Understanding Your CP14 NoticeInternal Revenue Service IRS Tax Forms 2022

Understanding the nh dp14 tax form

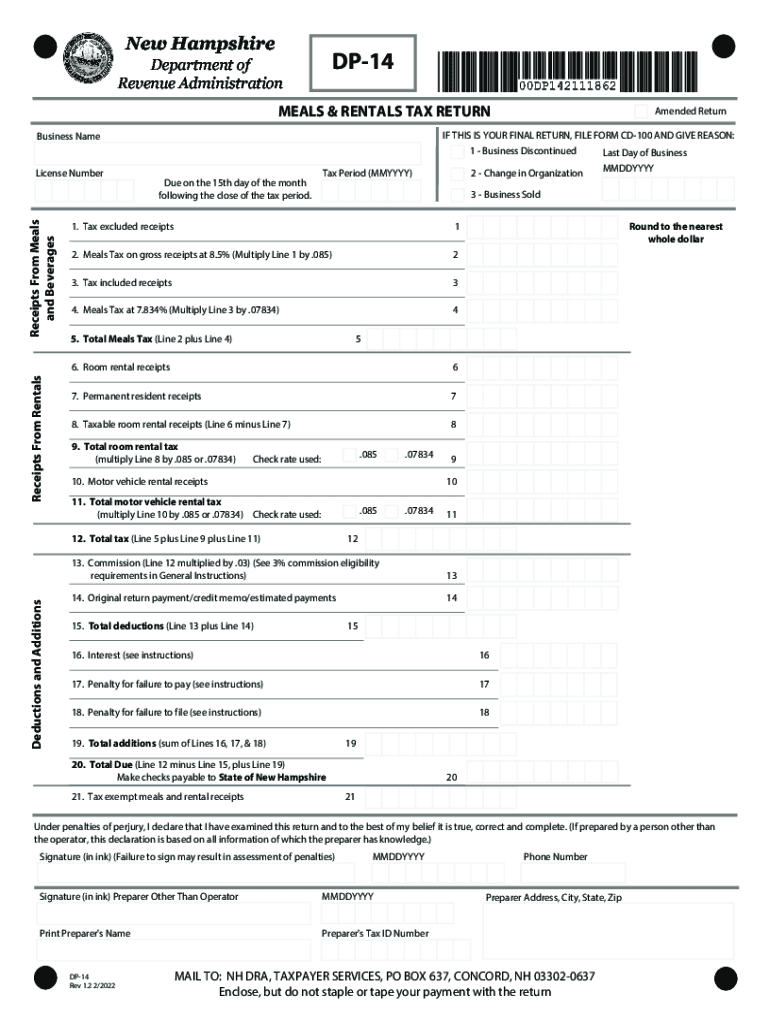

The nh dp14 tax form, also known as the New Hampshire Meals and Rooms Tax Return, is essential for businesses that collect meals and rooms tax in the state. This form is used to report and remit the tax collected from customers on meals and lodging services. The completion of this form ensures compliance with state tax regulations and helps maintain transparency in business operations. Businesses must accurately report their taxable sales and remit the appropriate tax amount to the New Hampshire Department of Revenue Administration (NH DRA).

Steps to complete the nh dp14 tax form

Filling out the nh dp14 tax form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including sales records and receipts for meals and rooms provided. Next, follow these steps:

- Enter your business information, including your name, address, and tax identification number.

- Report total sales for meals and rooms separately, ensuring that you include only taxable sales.

- Calculate the total tax due by applying the current tax rate to your taxable sales.

- Review your entries for accuracy before submitting the form.

Completing these steps carefully will help avoid errors that could lead to penalties or compliance issues.

Required documents for the nh dp14 tax form

To successfully complete the nh dp14 tax form, certain documents are necessary. These include:

- Sales records that detail all taxable meals and rooms sold during the reporting period.

- Receipts and invoices that support the reported sales figures.

- Previous tax returns, if applicable, to ensure consistency in reporting.

Having these documents on hand will streamline the process and help ensure that all reported figures are accurate and verifiable.

Filing deadlines for the nh dp14 tax form

Timely filing of the nh dp14 tax form is crucial to avoid penalties. The filing deadlines are typically set quarterly, with specific due dates for each quarter. Businesses should be aware of the following deadlines:

- First quarter: Due by the last day of April

- Second quarter: Due by the last day of July

- Third quarter: Due by the last day of October

- Fourth quarter: Due by the last day of January

Staying informed about these deadlines helps businesses maintain compliance and avoid late fees.

Penalties for non-compliance with the nh dp14 tax form

Failure to file the nh dp14 tax form on time or inaccuracies in reporting can lead to significant penalties. Common penalties include:

- Late filing penalties, which can accumulate over time if the form is not submitted by the deadline.

- Interest on unpaid taxes, which accrues until the tax is paid in full.

- Potential audits by the NH DRA, which can result in further scrutiny of business practices.

Understanding these penalties emphasizes the importance of accurate and timely filing of the nh dp14 tax form.

Digital submission methods for the nh dp14 tax form

Businesses have the option to submit the nh dp14 tax form digitally, which can simplify the filing process. Digital submission methods include:

- Online filing through the NH DRA's e-filing system, which allows for quick submission and confirmation.

- Email submission of scanned forms, though this method may require additional verification steps.

Utilizing digital submission methods can enhance efficiency and ensure that records are accurately maintained.

Quick guide on how to complete understanding your cp14 noticeinternal revenue service irs tax forms

Prepare Understanding Your CP14 NoticeInternal Revenue Service IRS Tax Forms effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed papers, allowing you to find the right form and safely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without hindrances. Manage Understanding Your CP14 NoticeInternal Revenue Service IRS Tax Forms on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign Understanding Your CP14 NoticeInternal Revenue Service IRS Tax Forms without hassle

- Find Understanding Your CP14 NoticeInternal Revenue Service IRS Tax Forms and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize important sections of your documents or redact confidential information with specific tools that airSlate SignNow offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional ink signature.

- Verify the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about missing or lost documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Understanding Your CP14 NoticeInternal Revenue Service IRS Tax Forms and enjoy perfect communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct understanding your cp14 noticeinternal revenue service irs tax forms

Create this form in 5 minutes!

People also ask

-

What is the nh dp14 tax and how does it affect my business?

The nh dp14 tax refers to a specific tax form used in New Hampshire for reporting purposes. If you operate a business in New Hampshire, understanding the nh dp14 tax is crucial for compliance and financial planning. This tax can influence your operational costs and should be factored into your overall business strategy.

-

How can airSlate SignNow help with the nh dp14 tax documentation?

With airSlate SignNow, you can easily create, sign, and send documents related to the nh dp14 tax electronically. Our platform streamlines the process, ensuring that your tax documents are managed efficiently and securely. This can save your business time and reduce the risk of errors in your tax filings.

-

What are the pricing options for airSlate SignNow when managing nh dp14 tax needs?

airSlate SignNow offers various pricing plans tailored for businesses of all sizes, ensuring you find an option suited to your needs while managing the nh dp14 tax. Our plans include essential features that allow for seamless eSigning and document management. Pricing is competitive, making it a cost-effective solution for handling all your tax documentation.

-

Are there any features specifically beneficial for handling the nh dp14 tax with airSlate SignNow?

Yes, airSlate SignNow includes features specifically designed for efficient document management, such as real-time tracking and automatic reminders for signing, which can be incredibly beneficial for managing the nh dp14 tax. Our user-friendly interface allows you to easily customize templates and store your documents securely. This ensures you stay organized and compliant with tax requirements.

-

Can I integrate airSlate SignNow with other tools for managing nh dp14 tax documents?

Absolutely! airSlate SignNow offers integrations with a variety of popular software tools that can simplify your workflow related to the nh dp14 tax. You can connect with accounting software, customer relationship management systems, and more. This adaptability makes it easier for your team to manage tax documentation alongside your other business processes.

-

What are the benefits of using airSlate SignNow for nh dp14 tax compliance?

Using airSlate SignNow for nh dp14 tax compliance provides several benefits, including enhanced efficiency and reduced paperwork. Our eSignature solution ensures documents are signed promptly, which can help prevent delays in filing. Additionally, our secure cloud storage means you can access important tax documents anytime, ensuring you’re always prepared for tax season.

-

Is airSlate SignNow secure for handling sensitive nh dp14 tax information?

Yes, security is a top priority at airSlate SignNow. Our platform utilizes advanced encryption and security protocols to ensure that all documents, including nh dp14 tax-related information, are protected. You can confidently manage and store sensitive data without worrying about unauthorized access or data bsignNowes.

Get more for Understanding Your CP14 NoticeInternal Revenue Service IRS Tax Forms

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children montana form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure montana form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497316189 form

- Montana landlord notice form

- Letter from tenant to landlord for failure of landlord to comply with building codes affecting health and safety or resulting 497316191 form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497316192 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497316193 form

- Montana failure form

Find out other Understanding Your CP14 NoticeInternal Revenue Service IRS Tax Forms

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template