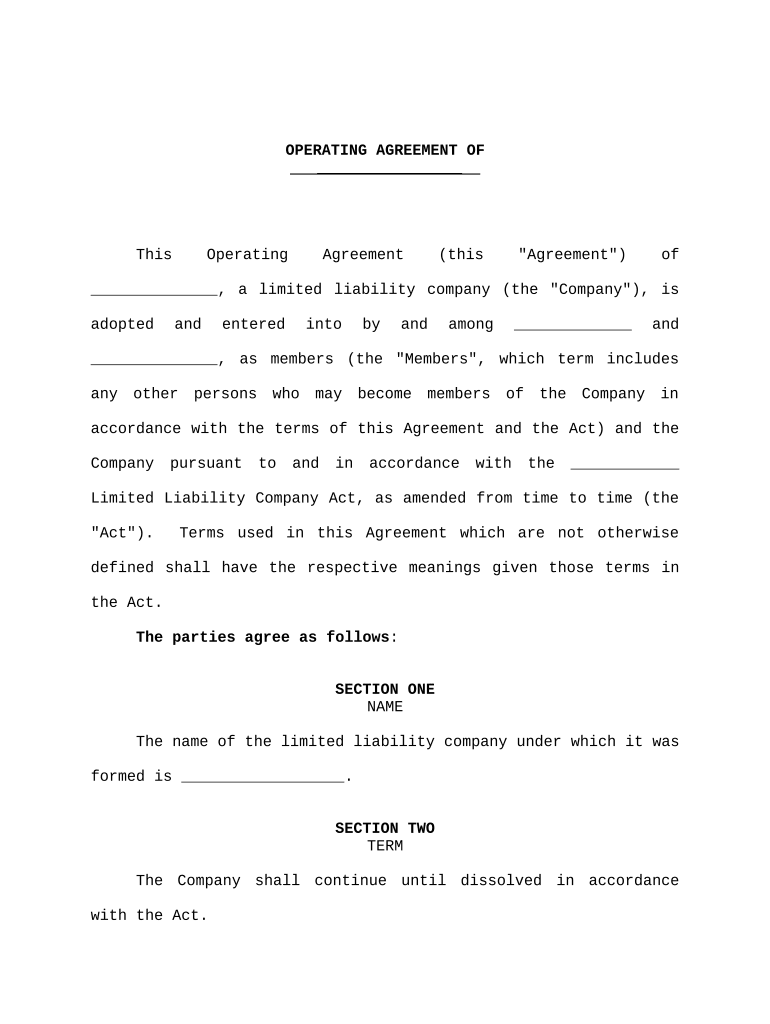

Limited Liability Company Llc Form

What is the Limited Liability Company (LLC)?

A Limited Liability Company (LLC) is a popular business structure in the United States that combines the benefits of both a corporation and a partnership. An LLC provides personal liability protection for its owners, known as members, meaning their personal assets are typically safeguarded from business debts and claims. This structure allows for flexible management and tax options, making it an attractive choice for many entrepreneurs. LLCs can be formed by one or more individuals, and they can include a variety of business types, from small startups to larger enterprises.

Key elements of the Limited Liability Company (LLC)

Establishing an LLC involves several key elements that are essential for its legal recognition and operation. These include:

- Name Registration: The name of the LLC must be unique and distinguishable from existing businesses in the state of formation.

- Operating Agreement: While not always required, an operating agreement outlines the management structure and operating procedures of the LLC.

- Registered Agent: An LLC must designate a registered agent to receive legal documents and official correspondence on behalf of the company.

- Filing Articles of Organization: This document, filed with the state, formally establishes the LLC and includes essential information such as the business name, address, and management structure.

Steps to complete the Limited Liability Company (LLC)

Completing the formation of an LLC involves several important steps:

- Choose a unique name for your LLC that complies with state regulations.

- Select a registered agent who will handle legal documents.

- Prepare and file the Articles of Organization with the appropriate state agency.

- Create an operating agreement to define the management structure and responsibilities.

- Obtain any necessary licenses and permits required for your specific business type.

- Apply for an Employer Identification Number (EIN) from the IRS for tax purposes.

Legal use of the Limited Liability Company (LLC)

The legal use of an LLC allows business owners to operate with limited liability while enjoying the flexibility of a partnership. This means that in the event of legal action or debt, members are generally not personally responsible for the LLC’s obligations. However, to maintain this protection, it is crucial to adhere to state laws and regulations, keep personal and business finances separate, and follow proper formalities in management and operations. Failure to do so may result in the loss of limited liability protection.

Required Documents

To successfully form an LLC, certain documents are typically required, including:

- Articles of Organization: The primary document filed with the state to create the LLC.

- Operating Agreement: A document that outlines the management structure and member responsibilities.

- Employer Identification Number (EIN): Issued by the IRS for tax identification purposes.

- State-specific licenses or permits: Depending on the nature of the business, additional documentation may be required.

IRS Guidelines

The IRS provides specific guidelines for LLCs regarding taxation and compliance. By default, an LLC with one member is treated as a sole proprietorship, while an LLC with multiple members is treated as a partnership for tax purposes. However, LLCs can elect to be taxed as a corporation if advantageous. It is essential for LLC owners to maintain accurate financial records and file appropriate tax forms, including the Form 1065 for partnerships or Form 1120 for corporations, to ensure compliance with federal tax regulations.

Quick guide on how to complete limited liability company llc 497333697

Effortlessly Prepare Limited Liability Company Llc on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the correct form and securely keep it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents promptly without any delays. Manage Limited Liability Company Llc on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The Easiest Method to Edit and Electronically Sign Limited Liability Company Llc with Ease

- Find Limited Liability Company Llc and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow addresses all your document management needs within a few clicks from any device of your choice. Edit and electronically sign Limited Liability Company Llc and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is company LLC capital and why is it important?

Company LLC capital refers to the financial resources that members contribute to a Limited Liability Company. It is crucial as it establishes the company's financial foundation, helps in operational activities, and protects members from personal liability. Properly managing your company LLC capital also supports business credibility and growth.

-

How can airSlate SignNow help with managing company LLC capital?

AirSlate SignNow streamlines the process of documenting and eSigning agreements related to company LLC capital. With efficient document management features, businesses can easily track contributions, member agreements, and financial records. This ensures that all vital documents are accessible and secure, fostering transparent financial operations.

-

What are the pricing options for airSlate SignNow's services?

AirSlate SignNow offers various pricing plans that cater to different business needs, making it affordable for managing company LLC capital. Plans vary based on the number of features and user access, allowing businesses to choose according to their budget and operational requirements. You can easily start with a free trial to evaluate the service.

-

What features does airSlate SignNow provide for managing legal documents related to company LLC capital?

AirSlate SignNow provides robust features such as customizable templates, secure eSigning, document sharing, and audit trails. These tools allow businesses to create, sign, and manage legal documents effortlessly—essential for transactions involving company LLC capital. Additionally, automated reminders ensure timely actions on important documents.

-

Can airSlate SignNow integrate with other applications to assist with company LLC capital?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, enhancing your ability to manage company LLC capital. This includes integrations with accounting software, CRM systems, and cloud storage providers. These integrations ensure that all financial data is synchronized, efficient, and easily accessible.

-

How secure is airSlate SignNow for documents relating to company LLC capital?

AirSlate SignNow prioritizes security with features like data encryption, secure access controls, and compliance with industry standards. You can confidently manage sensitive documents related to company LLC capital knowing that advanced security measures protect your information from unauthorized access. Our platform undergoes regular security assessments to maintain high standards.

-

What benefits does eSigning offer for company LLC capital transactions?

eSigning facilitates quicker and more efficient processing of documents related to company LLC capital. It eliminates the need for physical signatures, thereby reducing delays and potential errors in documentation. This streamlined approach enhances overall productivity, allowing businesses to focus on growth rather than paperwork.

Get more for Limited Liability Company Llc

Find out other Limited Liability Company Llc

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF