DP 14 New Hampshire Department of Revenue Administration Revenue Nh 2010

What is the DP 14 New Hampshire Department Of Revenue Administration Revenue Nh

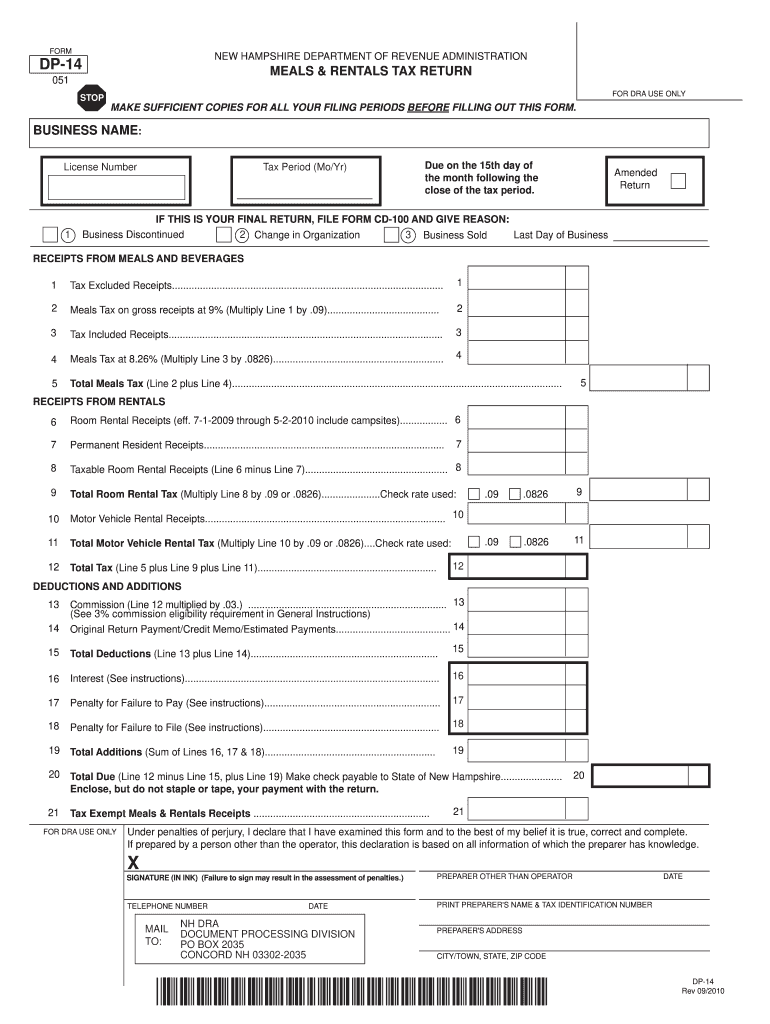

The DP 14 form is a crucial document issued by the New Hampshire Department of Revenue Administration. It is primarily used for reporting various tax-related information. This form helps ensure compliance with state tax regulations and provides essential data for the administration's records. Understanding the purpose and requirements of the DP 14 is vital for taxpayers in New Hampshire to avoid penalties and ensure accurate reporting.

Steps to complete the DP 14 New Hampshire Department Of Revenue Administration Revenue Nh

Completing the DP 14 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, carefully fill out the form, ensuring all information is accurate and complete. Pay close attention to specific sections that require detailed reporting, such as income sources and deductions. After completing the form, review it thoroughly for any errors or omissions. Finally, sign and date the form before submitting it to the appropriate department.

How to use the DP 14 New Hampshire Department Of Revenue Administration Revenue Nh

The DP 14 form serves multiple purposes, including reporting income and calculating tax liabilities. To use the form effectively, follow the instructions provided by the New Hampshire Department of Revenue Administration. Ensure that you fill out each section accurately, as this will impact your tax obligations. Utilize the form's fillable fields for electronic completion, which can streamline the process and reduce errors. Once completed, ensure that you submit the form by the designated deadline to avoid any late fees or penalties.

Legal use of the DP 14 New Hampshire Department Of Revenue Administration Revenue Nh

The DP 14 form must be filled out in accordance with New Hampshire state laws and regulations. It is legally binding, meaning that the information provided must be truthful and accurate. Misrepresentation or failure to file the form can result in penalties, including fines or additional tax liabilities. It is essential for taxpayers to understand their legal obligations when using this form to avoid any potential legal issues.

Filing Deadlines / Important Dates

Timely submission of the DP 14 form is critical to avoid penalties. The filing deadline typically aligns with the state tax deadline, which is usually April 15 for individuals. However, specific deadlines may vary based on individual circumstances, such as extensions or special filing statuses. It is advisable to check the New Hampshire Department of Revenue Administration's official announcements for any updates or changes to filing deadlines.

Form Submission Methods (Online / Mail / In-Person)

The DP 14 form can be submitted through various methods to accommodate different preferences. Taxpayers can file the form online through the New Hampshire Department of Revenue Administration's e-filing system, which offers a secure and efficient way to submit documents. Alternatively, the form can be mailed to the designated office or delivered in person. Each submission method has its advantages, so choose the one that best fits your needs while ensuring compliance with submission guidelines.

Quick guide on how to complete dp 14 new hampshire department of revenue administration revenue nh

Your assistance manual on how to prepare your DP 14 New Hampshire Department Of Revenue Administration Revenue Nh

If you’re seeking information on how to generate and transmit your DP 14 New Hampshire Department Of Revenue Administration Revenue Nh, here are a few brief recommendations on how to simplify tax submission.

To get started, all you need to do is create your airSlate SignNow account to transform your document management online. airSlate SignNow is an exceptionally intuitive and robust document solution that allows you to edit, draft, and finalize your tax documents effortlessly. Utilizing its editor, you can toggle between text, check boxes, and electronic signatures and revisit to modify data as required. Enhance your tax handling with sophisticated PDF editing, electronic signing, and user-friendly sharing.

Follow the instructions below to finalize your DP 14 New Hampshire Department Of Revenue Administration Revenue Nh in just a few minutes:

- Create your profile and begin processing PDFs in no time.

- Browse our catalog to locate any IRS tax form; explore various versions and schedules.

- Click Obtain form to access your DP 14 New Hampshire Department Of Revenue Administration Revenue Nh in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Signing Tool to add your legally-binding electronic signature (if required).

- Review your document and correct any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to electronically file your taxes with airSlate SignNow. Please be aware that filing on paper can lead to more mistakes on returns and delay refunds. It is advisable to consult the IRS website for filing regulations in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct dp 14 new hampshire department of revenue administration revenue nh

Create this form in 5 minutes!

How to create an eSignature for the dp 14 new hampshire department of revenue administration revenue nh

How to generate an eSignature for the Dp 14 New Hampshire Department Of Revenue Administration Revenue Nh online

How to generate an eSignature for your Dp 14 New Hampshire Department Of Revenue Administration Revenue Nh in Chrome

How to generate an eSignature for putting it on the Dp 14 New Hampshire Department Of Revenue Administration Revenue Nh in Gmail

How to generate an eSignature for the Dp 14 New Hampshire Department Of Revenue Administration Revenue Nh from your smart phone

How to create an eSignature for the Dp 14 New Hampshire Department Of Revenue Administration Revenue Nh on iOS

How to make an eSignature for the Dp 14 New Hampshire Department Of Revenue Administration Revenue Nh on Android OS

People also ask

-

What is the DP 14 New Hampshire Department of Revenue Administration Revenue Nh form?

The DP 14 New Hampshire Department of Revenue Administration Revenue Nh form is a crucial document for property owners in New Hampshire. It provides essential information for tax assessments and allows taxpayers to report property values accurately. Understanding this form can signNowly impact your tax responsibilities.

-

How does airSlate SignNow help with the DP 14 New Hampshire Department of Revenue Administration Revenue Nh process?

airSlate SignNow streamlines the submission of the DP 14 New Hampshire Department of Revenue Administration Revenue Nh by allowing you to easily eSign and send documents online. This feature reduces the need for physical paperwork and accelerates your filing process. By using our platform, you can ensure timely submissions and maintain compliance.

-

Is there a cost associated with using airSlate SignNow for DP 14 New Hampshire Department of Revenue Administration Revenue Nh forms?

Yes, airSlate SignNow offers a variety of pricing plans tailored to meet different business needs. Our plans are cost-effective and designed to provide maximum value, specifically for managing documents like the DP 14 New Hampshire Department of Revenue Administration Revenue Nh form. You can choose the plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the DP 14 New Hampshire Department of Revenue Administration Revenue Nh?

airSlate SignNow includes features such as customizable templates, in-app signing, and easy document tracking that are particularly useful for managing the DP 14 New Hampshire Department of Revenue Administration Revenue Nh form. These features enhance efficiency and ensure your documents are always accessible when you need them. With our user-friendly interface, managing these forms becomes hassle-free.

-

Can I integrate airSlate SignNow with other software I use for the DP 14 New Hampshire Department of Revenue Administration Revenue Nh?

Absolutely! airSlate SignNow offers seamless integrations with various applications that can enhance your workflow for the DP 14 New Hampshire Department of Revenue Administration Revenue Nh form. Whether you are using CRM systems or cloud storage services, our platform can connect to maximize efficiency and streamline document management.

-

What are the benefits of using airSlate SignNow for the DP 14 New Hampshire Department of Revenue Administration Revenue Nh?

Using airSlate SignNow for the DP 14 New Hampshire Department of Revenue Administration Revenue Nh brings numerous benefits including increased efficiency, reduced paper usage, and enhanced security. Our platform ensures that your sensitive information is safely handled while speeding up the document signing process. This allows you to focus more on your business rather than paperwork.

-

How secure is airSlate SignNow when handling the DP 14 New Hampshire Department of Revenue Administration Revenue Nh?

airSlate SignNow takes security very seriously, employing advanced encryption and compliance standards to protect documents like the DP 14 New Hampshire Department of Revenue Administration Revenue Nh. Your data is safe with us, ensuring peace of mind as you manage your important tax documents. We are committed to providing a secure environment for all your document needs.

Get more for DP 14 New Hampshire Department Of Revenue Administration Revenue Nh

Find out other DP 14 New Hampshire Department Of Revenue Administration Revenue Nh

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure