General Letter Credit Form

What is the General Letter Credit

A general letter credit is a financial document issued by a bank or financial institution that guarantees payment to a seller on behalf of a buyer, provided that the seller meets specific conditions outlined in the letter. This instrument is commonly used in international trade to mitigate risks associated with cross-border transactions. By assuring the seller of payment, it facilitates trust and encourages trade between parties who may not have prior relationships.

How to Use the General Letter Credit

Using a general letter credit involves several steps. First, the buyer must apply for the letter through their bank, specifying the terms and conditions that need to be met for payment. Once the bank issues the letter, it is sent to the seller's bank, which informs the seller of the credit's availability. The seller then prepares the goods or services and submits the required documentation to their bank to receive payment. It is crucial for both parties to understand the terms outlined in the letter to ensure compliance and avoid disputes.

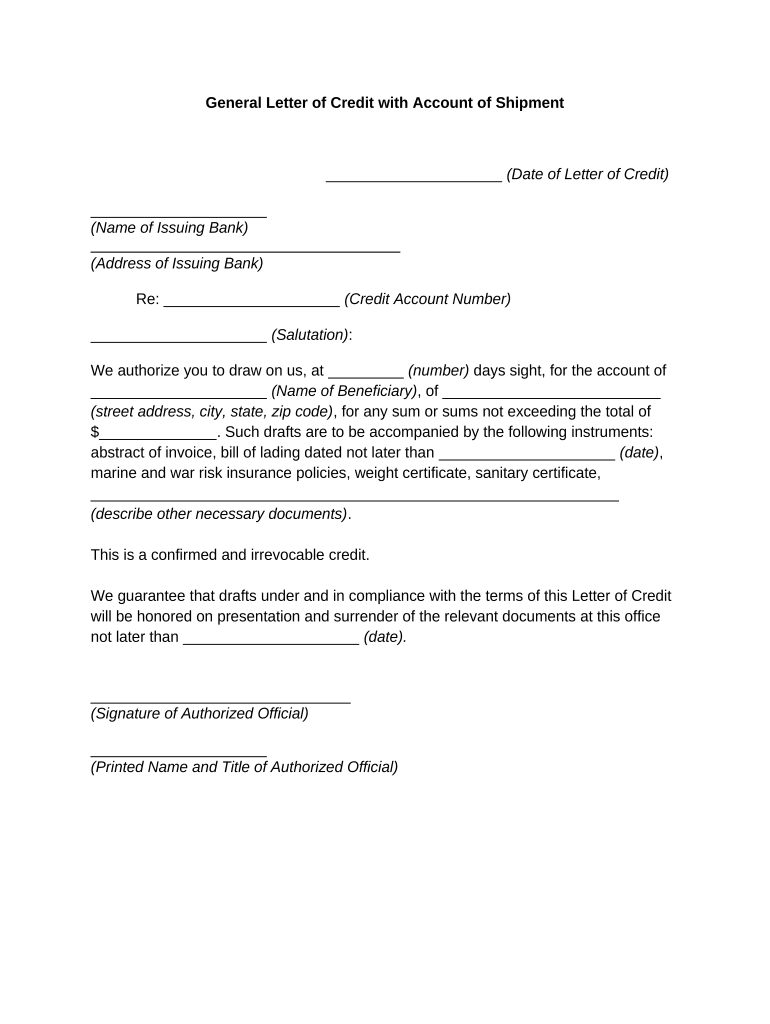

Key Elements of the General Letter Credit

Several key elements define a general letter credit. These include:

- Beneficiary: The party entitled to receive payment, usually the seller.

- Applicant: The buyer who requests the letter credit from their bank.

- Issuing Bank: The financial institution that issues the letter credit on behalf of the buyer.

- Amount: The total sum guaranteed by the letter credit.

- Expiration Date: The date by which the seller must present the required documents to receive payment.

- Terms and Conditions: Specific requirements that must be met for payment to be released, such as shipping documents or invoices.

Steps to Complete the General Letter Credit

Completing a general letter credit involves a series of steps to ensure all parties fulfill their obligations. The process typically includes:

- The buyer applies for the letter credit from their bank.

- The bank reviews the application and issues the letter, detailing the terms.

- The letter is sent to the seller's bank.

- The seller prepares the goods and necessary documentation.

- The seller submits the documentation to their bank for verification.

- The seller's bank forwards the documents to the issuing bank.

- The issuing bank reviews the documents and releases payment to the seller if all conditions are met.

Legal Use of the General Letter Credit

The legal use of a general letter credit is governed by international trade laws and regulations, including the Uniform Customs and Practice for Documentary Credits (UCP). This framework provides guidelines for the issuance and handling of letters of credit, ensuring that transactions are conducted fairly and transparently. It is essential for all parties involved to understand their rights and obligations under these laws to avoid potential legal issues.

Examples of Using the General Letter Credit

General letters of credit are frequently used in various scenarios. For instance, a U.S. importer may use a letter credit to purchase machinery from a manufacturer in Europe. The importer’s bank issues the letter, guaranteeing payment upon receipt of shipping documents. Another example could involve a U.S. exporter who requires assurance of payment from a foreign buyer. In this case, the buyer’s bank issues a letter credit to protect the exporter’s interests. These examples illustrate how letters of credit facilitate international trade by providing security and trust between parties.

Quick guide on how to complete general letter credit

Effortlessly Prepare General Letter Credit on Any Device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the required forms and securely store them online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents rapidly without delays. Handle General Letter Credit on any device with the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The Easiest Way to Edit and eSign General Letter Credit with Ease

- Obtain General Letter Credit and click Get Form to initiate the process.

- Utilize the tools we supply to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal significance as a traditional hand-signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign General Letter Credit and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a general letter credit?

A general letter credit is a financial instrument used in international trade that provides a guarantee of payment to a seller. This ensures that the seller receives funds upon fulfilling their obligations, providing security for both parties involved in a transaction.

-

How can airSlate SignNow help with general letter credit transactions?

airSlate SignNow simplifies the process of managing general letter credit transactions by allowing users to create, send, and electronically sign necessary documents quickly. This streamlines compliance and reduces processing time, helping businesses close deals more efficiently.

-

What are the benefits of using airSlate SignNow for general letter credit?

Using airSlate SignNow for general letter credit offers numerous benefits, including enhanced security, reduced transaction times, and cost-effectiveness. The platform’s easy-to-use interface allows users to handle documents without needing technical expertise, making it accessible for all businesses.

-

Are there any integration options available for airSlate SignNow and general letter credit?

Yes, airSlate SignNow integrates seamlessly with various business applications, enhancing its utility for managing general letter credit. This allows users to streamline their workflows, connect with financial systems, and maintain data consistency throughout the document management process.

-

What is the pricing structure for airSlate SignNow related to general letter credit services?

airSlate SignNow offers flexible pricing plans tailored for businesses of all sizes, making it affordable for managing general letter credit transactions. Pricing details, including subscriptions and pay-per-use options, can be found on our website, ensuring transparency and ease of budgeting for organizations.

-

Can I track the status of my general letter credit documents with airSlate SignNow?

Yes, with airSlate SignNow, you can easily track the status of your general letter credit documents in real-time. This feature enables users to stay informed about when documents are sent, viewed, and signed, enhancing accountability and communication with all parties involved.

-

What types of documents can be processed with airSlate SignNow for general letter credit?

airSlate SignNow can process various documents related to general letter credit, such as applications, agreements, and confirmations. This versatility makes it a valuable tool for businesses needing to handle different documentation requirements in international trade.

Get more for General Letter Credit

- Ibm shap form

- Free 23 sample medical history forms in pdfwordexcel

- Csx medical department form

- Mental health relapse prevention plan pdf form

- Kaiser permanente authorization and neighbor island referral form providers kaiserpermanente

- Name dob age sex male female form

- Ob gyn lab tests form

- Dental patient medical form

Find out other General Letter Credit

- Sign Arizona Banking Permission Slip Easy

- Can I Sign California Banking Lease Agreement Template

- How Do I Sign Colorado Banking Credit Memo

- Help Me With Sign Colorado Banking Credit Memo

- How Can I Sign Colorado Banking Credit Memo

- Sign Georgia Banking Affidavit Of Heirship Myself

- Sign Hawaii Banking NDA Now

- Sign Hawaii Banking Bill Of Lading Now

- Sign Illinois Banking Confidentiality Agreement Computer

- Sign Idaho Banking Rental Lease Agreement Online

- How Do I Sign Idaho Banking Limited Power Of Attorney

- Sign Iowa Banking Quitclaim Deed Safe

- How Do I Sign Iowa Banking Rental Lease Agreement

- Sign Iowa Banking Residential Lease Agreement Myself

- Sign Kansas Banking Living Will Now

- Sign Kansas Banking Last Will And Testament Mobile

- Sign Kentucky Banking Quitclaim Deed Online

- Sign Kentucky Banking Quitclaim Deed Later

- How Do I Sign Maine Banking Resignation Letter

- Sign Maine Banking Resignation Letter Free