Florida Dept of Revenue Discretionary Sales SurtaxDiscretionary Sales Surtax Rate TableDiscretionary Sales Surtax Information Fo 2022

Understanding the Florida Discretionary Sales Surtax

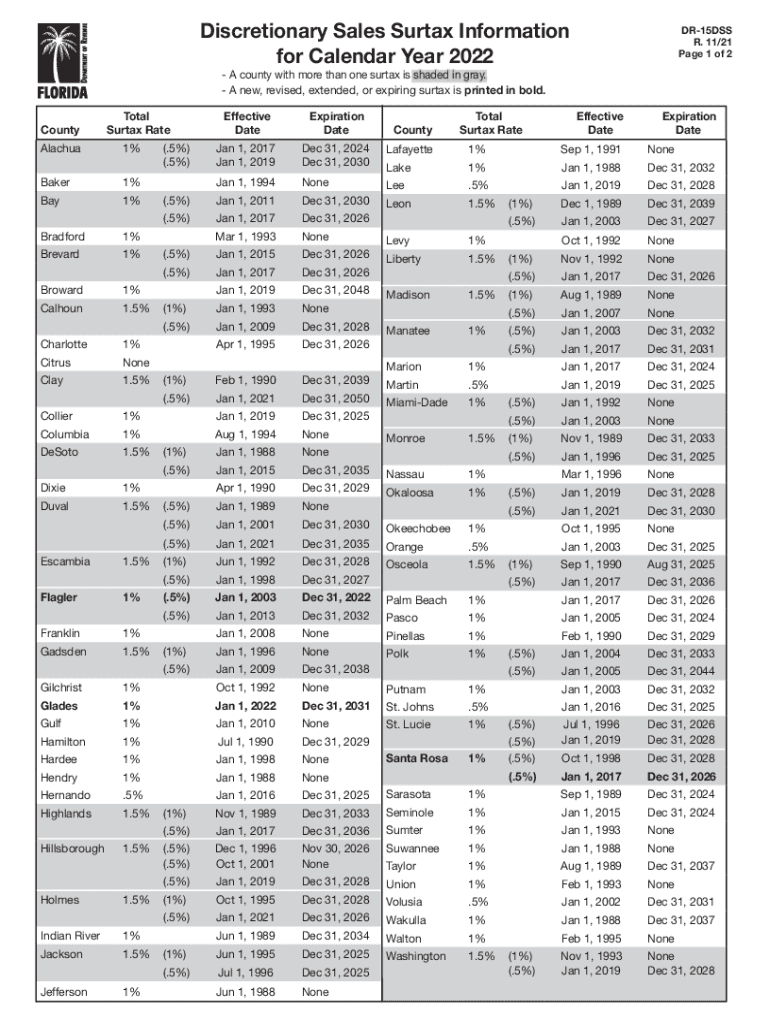

The Florida discretionary sales surtax is an additional tax imposed by local governments on top of the state sales tax. This tax is used to fund various local initiatives and projects. Each county has the authority to determine its own surtax rate, which can vary significantly across the state. This flexibility allows counties to address their unique financial needs while adhering to state guidelines.

The surtax applies to most retail sales, leases, and rentals of tangible personal property, as well as some services. It is essential for residents and businesses to be aware of their local surtax rates and how they impact purchases.

Steps to Complete the Form DR-15DSS

Completing the form DR-15DSS involves several straightforward steps. First, gather all necessary documentation, including sales records and tax identification numbers. Next, accurately fill out the form by entering the required information, such as total sales and applicable tax rates. Ensure that all calculations are correct to avoid discrepancies.

After completing the form, review it for accuracy. Once verified, submit the form to the Florida Department of Revenue through the designated submission method, whether online or via mail. Keep a copy of the completed form for your records, as it may be needed for future reference or audits.

Key Elements of the DR-15DSS Form

The DR-15DSS form includes several critical components that must be accurately filled out. Key elements include:

- Taxpayer Information: This section requires the taxpayer's name, address, and identification number.

- Total Sales: Report the total sales amount subject to the discretionary sales surtax.

- Surtax Rate: Indicate the applicable surtax rate based on the county of sale.

- Tax Calculation: Provide the calculated surtax amount based on total sales and the surtax rate.

Completing these sections accurately ensures compliance with local tax regulations and helps avoid penalties.

Filing Deadlines and Important Dates

It is crucial to be aware of filing deadlines for the DR-15DSS form to maintain compliance with Florida tax laws. Generally, the form must be submitted by the end of the month following the reporting period. For example, for sales made in January, the form is due by February 28. Missing these deadlines can result in penalties and interest on unpaid taxes.

Taxpayers should also stay informed about any changes to deadlines or requirements announced by the Florida Department of Revenue to ensure timely submissions.

Penalties for Non-Compliance

Failure to file the DR-15DSS form on time or inaccuracies in reporting can lead to significant penalties. The Florida Department of Revenue imposes fines based on the amount of tax owed, and interest accrues on unpaid taxes. Additionally, repeated non-compliance may result in further legal action or increased scrutiny from tax authorities.

To avoid these consequences, it is advisable to file the form accurately and on time, and to seek assistance if needed.

Eligibility Criteria for Filing the DR-15DSS

Eligibility to file the DR-15DSS form typically includes businesses and individuals engaged in retail sales within Florida. Any entity that sells taxable goods or services must comply with the discretionary sales surtax regulations. This includes sole proprietors, partnerships, corporations, and other business structures.

It is important for taxpayers to verify their eligibility and ensure they are registered with the Florida Department of Revenue to avoid issues during the filing process.

Quick guide on how to complete florida dept of revenue discretionary sales surtaxdiscretionary sales surtax rate tablediscretionary sales surtax information

Prepare Florida Dept Of Revenue Discretionary Sales SurtaxDiscretionary Sales Surtax Rate TableDiscretionary Sales Surtax Information Fo effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can obtain the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Florida Dept Of Revenue Discretionary Sales SurtaxDiscretionary Sales Surtax Rate TableDiscretionary Sales Surtax Information Fo on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and electronically sign Florida Dept Of Revenue Discretionary Sales SurtaxDiscretionary Sales Surtax Rate TableDiscretionary Sales Surtax Information Fo without hassle

- Locate Florida Dept Of Revenue Discretionary Sales SurtaxDiscretionary Sales Surtax Rate TableDiscretionary Sales Surtax Information Fo and click on Get Form to begin.

- Employ the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive details using tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or errors that necessitate reprinting new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choosing. Edit and electronically sign Florida Dept Of Revenue Discretionary Sales SurtaxDiscretionary Sales Surtax Rate TableDiscretionary Sales Surtax Information Fo and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida dept of revenue discretionary sales surtaxdiscretionary sales surtax rate tablediscretionary sales surtax information

Create this form in 5 minutes!

People also ask

-

What is dr 15dss in the context of airSlate SignNow?

The dr 15dss refers to a specific feature within airSlate SignNow that optimizes document management and signing processes. By utilizing this feature, businesses can streamline workflows, making document handling faster and more efficient. This is essential for organizations aiming to enhance their operational efficiency.

-

How does airSlate SignNow's dr 15dss feature compare in pricing to other eSignature solutions?

airSlate SignNow offers competitive pricing for its dr 15dss feature compared to other eSignature solutions. Users can access a cost-effective pricing model that fits various business sizes and needs. This makes it an attractive choice for organizations looking to optimize their budget while utilizing powerful digital tools.

-

What are the key benefits of using the dr 15dss feature?

Using the dr 15dss feature allows businesses to accelerate their document processes, reduce errors, and improve compliance. This feature also supports real-time collaboration, making it easier for team members to work together on documents. Ultimately, it enhances productivity and accelerates decision-making.

-

Can the dr 15dss feature be integrated with other software platforms?

Yes, the dr 15dss feature is designed for seamless integration with various software platforms, such as CRM and document management systems. This connectivity allows users to incorporate airSlate SignNow into their existing workflows smoothly. Streamlining processes through integrations enhances overall efficiency.

-

Is there a mobile app for accessing the dr 15dss functionality?

Certainly, airSlate SignNow provides a mobile app that allows users to access the dr 15dss functionality on the go. This mobile access ensures that users can manage and sign documents anywhere, anytime, improving flexibility in operations. The app is available for both iOS and Android devices.

-

How easy is it to set up and use the dr 15dss feature?

Setting up the dr 15dss feature is straightforward and user-friendly. airSlate SignNow provides step-by-step guides and tutorials to help users familiarize themselves with the platform. Most users can start leveraging the full benefits of the dr 15dss feature in just a short time after sign-up.

-

What types of documents can I send for eSigning using dr 15dss?

You can send a variety of document types for eSigning using the dr 15dss feature, including contracts, agreements, and forms. airSlate SignNow supports multiple file formats, ensuring that users can easily upload and manage their necessary documents. This versatility is key to accommodating diverse business needs.

Get more for Florida Dept Of Revenue Discretionary Sales SurtaxDiscretionary Sales Surtax Rate TableDiscretionary Sales Surtax Information Fo

- Montana power attorney form

- Life treatment form

- Revocation of living will montana form

- Montana healthcare power of attorney montana form

- Revised uniform anatomical gift act donation montana

- Employment hiring process package montana form

- Revocation of anatomical gift act donation montana form

- Employment or job termination package montana form

Find out other Florida Dept Of Revenue Discretionary Sales SurtaxDiscretionary Sales Surtax Rate TableDiscretionary Sales Surtax Information Fo

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS

- Send Sign Document iPad

- How To Send Sign Document

- Fax Sign PDF Online