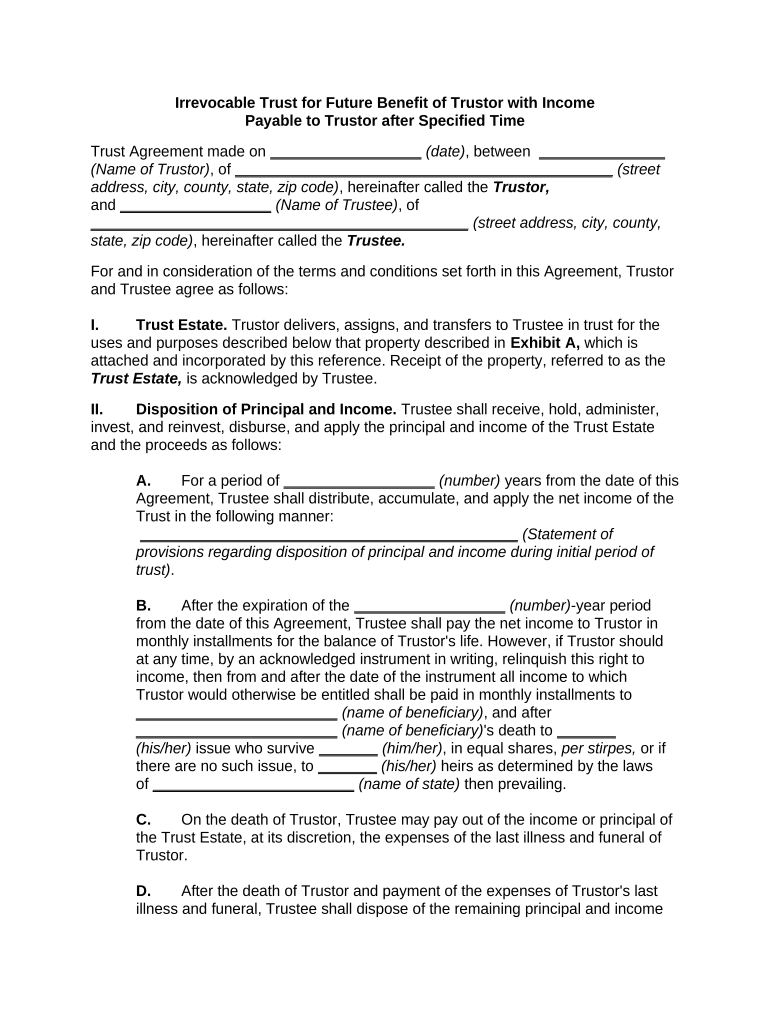

Irrevocable Income Form

What is the irrevocable trust income?

The irrevocable trust income refers to the income generated from assets held within an irrevocable trust. Unlike revocable trusts, irrevocable trusts cannot be altered or revoked once established, meaning the trustor relinquishes control over the assets. This type of trust is often used for estate planning, asset protection, and tax benefits. The income generated is typically subject to specific tax rules, and the beneficiaries may receive distributions according to the terms set forth in the trust agreement.

Key elements of the irrevocable trust income

Understanding the key elements of irrevocable trust income is essential for both trustors and beneficiaries. These elements include:

- Trust Structure: The irrevocable trust must be properly structured to ensure it meets legal requirements.

- Income Generation: Income can come from various sources, such as rental properties, dividends, or interest from investments.

- Tax Implications: The income generated may be taxed at the trust level or passed through to beneficiaries, who will then report it on their tax returns.

- Distribution Terms: The trust document outlines how and when income is distributed to beneficiaries.

Steps to complete the irrevocable trust income

Completing the irrevocable trust income involves several steps to ensure compliance and proper management. These steps include:

- Drafting the Trust Document: Work with a legal professional to draft a trust agreement that clearly outlines the terms and conditions.

- Funding the Trust: Transfer assets into the trust to generate income. This may include cash, real estate, or investments.

- Tax Identification Number: Obtain a Tax Identification Number (TIN) for the trust to facilitate tax reporting.

- Income Tracking: Maintain accurate records of income generated from trust assets for tax purposes.

- Distributions: Follow the terms of the trust regarding how and when income is distributed to beneficiaries.

Legal use of the irrevocable trust income

The legal use of irrevocable trust income is governed by both state and federal laws. Trustors must ensure compliance with relevant regulations to avoid penalties. Key legal considerations include:

- Trustee Responsibilities: The trustee must manage the trust assets prudently and in accordance with the trust document.

- Tax Compliance: Trust income must be reported accurately on tax returns, and any distributions to beneficiaries must also comply with tax laws.

- Beneficiary Rights: Beneficiaries have rights to the income as specified in the trust agreement, and any disputes may require legal resolution.

IRS guidelines for irrevocable trust income

The Internal Revenue Service (IRS) provides specific guidelines for the taxation of irrevocable trust income. Key points to consider include:

- Tax Filing: Irrevocable trusts must file Form 1041, U.S. Income Tax Return for Estates and Trusts, to report income.

- Distribution Deduction: Trusts can deduct distributions made to beneficiaries, which may help reduce taxable income at the trust level.

- Tax Rates: Trust income is taxed at higher rates than individual income, making proper management and distribution crucial.

Required documents for irrevocable trust income

To effectively manage irrevocable trust income, certain documents are essential. These documents include:

- Trust Agreement: The foundational document that outlines the terms of the trust.

- Asset Inventory: A detailed list of all assets held within the trust.

- Tax Identification Number: Documentation showing the TIN assigned to the trust.

- Income Records: Statements and reports detailing income generated from trust assets.

- Distribution Records: Documentation of any distributions made to beneficiaries.

Quick guide on how to complete irrevocable income

Handle Irrevocable Income seamlessly on any gadget

Digital document management has gained signNow traction among enterprises and individuals alike. It offers a sustainable alternative to conventional printed and signed documents, allowing you to easily find the right template and securely save it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and eSign your documents rapidly without any hold-ups. Manage Irrevocable Income on any gadget with the airSlate SignNow Android or iOS applications and enhance any document-centered task today.

The optimal method to modify and eSign Irrevocable Income effortlessly

- Find Irrevocable Income and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive content with tools that airSlate SignNow specifically offers for such tasks.

- Generate your eSignature using the Sign tool, a process that takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require new hard copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Alter and eSign Irrevocable Income to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is irrevocable trust income and how is it generated?

Irrevocable trust income refers to the earnings generated from an irrevocable trust, which cannot be altered once established. This income can come from various sources, including investments, rental properties, or interest from bank accounts. Understanding how to manage this income effectively is crucial for beneficiaries and trustees alike.

-

How can airSlate SignNow assist in managing irrevocable trust income documentation?

airSlate SignNow streamlines the process of managing irrevocable trust income by allowing users to easily send, sign, and store important documents securely. This not only reduces paperwork but also ensures that all parties involved maintain compliance with legal requirements. Accessing and sharing documents becomes hassle-free with our platform.

-

What are the benefits of using airSlate SignNow for irrevocable trust income-related contracts?

Using airSlate SignNow for irrevocable trust income-related contracts provides the benefits of enhanced security, legal compliance, and ease of use. The platform is designed to safeguard sensitive information while facilitating quick and efficient signing processes. This ensures that all agreements related to trust income are duly executed and stored safely.

-

Is airSlate SignNow suitable for large firms managing multiple irrevocable trusts?

Yes, airSlate SignNow is particularly well-suited for large firms managing multiple irrevocable trusts, as it offers robust features for document management and collaboration. With its scalable solutions, firms can handle various incoming documents related to trust income efficiently. This helps maintain organization while ensuring compliance across all trusts.

-

How does airSlate SignNow integrate with other financial systems for trust income management?

airSlate SignNow offers seamless integration with various financial and accounting systems, making it easier to manage irrevocable trust income efficiently. This integration allows for automatic syncing of important data, ensuring that all financial records remain up-to-date. As a result, managing trust income becomes more streamlined.

-

What pricing plans does airSlate SignNow offer for managing irrevocable trust income?

airSlate SignNow offers flexible pricing plans designed to cater to different business sizes and needs. Our plans provide access to essential features needed for managing irrevocable trust income while maintaining cost-effectiveness. Businesses can choose a plan that perfectly aligns with their requirements.

-

Can I track the status of documents related to irrevocable trust income using airSlate SignNow?

Absolutely! airSlate SignNow includes features that allow users to track the status of documents related to irrevocable trust income in real-time. This helps ensure that all necessary signatures are collected efficiently while keeping all stakeholders informed throughout the process.

Get more for Irrevocable Income

Find out other Irrevocable Income

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe