Personal Guaranty Form

What is the Personal Guaranty Form

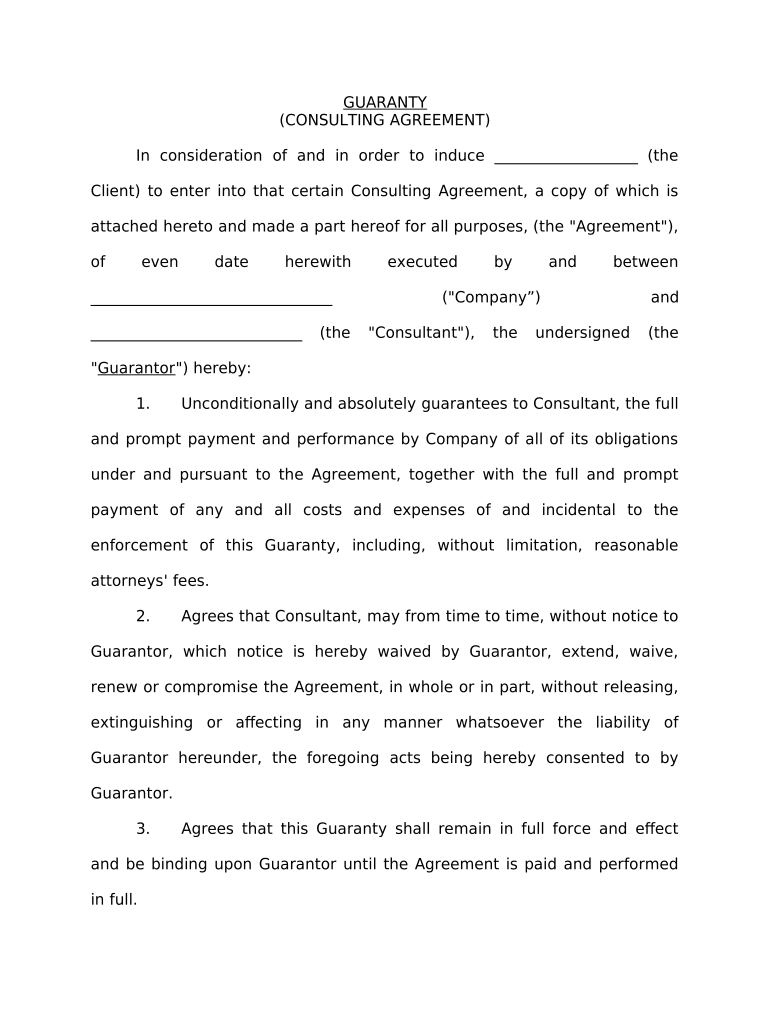

The personal guaranty form is a legal document that provides a guarantee from an individual to assume responsibility for the debt or obligations of another party, typically a business. This form is often used in various financial agreements, including loans and leases, where a lender or landlord requires additional assurance that the obligations will be met. By signing the personal guaranty agreement, the guarantor agrees to fulfill the obligations if the primary borrower defaults, making it a crucial tool for lenders seeking security in their transactions.

How to use the Personal Guaranty Form

Using the personal guaranty form involves several steps to ensure it is completed correctly and legally binding. First, the form should be obtained from a reliable source, ensuring it meets any specific requirements of the lender or landlord. Next, the guarantor must fill out their personal information, including name, address, and financial details, as required. It is essential to read the terms carefully, as they outline the responsibilities and obligations being guaranteed. Finally, the form must be signed in the presence of a witness or notary, depending on state laws, to ensure its validity.

Key elements of the Personal Guaranty Form

Several key elements must be included in a personal guaranty form for it to be considered valid. These elements typically consist of:

- Identification of the parties: Clearly state the names of the guarantor and the party whose obligations are being guaranteed.

- Details of the obligation: Specify the nature of the debt or obligation, including amounts and terms.

- Conditions of the guarantee: Outline any conditions under which the guaranty will be enforced.

- Signature and date: The guarantor must sign and date the form, confirming their agreement to the terms.

Steps to complete the Personal Guaranty Form

Completing the personal guaranty form involves a systematic approach to ensure all necessary information is provided accurately. Follow these steps:

- Obtain the correct form from a trusted source.

- Fill in the personal details of the guarantor, including full name and contact information.

- Provide the details of the obligation being guaranteed, including amounts and terms.

- Review the form for accuracy and completeness.

- Sign the form in the presence of a witness or notary, if required by state law.

Legal use of the Personal Guaranty Form

The personal guaranty form must comply with specific legal requirements to be enforceable. In the United States, the form should adhere to the Uniform Commercial Code (UCC) and any relevant state laws governing contracts and guarantees. Additionally, the form must be signed voluntarily, without coercion, and the guarantor should have the legal capacity to enter into the agreement. Ensuring compliance with these legal standards helps protect the rights of both the lender and the guarantor.

State-specific rules for the Personal Guaranty Form

Each state may have unique regulations regarding personal guaranty agreements. It is important for both guarantors and lenders to be aware of these rules, as they can affect the enforceability of the agreement. For instance, some states may require specific language or disclosures to be included in the form, while others may have different requirements for notarization or witnessing. Consulting with a legal professional familiar with local laws can ensure compliance and mitigate potential legal issues.

Quick guide on how to complete personal guaranty form

Effortlessly Complete Personal Guaranty Form on Any Device

Managing documents online has become increasingly sought after by companies and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed forms, allowing you to obtain the necessary document and securely save it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly and without delays. Handle Personal Guaranty Form on any device using the airSlate SignNow applications for Android or iOS and streamline your document processes today.

The Easiest Way to Modify and Electronically Sign Personal Guaranty Form with Ease

- Find Personal Guaranty Form and click Get Form to begin.

- Utilize the tools provided to fill out your document.

- Highlight important sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred delivery method for your document, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious document searches, or errors that necessitate reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Personal Guaranty Form to ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a personal guaranty agreement?

A personal guaranty agreement is a legal document in which an individual agrees to be personally responsible for a business's debt. This agreement ensures that if the business defaults, the guarantor's personal assets can be used to cover the obligation. This is particularly important for small businesses requiring financing.

-

How can airSlate SignNow assist in creating a personal guaranty agreement?

AirSlate SignNow simplifies the process of creating a personal guaranty agreement by providing customizable templates and an intuitive interface. Users can easily draft, edit, and finalize agreements in a secure environment, making it suitable for both novice and experienced users. This functionality ensures your agreements are legally sound and professiona.

-

What are the key benefits of using airSlate SignNow for personal guaranty agreements?

By using airSlate SignNow for personal guaranty agreements, businesses can enjoy quicker signing processes, enhanced security, and a reduction in paper usage. The platform also offers automated reminders for signers, ensuring timely execution of agreements. This results in more efficient transactions and improved business relationships.

-

Is airSlate SignNow affordable for small businesses needing a personal guaranty agreement?

Yes, airSlate SignNow offers cost-effective pricing plans suitable for small businesses needing personal guaranty agreements. With various tiers available, users can select a plan that fits their budget while still gaining access to essential features. The potential savings from faster transactions can outweigh the minimal costs.

-

Can I integrate airSlate SignNow with other applications when managing personal guaranty agreements?

Absolutely! airSlate SignNow integrates seamlessly with various applications, such as CRM and project management tools, allowing users to manage personal guaranty agreements conveniently. These integrations help streamline workflows and improve efficiency by keeping all documentation and communications centralized.

-

What features does airSlate SignNow offer for managing personal guaranty agreements?

AirSlate SignNow offers a range of features tailored for personal guaranty agreements, including eSigning, document templates, and real-time tracking. Users can also utilize advanced security features, such as encryption and audit trails, to keep their agreements safe and compliant. These features empower users to manage their documents with confidence.

-

How secure is airSlate SignNow for storing personal guaranty agreements?

Security is a top priority at airSlate SignNow. The platform employs industry-standard encryption, secure access controls, and comprehensive audit logs to protect personal guaranty agreements from unauthorized access. Users can trust that their sensitive information is safeguarded throughout the entire document lifecycle.

Get more for Personal Guaranty Form

- Form nj 2440 download fillable pdf or fill online statement

- New york form it 59 tax forgiveness for victims of the

- Instructions for form it 203 nonresident and part year

- Form it 245 claim for volunteer firefighters and ambulance workers credit tax year 2020

- Form it 255 claim for solar energy system equipment credit tax year 2020

- Form it 603 ampquotclaim for ez investment tax credit and ez

- Passive activity loss internal revenue service form

- Printable 2020 new york form it 602 claim for ez capital tax credit

Find out other Personal Guaranty Form

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF