Discretionary Sales Surtax Information for Calenda 2025-2026

Understanding the Discretionary Sales Surtax

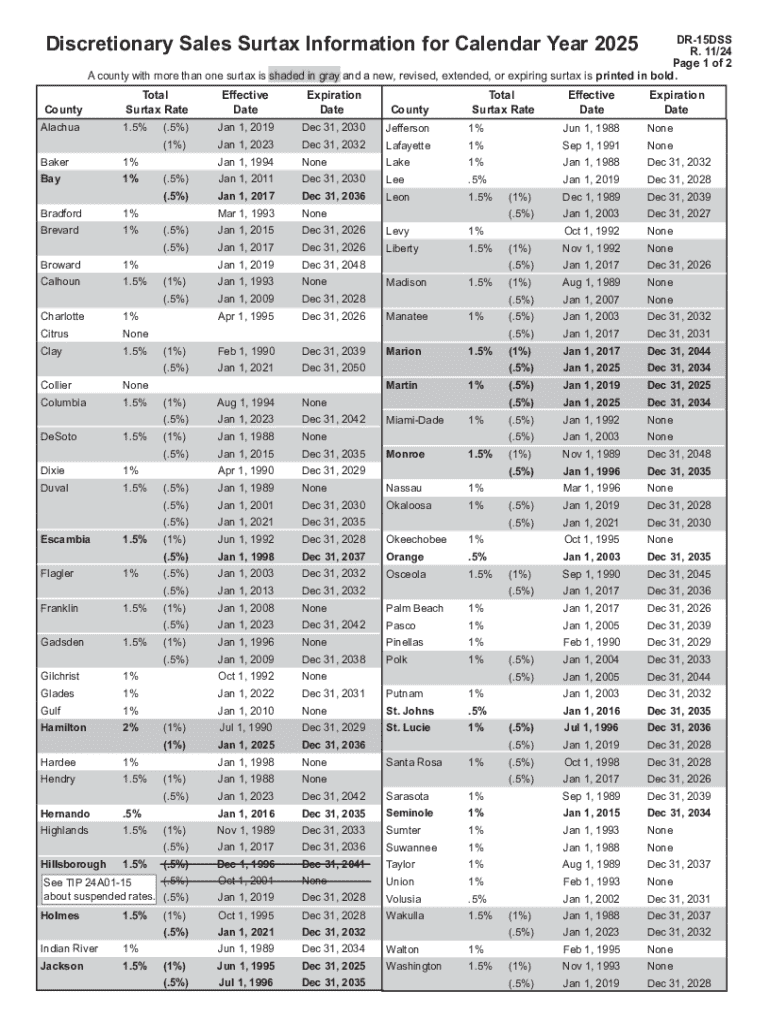

The Florida DR-15DSS form is essential for reporting the Discretionary Sales Surtax, which is an additional tax imposed by local governments in Florida. This surtax is applied on top of the state sales tax and varies by county. The funds collected from this surtax are typically used for local projects, infrastructure improvements, and community services. Understanding the purpose and implications of this surtax is crucial for businesses operating in Florida, as it directly affects pricing and compliance.

Steps to Complete the Florida DR-15DSS Form

Filling out the Florida DR-15DSS form involves several key steps:

- Gather necessary sales records, including total sales and exempt sales.

- Calculate the discretionary sales surtax based on the applicable rate for your county.

- Complete the form by entering your business information, sales data, and calculated surtax.

- Review the form for accuracy to ensure all figures are correct.

- Submit the form by the designated filing deadline, either online or via mail.

Filing Deadlines and Important Dates

Timely filing of the Florida DR-15DSS form is crucial to avoid penalties. The filing deadlines typically align with the sales tax reporting periods, which can be monthly, quarterly, or annually, depending on the volume of sales. Businesses should be aware of these deadlines to ensure compliance and avoid late fees. It is advisable to check the Florida Department of Revenue website for the most current deadlines and any changes to the filing schedule.

Required Documents for Submission

When completing the Florida DR-15DSS form, businesses need to have certain documents on hand. These may include:

- Sales records that detail total sales and exempt transactions.

- Previous tax returns for reference and accuracy.

- Any correspondence from the Florida Department of Revenue regarding your tax status.

Having these documents ready can streamline the completion process and help ensure that all information is accurate and complete.

Legal Use of the Discretionary Sales Surtax

The Discretionary Sales Surtax is governed by Florida state law, and its collection is mandatory for businesses operating in counties that impose this tax. Failure to collect and remit the surtax can result in significant penalties, including fines and interest on unpaid amounts. Businesses must understand their legal obligations regarding the collection of this tax to maintain compliance and avoid legal issues.

Examples of Discretionary Sales Surtax Applications

Businesses may encounter various scenarios where the Discretionary Sales Surtax applies. For instance:

- A retail store selling goods in a county with a one percent surtax must charge the additional tax on all taxable sales.

- A restaurant in a different county with a higher surtax will need to adjust its pricing to reflect the additional tax burden on its customers.

Understanding these examples can help businesses better prepare for the financial implications of the surtax and ensure proper pricing strategies.

Create this form in 5 minutes or less

Find and fill out the correct discretionary sales surtax information for calenda

Create this form in 5 minutes!

How to create an eSignature for the discretionary sales surtax information for calenda

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is fl dr15dss and how does it relate to airSlate SignNow?

The fl dr15dss is a specific document type that can be easily managed using airSlate SignNow. This platform allows users to send, sign, and store fl dr15dss documents securely and efficiently, streamlining the entire process.

-

How much does airSlate SignNow cost for managing fl dr15dss documents?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Depending on your needs for handling fl dr15dss documents, you can choose from various subscription options that provide cost-effective solutions.

-

What features does airSlate SignNow offer for fl dr15dss document management?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning capabilities specifically designed for fl dr15dss documents. These features enhance productivity and ensure compliance with legal standards.

-

Can I integrate airSlate SignNow with other tools for fl dr15dss processing?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing you to manage fl dr15dss documents alongside your existing tools. This integration capability enhances workflow efficiency and data management.

-

What are the benefits of using airSlate SignNow for fl dr15dss?

Using airSlate SignNow for fl dr15dss provides numerous benefits, including faster turnaround times, reduced paper usage, and enhanced security. This solution empowers businesses to streamline their document processes while maintaining compliance.

-

Is airSlate SignNow user-friendly for handling fl dr15dss documents?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to manage fl dr15dss documents. The intuitive interface ensures that users can quickly learn how to send and sign documents without extensive training.

-

How secure is airSlate SignNow when dealing with fl dr15dss documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect fl dr15dss documents. Users can trust that their sensitive information is safeguarded throughout the document management process.

Get more for Discretionary Sales Surtax Information For Calenda

- Read the bible in a year calendar form

- Side chick application form

- Enrolment form karachi board

- A4 printable rainfall chart form

- Fitness certificate for school admission form

- Registeryour shark com form

- Tax client intake form

- Www ndis gov aupreparing your plan reviewpreparing for your plan reviewndis form

Find out other Discretionary Sales Surtax Information For Calenda

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online