Annuity Trust Form

What is the Annuity Trust

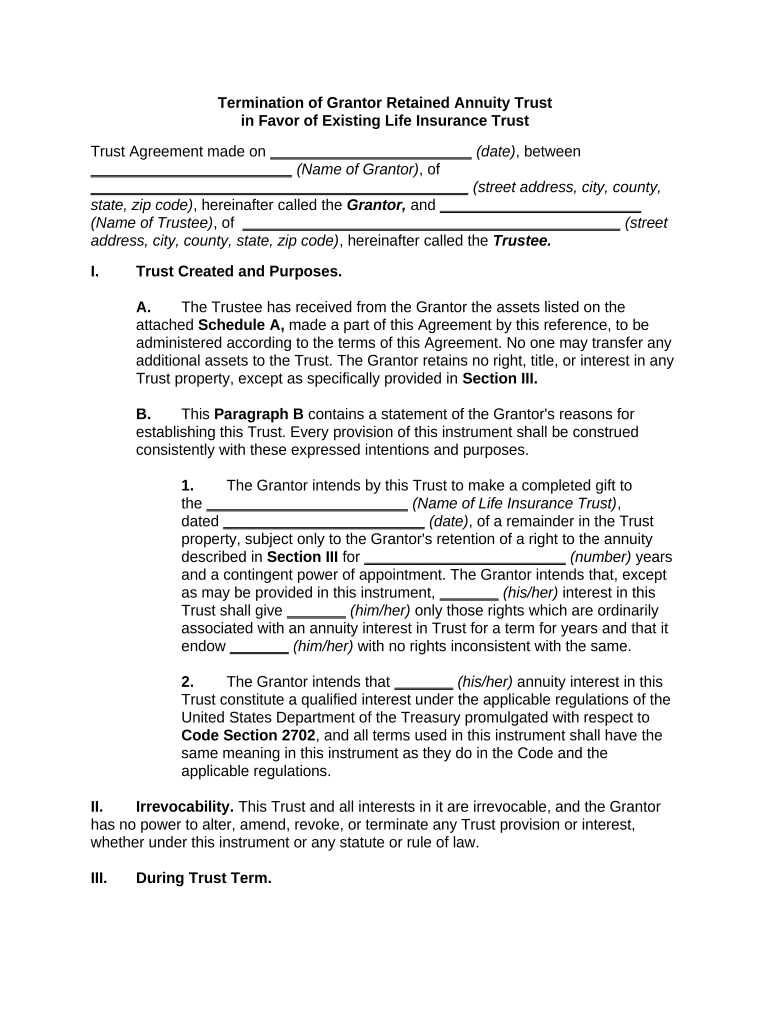

An annuity trust is a financial arrangement that allows individuals to transfer assets into a trust and receive income from those assets over a specified period. This type of trust is often used for estate planning and can provide tax benefits. The grantor retained annuity trust (GRAT) is a common variant, where the grantor retains the right to receive payments for a certain number of years before the remaining assets are passed on to beneficiaries. This structure can help minimize gift taxes while providing a steady income stream.

How to use the Annuity Trust

Using an annuity trust involves several key steps. Initially, the grantor must decide on the assets to be placed in the trust. These can include cash, securities, or other investments. Next, the grantor specifies the terms of the trust, including the duration and payment structure. Once established, the trust can provide income to the grantor or designated beneficiaries while ensuring that the remaining assets are transferred according to the grantor's wishes. It is essential to consult with legal and financial professionals to ensure compliance with relevant laws and regulations.

Steps to complete the Annuity Trust

Completing an annuity trust typically involves the following steps:

- Determine the assets to be included in the trust.

- Choose the beneficiaries who will receive the remaining assets after the trust term.

- Draft the trust document, outlining the terms and conditions.

- Fund the trust by transferring the selected assets.

- File any necessary documentation with the appropriate state authorities.

Each step is crucial for ensuring the trust operates as intended and complies with legal requirements.

Legal use of the Annuity Trust

The legal use of an annuity trust is governed by both state and federal laws. It is essential for the grantor to understand the legal implications of creating such a trust, including tax responsibilities and compliance with the IRS guidelines. Annuity trusts must adhere to specific regulations to maintain their tax advantages, such as ensuring that the trust is irrevocable and that the grantor does not retain excessive control over the trust assets. Consulting with a legal expert can help navigate these complexities.

IRS Guidelines

The IRS has established guidelines for annuity trusts, particularly concerning taxation and reporting requirements. For instance, income generated by the trust may be subject to different tax treatments depending on the trust's structure and the type of assets involved. Grantors must report income received from the trust on their tax returns, and any distributions to beneficiaries may also have tax implications. Staying informed about IRS regulations is vital for maintaining compliance and optimizing tax benefits.

Required Documents

Establishing an annuity trust requires specific documentation to ensure legal compliance. Essential documents may include:

- The trust agreement, detailing the terms and conditions.

- Asset transfer documents, proving the transfer of ownership.

- Tax identification number for the trust.

- Any state-specific filings required for trust registration.

Having these documents prepared accurately is crucial for the trust's validity and functionality.

Quick guide on how to complete annuity trust

Complete Annuity Trust effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, as you can access the correct format and securely save it online. airSlate SignNow equips you with all the features necessary to create, edit, and eSign your documents quickly without delays. Manage Annuity Trust on any device using airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to modify and eSign Annuity Trust with ease

- Find Annuity Trust and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the information and then click the Done button to save your changes.

- Select how you would like to send your form, whether via email, SMS, or an invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Alter and eSign Annuity Trust and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an annuity trust?

An annuity trust is a financial arrangement that provides regular income payments over a specified period or until a beneficiary's death. This type of trust can be essential for managing long-term income and ensuring stable benefits for heirs. By understanding the details of an annuity trust, you can plan effectively for your financial future.

-

How does an annuity trust work?

An annuity trust works by converting a lump sum of assets into a stream of income that is distributed to beneficiaries, usually over their lifetime or a set term. The trust is established through a legal agreement that specifies the payout terms and conditions. This structured approach allows for more predictable and secure financial outcomes for your beneficiaries.

-

What are the benefits of setting up an annuity trust?

Setting up an annuity trust offers numerous benefits, including tax advantages, controlled transfers of wealth, and providing a steady income stream for designated beneficiaries. Additionally, it can help reduce estate taxes and ensure that your assets are distributed according to your wishes. An annuity trust can be an essential part of your comprehensive estate planning strategy.

-

Are there any fees associated with an annuity trust?

Yes, establishing and maintaining an annuity trust may incur various fees, including setup costs, administrative fees, and potential investment management fees. It is crucial to discuss these costs with a financial advisor to understand how they may impact the overall value of your annuity trust. Proper financial planning can help mitigate these costs effectively.

-

Can I integrate airSlate SignNow with my annuity trust documentation?

Absolutely! airSlate SignNow allows you to easily create, send, and eSign documents relating to your annuity trust online. This integration streamlines the process of managing trust documents while ensuring they are legally binding and securely stored. Utilizing airSlate SignNow can enhance the efficiency of your annuity trust management.

-

What features should I look for in annuity trust software?

When selecting software for managing an annuity trust, look for features such as eSigning capabilities, document management, secure storage, and easy collaboration tools. Additionally, integration with financial planning tools can be beneficial. Choosing the right software can simplify the administration of your annuity trust and enhance client communication.

-

How can an annuity trust help with estate planning?

An annuity trust can play a signNow role in estate planning by providing guaranteed income for beneficiaries while ensuring that assets are distributed according to your wishes. This type of trust helps minimize estate taxes and can protect assets from creditors. By incorporating an annuity trust into your estate plan, you can achieve greater financial security for your loved ones.

Get more for Annuity Trust

Find out other Annuity Trust

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter