclusion limit set by the IRS.

- You must meet either the bona fide residence test or the physical presence test.

- You cannot claim the foreign housing exclusion or deduction.

Meeting these criteria ensures that you can legally file the F2555ez Form and benefit from the foreign earned income exclusion.

Quick guide on how to complete f2555ez 2002 form

Effortlessly prepare F2555ez Form on any device

Managing documents online has become increasingly popular among companies and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, as you can access the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to swiftly create, modify, and electronically sign your documents without delays. Handle F2555ez Form on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign F2555ez Form with ease

- Locate F2555ez Form and click Get Form to begin.

- Employ the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your digital signature using the Sign tool, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Adjust and electronically sign F2555ez Form and ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct f2555ez 2002 form

Create this form in 5 minutes!

How to create an eSignature for the f2555ez 2002 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

The way to create an eSignature for a PDF on Android

People also ask

-

What is the F2555ez Form?

The F2555ez Form is a simplified tax return form that U.S. citizens can use to claim the foreign earned income exclusion. Utilizing the F2555ez Form allows you to easily report your foreign earnings and ensure you are compliant with IRS regulations while maximizing your tax benefits.

-

How can airSlate SignNow help with the F2555ez Form?

airSlate SignNow provides a seamless platform to eSign and send your F2555ez Form securely. With its user-friendly interface, you can easily prepare, sign, and manage your tax documents from anywhere, ensuring you meet all submission deadlines without hassle.

-

Is there a cost to use airSlate SignNow for the F2555ez Form?

Yes, airSlate SignNow offers various pricing plans to fit your needs, ranging from basic to more comprehensive options. Each plan provides access to features that simplify the process of eSigning and managing your F2555ez Form and other essential documents.

-

What features does airSlate SignNow offer for eSigning the F2555ez Form?

AirSlate SignNow includes multiple features such as document templates, customizable workflows, and secure storage for your F2555ez Form. Additionally, you can track document status in real-time, ensuring that you can monitor each step of the signing process efficiently.

-

Can I integrate airSlate SignNow with other software for managing my F2555ez Form?

Absolutely! airSlate SignNow offers integrations with popular applications such as Google Drive, Dropbox, and more. This helps streamline the process of preparing your F2555ez Form and enables you to keep your files organized in one central location.

-

Is it safe to use airSlate SignNow for my F2555ez Form?

Yes, airSlate SignNow prioritizes your security with bank-level encryptions and compliance with international security standards. When you use airSlate SignNow to manage your F2555ez Form, you can rest assured that your personal information and documents will remain safe and private.

-

How quickly can I complete and submit my F2555ez Form using airSlate SignNow?

With airSlate SignNow, you can complete and submit your F2555ez Form in just a few minutes. The platform simplifies the eSigning process, allowing you to send, receive, and manage your documents swiftly to ensure timely submission to the IRS.

Get more for F2555ez Form

Find out other F2555ez Form

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application