Corporation Employee Form

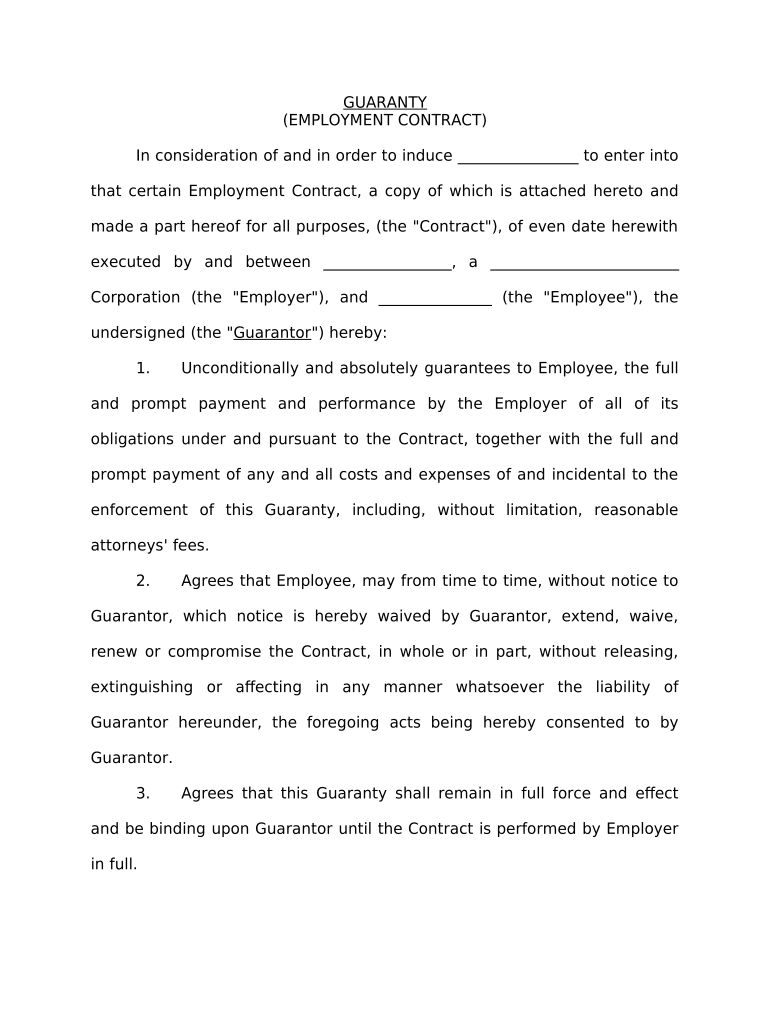

What is a personal guaranty agreement?

A personal guaranty agreement is a legal document that provides a guarantee from an individual to assume responsibility for a debt or obligation if the primary borrower defaults. This agreement is often used in business transactions, particularly when a lender requires additional assurance that the loan will be repaid. By signing this document, the guarantor agrees to cover the financial obligations of the borrower, which can include loans, leases, or other financial commitments.

Key elements of a personal guaranty agreement

Several essential components must be included in a personal guaranty agreement to ensure its validity and enforceability:

- Identification of parties: Clearly state the names and addresses of the borrower and the guarantor.

- Description of the obligation: Specify the nature of the debt or obligation being guaranteed.

- Terms of the guarantee: Outline the conditions under which the guarantor will be liable, including any limitations or exclusions.

- Duration: Indicate how long the guaranty will remain in effect, which could be until the obligation is fulfilled or for a specified period.

- Signatures: Ensure that both the guarantor and a representative of the lending institution sign the agreement to validate it.

Legal use of a personal guaranty agreement

To be legally binding, a personal guaranty agreement must comply with applicable laws and regulations. This includes ensuring that the document is signed voluntarily, without coercion, and that both parties fully understand the terms. The agreement should also be executed in accordance with state laws, which may vary regarding the enforceability of such contracts. It is advisable for both parties to seek legal counsel to review the agreement before signing to ensure all legal requirements are met.

Steps to complete a personal guaranty agreement

Completing a personal guaranty agreement involves several straightforward steps:

- Gather necessary information about the borrower and the guarantor, including identification and financial details.

- Draft the agreement, ensuring that all key elements are included and clearly articulated.

- Review the document with legal counsel to confirm compliance with relevant laws.

- Have both parties sign the agreement in the presence of a witness or notary, if required by state law.

- Distribute copies of the signed agreement to all parties involved for their records.

Examples of using a personal guaranty agreement

Personal guaranty agreements are commonly utilized in various scenarios, including:

- Small business loans, where the lender requests a personal guarantee from the business owner.

- Commercial leases, requiring the owner of a business to guarantee rent payments.

- Lines of credit, where lenders may seek personal guarantees to mitigate risk.

Who issues the personal guaranty agreement?

A personal guaranty agreement is typically issued by the lender or financial institution involved in the transaction. This document serves as a protective measure for the lender, ensuring they have recourse in case the borrower fails to meet their financial obligations. The lender may provide a standard template for the agreement or require the borrower to draft one that meets their specifications.

Quick guide on how to complete corporation employee

Effortlessly Complete Corporation Employee on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Corporation Employee on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign Corporation Employee Seamlessly

- Find Corporation Employee and click Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choosing. Edit and eSign Corporation Employee and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a personal guaranty agreement?

A personal guaranty agreement is a legal document in which an individual agrees to personally guarantee the obligations of a business. This means that if the business fails to meet its obligations, the individual is responsible for repayment. Understanding this document is crucial for both lenders and business owners to ensure financial security.

-

How does airSlate SignNow simplify the signing process for personal guaranty agreements?

airSlate SignNow streamlines the signing process by offering a user-friendly platform that allows you to create, send, and eSign personal guaranty agreements quickly. With features like templates and secure storage, you can manage your documents efficiently. This eliminates the hassle of traditional paper processes and enhances your workflow.

-

What are the pricing options for using airSlate SignNow to manage personal guaranty agreements?

airSlate SignNow offers flexible pricing plans that cater to different business needs, starting from a free trial to premium subscriptions. The pricing is competitive, especially considering the comprehensive features provided for managing personal guaranty agreements. This ensures you receive value for your investment while streamlining document processes.

-

What features does airSlate SignNow offer for personal guaranty agreements?

airSlate SignNow provides several features to enhance the use of personal guaranty agreements, including customizable templates, secure eSignature options, and document tracking. These features allow users to create compliant, legally binding agreements easily and monitor their status in real-time. This ensures that you can manage your agreements effectively.

-

Are there integrations available with airSlate SignNow for personal guaranty agreements?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage personal guaranty agreements alongside other business processes. Integrations with tools like CRM systems and cloud storage services ensure that your documents are accessible and collaborate-friendly. This set-up minimizes disruption and enhances productivity.

-

What are the benefits of using airSlate SignNow for personal guaranty agreements?

Using airSlate SignNow for personal guaranty agreements offers numerous benefits, including time savings, increased security, and reduced costs associated with paperwork. The digital platform allows for quick turnaround times and easy access, which is crucial for business transactions. Overall, it improves efficiency and helps maintain compliance.

-

Is airSlate SignNow secure for storing personal guaranty agreements?

Absolutely! airSlate SignNow prioritizes data security and employs advanced encryption and secure cloud storage to protect your personal guaranty agreements. This ensures that sensitive information is safeguarded against unauthorized access. You can conduct business confidently, knowing that your documents are secure.

Get more for Corporation Employee

Find out other Corporation Employee

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template