Disclosure Debtor Form

What is the Disclosure Debtor

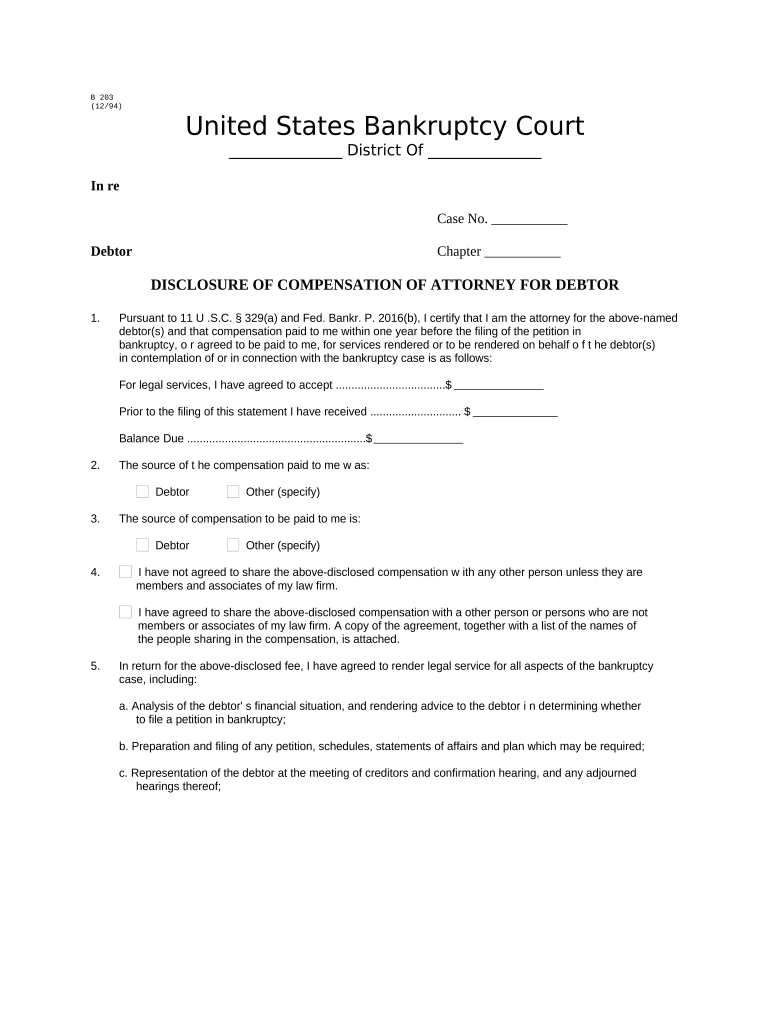

The disclosure debtor is a crucial document used in various legal and financial contexts, primarily to outline the obligations and liabilities of a debtor. This form typically details the debtor's financial situation, including assets, liabilities, and any other relevant information that may impact their ability to repay debts. Understanding the disclosure debtor is essential for both creditors and debtors, as it provides transparency and helps facilitate informed decisions regarding debt management and repayment plans.

Steps to complete the Disclosure Debtor

Completing the disclosure debtor form involves several key steps to ensure accuracy and compliance with legal standards. Here are the essential steps:

- Gather necessary information: Collect all relevant financial documents, including income statements, asset valuations, and existing debt records.

- Fill out the form: Accurately input all required information, ensuring that each section is completed to avoid delays.

- Review for accuracy: Double-check all entries for correctness, as inaccuracies can lead to complications in the process.

- Sign the document: Ensure that the form is signed digitally or physically, depending on the submission method.

- Submit the form: Choose the appropriate submission method, whether online, by mail, or in-person, and keep a copy for your records.

Legal use of the Disclosure Debtor

The legal use of the disclosure debtor is vital in various scenarios, including bankruptcy proceedings, loan applications, and debt settlements. This document serves as a formal declaration of the debtor's financial status and is often required by courts or financial institutions. Properly executed, the disclosure debtor can help protect the rights of both parties by ensuring that all financial obligations are clearly outlined and understood. Compliance with relevant laws and regulations is essential to maintain the document's validity.

Key elements of the Disclosure Debtor

Several key elements must be included in a disclosure debtor form to ensure its effectiveness and legal standing. These elements typically include:

- Personal information: Full name, address, and contact information of the debtor.

- Financial status: Detailed accounts of income, expenses, assets, and liabilities.

- Debt information: A comprehensive list of all outstanding debts, including creditor names and amounts owed.

- Signature: A digital or physical signature confirming the accuracy of the information provided.

Form Submission Methods

Submitting the disclosure debtor form can be done through various methods, depending on the requirements of the requesting entity. Common submission methods include:

- Online: Many institutions allow for electronic submission through secure portals, facilitating quicker processing times.

- Mail: The form can be printed and mailed to the appropriate address, ensuring that it is sent via a traceable method for security.

- In-person: Some situations may require the form to be submitted in person, allowing for immediate confirmation of receipt.

Disclosure Requirements

Disclosure requirements for the disclosure debtor can vary based on jurisdiction and the specific context in which the form is used. Generally, these requirements mandate that the debtor provide a full and honest account of their financial situation. Failure to disclose accurate information can lead to legal repercussions, including penalties or denial of credit. It is crucial for debtors to understand their obligations and ensure that all information submitted is complete and truthful.

Quick guide on how to complete disclosure debtor

Effortlessly Prepare Disclosure Debtor on Any Device

Managing documents online has gained traction among companies and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to easily retrieve the proper form and securely keep it online. airSlate SignNow provides all the essential tools to swiftly create, modify, and eSign your documents without delays. Manage Disclosure Debtor on any platform using airSlate SignNow's Android or iOS applications and enhance your document-related tasks today.

The simplest method to modify and eSign Disclosure Debtor with ease

- Obtain Disclosure Debtor and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or hide sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs with just a few clicks from any device you prefer. Adjust and eSign Disclosure Debtor and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a disclosure debtor?

A disclosure debtor refers to an individual or entity that must disclose certain financial information as required by law. Understanding who qualifies as a disclosure debtor is crucial for ensuring compliance in financial transactions.

-

How can airSlate SignNow help with disclosure debtor documentation?

airSlate SignNow simplifies the process of preparing and signing documents related to disclosure debtors. With our platform, you can easily create, send, and eSign essential documents, ensuring that all required information is seamlessly captured and legally binding.

-

Is airSlate SignNow cost-effective for managing disclosure debtor agreements?

Yes, airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes. Our cost-effective solution streamlines your document management process, making it easy to maintain compliance with disclosure debtor requirements without breaking the bank.

-

What features does airSlate SignNow offer for disclosure debtor transactions?

airSlate SignNow provides robust features, including customizable templates, advanced eSignature capabilities, and secure document storage. These features enable you to manage disclosure debtor transactions efficiently and ensure all necessary disclosures are appropriately handled.

-

Can I integrate airSlate SignNow with other tools for disclosure debtor management?

Absolutely! airSlate SignNow offers integrations with a variety of popular software applications, including CRM systems and cloud storage solutions. This ensures that your disclosure debtor management process is seamless, allowing for better organization and retrieval of important documents.

-

What benefits can I expect from using airSlate SignNow for disclosure debtor documentation?

Using airSlate SignNow for disclosure debtor documentation can signNowly enhance your workflow efficiency. The platform ensures all documents are signed and stored securely, reducing the risk of errors and improving compliance with financial disclosure regulations.

-

Is there support available for using airSlate SignNow with disclosure debtor requirements?

Yes, airSlate SignNow provides extensive support resources, including customer service and documentation to help you navigate disclosure debtor requirements. Whether you need help on setup or how to utilize specific features, our team is ready to assist you.

Get more for Disclosure Debtor

- Credits utahcredits utah income taxesutah state tax commissioncurrent forms utah state tax commissioncredits utah

- Utah income taxesutah state tax commissionpayment methods utah income taxesutah state tax filing utah state taxes things to form

- Forms ampamp information utah income taxesutah state tax

- Printable 2020 rhode island form 2210 underpayment of estimate

- Ri 1040es rhode island resident and nonresident estimated ri 1040es rhode island resident and nonresident estimated state of form

- About schedule f form 1040 profit or loss from farming navigating a schedule f farm tax returnsmall farm reviewing and

- Transfer adjust form

- Printable 2020 pennsylvania form rev 1630 underpayment of estimated tax by individuals

Find out other Disclosure Debtor

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT