Nh Dor 2019

What is the NH Department of Revenue?

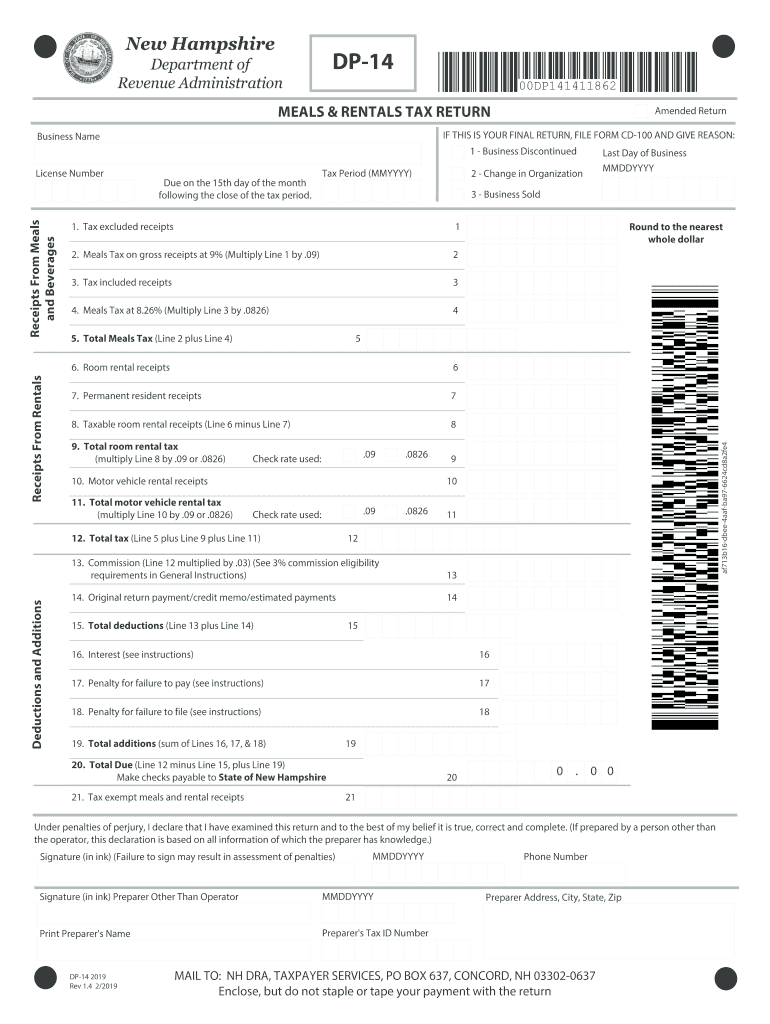

The NH Department of Revenue Administration (NH DRA) is the state agency responsible for administering tax laws and collecting state revenue in New Hampshire. This agency oversees various tax programs, including property tax, business taxes, and income tax. The NH DRA provides essential resources and support to taxpayers, ensuring compliance with state tax regulations. Understanding the role of the NH DRA is crucial for anyone filing taxes in New Hampshire, as it helps clarify where to direct inquiries and how to access necessary forms, such as the NH DP 14 fillable form.

Steps to Complete the NH DP 14 Form

Completing the NH DP 14 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense records. Next, access the fillable version of the NH DP 14 form online. Carefully enter all required information in the designated fields, ensuring that figures are accurate and properly formatted. Once completed, review the form for any errors or omissions. After verification, you can eSign the document using airSlate SignNow, which provides a secure method for submitting your tax return electronically. Finally, submit the form by the established deadline to avoid any penalties.

Legal Use of the NH DP 14 Form

The NH DP 14 form is legally recognized for reporting meals and rentals tax in New Hampshire. It is essential for businesses involved in providing taxable services to comply with state tax laws. The form must be filled out accurately to ensure that the reported amounts align with actual sales and expenses. Using the NH DP 14 form correctly helps businesses avoid legal issues and potential penalties from the NH DRA. Additionally, the use of eSignatures on this form is legally valid, allowing for a more efficient filing process while maintaining compliance with the law.

Filing Deadlines / Important Dates

Filing deadlines for the NH DP 14 form are crucial for taxpayers to remember. Generally, the form must be submitted on or before the 15th day of the month following the end of each quarter. For example, the deadline for the first quarter is April 15, the second quarter is July 15, the third quarter is October 15, and the fourth quarter is January 15 of the following year. It is important to stay informed about any changes to these deadlines, as late submissions can result in penalties and interest charges.

Form Submission Methods

The NH DP 14 form can be submitted in several ways to accommodate different preferences. Taxpayers can file the form online using airSlate SignNow, which offers a secure and efficient method for electronic submissions. Alternatively, the form can be printed and mailed to the NH Department of Revenue Administration. For those who prefer in-person submissions, visiting a local NH DRA office is also an option. Each method has its advantages, but electronic filing is often the quickest way to ensure timely processing.

Required Documents

When completing the NH DP 14 form, certain documents are required to support the information provided. Taxpayers should have their sales records, receipts, and any relevant financial statements on hand. Additionally, documentation proving the collection of meals and rentals tax is necessary to ensure compliance with state regulations. Having these documents ready will facilitate a smoother filing process and help avoid potential discrepancies during review by the NH DRA.

Quick guide on how to complete meals and rooms rentals tax faqnh department of revenue

Your assistance manual on how to prepare your Nh Dor

If you're interested in learning how to finish and submit your Nh Dor, here are a few brief guidelines on how to simplify tax filing.

To begin, you just need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an efficient and user-friendly document solution that enables you to modify, generate, and finalize your tax paperwork effortlessly. With its editor, you can toggle between text, check boxes, and electronic signatures, and go back to revise information as required. Enhance your tax handling with advanced PDF editing, eSigning, and user-friendly sharing.

Follow these instructions to complete your Nh Dor within minutes:

- Establish your account and start working on PDFs in no time.

- Utilize our directory to locate any IRS tax form; browse through various versions and schedules.

- Click Get form to access your Nh Dor in our editor.

- Fill out the mandatory fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally binding eSignature (if required).

- Examine your document and correct any mistakes.

- Save changes, print your version, send it to your designated recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Be aware that submitting on paper may lead to increased return errors and delays in refunds. Naturally, before e-filing your taxes, check the IRS website for reporting regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct meals and rooms rentals tax faqnh department of revenue

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How do I understand the 1040 U.S. tax form in terms of an equation instead of a ton of boxes to fill in and instructions to read?

First the 1040 is an exercise in sets:Gross Income - A collection and summation of all your income types.Adjustments - A collection of deductions the tax law allow you to deduct before signNowing AGI. (AGI is used as a threshold for another set of deductions).ExemptionsDeductions - A collection of allowed deductions.Taxes - A Collection of Different collected along with Income TaxesCredits - A collection of allowed reductions in tax owed.Net Tax Owed or Refundable - Hopefully Self Explanatory.Now the formulas:[math]Gross Income - Adjustments = Adjusted Gross Income (AGI)[/math][math]AGI - Exemptions - Deductions = Taxable Income[/math][math]Tax Function (Taxable Income ) = Income Tax[/math][math]Taxes - Credits = Net Tax Owed or Refundable[/math]Please Note each set of lines is meant as a means to make collecting and summing the subsidiary information easier.It would probably be much easier to figure out if everyone wanted to pay more taxes instead of less.

-

What is the different between states’ department of revenue and department of labor? Specifically, as it relates to employer taxes to be paid out to whom and for what reason?

DOL is all about making sure the work life for people is reasonable and that they are not taken advantages of by their employers.

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

Create this form in 5 minutes!

How to create an eSignature for the meals and rooms rentals tax faqnh department of revenue

How to create an eSignature for your Meals And Rooms Rentals Tax Faqnh Department Of Revenue online

How to make an eSignature for your Meals And Rooms Rentals Tax Faqnh Department Of Revenue in Chrome

How to make an electronic signature for signing the Meals And Rooms Rentals Tax Faqnh Department Of Revenue in Gmail

How to make an eSignature for the Meals And Rooms Rentals Tax Faqnh Department Of Revenue from your smart phone

How to create an eSignature for the Meals And Rooms Rentals Tax Faqnh Department Of Revenue on iOS devices

How to make an eSignature for the Meals And Rooms Rentals Tax Faqnh Department Of Revenue on Android OS

People also ask

-

What is the nh dp 14 fillable form and how can it be used?

The nh dp 14 fillable form is a customizable document that allows users to complete and sign it electronically. With airSlate SignNow, you can easily fill out the nh dp 14 fillable form and send it securely to other parties. This streamlines the process of document handling and enhances efficiency.

-

How does airSlate SignNow support the nh dp 14 fillable form?

airSlate SignNow provides a user-friendly platform to create, fill, and eSign the nh dp 14 fillable form quickly. Our features ensure that you can integrate fields for signatures, dates, and other information directly into the form, making it easy for users to complete necessary documentation.

-

Is there a cost associated with using the nh dp 14 fillable form on airSlate SignNow?

Yes, there is a pricing structure for using airSlate SignNow, which supports the nh dp 14 fillable form. Our plans are designed to be cost-effective while providing full access to all features, ensuring your business can efficiently manage and eSign documents without breaking the bank.

-

What features are included with the nh dp 14 fillable form in airSlate SignNow?

The nh dp 14 fillable form includes features such as templates, real-time tracking, and secure storage. airSlate SignNow also allows for collaboration features, so multiple users can fill out the form and sign it simultaneously, enhancing teamwork and document flow.

-

Can the nh dp 14 fillable form be integrated with other applications?

Absolutely! airSlate SignNow allows users to integrate the nh dp 14 fillable form with various applications, including CRM and document management systems. This integration makes it seamless to manage workflows and keeps your data synchronized across platforms.

-

What are the benefits of using the nh dp 14 fillable form in airSlate SignNow?

Using the nh dp 14 fillable form in airSlate SignNow offers numerous benefits, such as increased efficiency and reduced turnaround time for document processing. Additionally, the electronic signing process is more secure and environmentally friendly, helping streamline your business operations.

-

How secure is the electronic signing process for the nh dp 14 fillable form?

The electronic signing process for the nh dp 14 fillable form on airSlate SignNow is highly secure. We implement industry-standard encryption and comply with legal regulations to ensure that your documents remain safe and that your signatures are legally binding.

Get more for Nh Dor

- Nichq vanderbilt assessment scale parent 248946856 form

- Kansas marriage license form

- Negotiated plea agreement rutherford county form

- U s usps form usps ps 1508

- Instructions this certificate should be completed by the purchaser and given to the seller for retention as part of the sellers form

- Tertiary survey template form

- Notice of asbestos renovation of demolition dep form 62 2579001

- Loopnet lease listing entry form

Find out other Nh Dor

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy