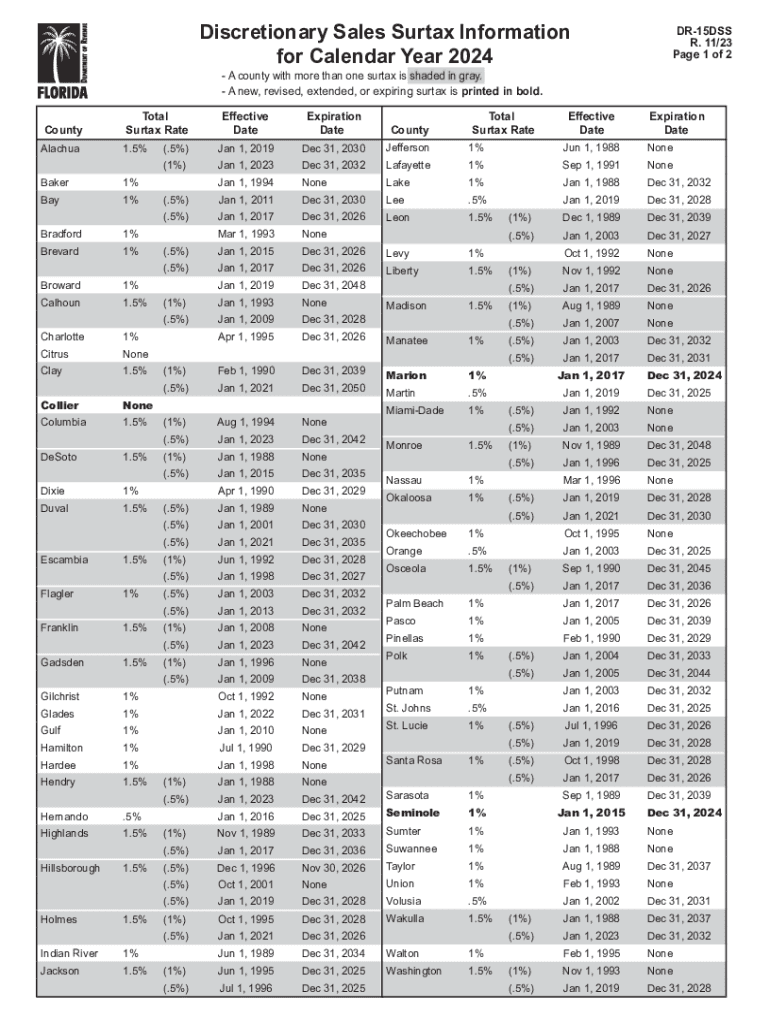

a County with More Than One Surtax is Shaded in Gray 2024

Understanding Florida's Discretionary Sales Surtax

The discretionary sales surtax is an additional tax imposed by Florida counties on top of the state sales tax. This surtax is used to fund local projects and services. Each county may choose to implement a surtax, and the rate can vary significantly. For instance, some counties may have a surtax rate of one percent, while others may implement higher rates. Understanding the specific rate applicable in your county is essential for accurate tax calculations.

Key Elements of Form DR-15DSS

Form DR-15DSS is used to report discretionary sales surtax information. This form requires details such as the total sales, the amount of surtax collected, and the specific county where the sales occurred. Accurate completion of this form is crucial for compliance with Florida tax regulations. Additionally, the form must be submitted to the Florida Department of Revenue, ensuring that local governments receive the appropriate funds from the surtax collected.

Filing Deadlines and Important Dates

Filing deadlines for Form DR-15DSS are typically aligned with the state’s sales tax return deadlines. Generally, businesses must file this form monthly or quarterly, depending on their sales volume. It is important to stay informed about these deadlines to avoid penalties. Keeping a calendar with important tax dates can help ensure timely submissions and compliance with state regulations.

Penalties for Non-Compliance

Failure to file Form DR-15DSS or inaccuracies in the form can result in penalties imposed by the Florida Department of Revenue. These penalties may include fines or interest on unpaid taxes. Businesses are encouraged to maintain accurate records and file timely to avoid these consequences. Understanding the implications of non-compliance can help businesses manage their tax obligations effectively.

Application Process for Discretionary Sales Surtax

To apply for the discretionary sales surtax, businesses must register with the Florida Department of Revenue. This process includes providing necessary documentation and details about the business operations. Once registered, businesses will receive guidance on how to collect and remit the surtax. Staying informed about the application process can facilitate compliance and ensure that businesses are properly registered to collect the surtax.

Examples of Surtax Application

Understanding how the discretionary sales surtax applies in real-world scenarios can be beneficial. For instance, a retail store in a county with a one percent surtax must charge customers a total of six percent sales tax, combining the state rate with the local surtax. Another example is a restaurant that collects surtax on food and beverage sales, which contributes to local infrastructure projects. These examples illustrate the practical implications of the surtax in everyday business operations.

Quick guide on how to complete a county with more than one surtax is shaded in gray

Effortlessly Prepare A County With More Than One Surtax Is Shaded In Gray on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage A County With More Than One Surtax Is Shaded In Gray on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Edit and Electronically Sign A County With More Than One Surtax Is Shaded In Gray with Ease

- Find A County With More Than One Surtax Is Shaded In Gray and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal standing as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign A County With More Than One Surtax Is Shaded In Gray and ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct a county with more than one surtax is shaded in gray

Create this form in 5 minutes!

How to create an eSignature for the a county with more than one surtax is shaded in gray

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the discretionary sales surtax information for calendar year 2025?

The discretionary sales surtax information for calendar year 2025 outlines the specific tax rates and regulations that apply to businesses and consumers in various jurisdictions. This information is crucial for compliance and financial planning, as it affects pricing and overall costs. Staying updated on these rates helps ensure accurate collection and remittance.

-

How does airSlate SignNow assist with discretionary sales surtax compliance?

airSlate SignNow provides tools to streamline the signing and management of documents, helping businesses maintain compliance with the discretionary sales surtax information for calendar year 2025. With automated workflows and integrations, you can easily track and report sales tax documents. This ensures that your business remains compliant while saving time and reducing errors.

-

What are the pricing plans for airSlate SignNow related to tax document management?

airSlate SignNow offers flexible pricing plans designed to suit businesses of all sizes. Each plan includes tools to manage important documents related to discretionary sales surtax information for calendar year 2025. By investing in effective document management, businesses can enhance efficiency and compliance.

-

What features help businesses understand discretionary sales surtax information for calendar year 2025?

Key features of airSlate SignNow include customizable templates, automated reminders, and robust analytics that help businesses interpret the discretionary sales surtax information for calendar year 2025 more efficiently. These tools make it easy to create, manage, and archive essential tax documents, ensuring ready access for audits or inspections.

-

Can airSlate SignNow integrate with accounting software for tax compliance?

Yes, airSlate SignNow seamlessly integrates with popular accounting software to enhance compliance with discretionary sales surtax information for calendar year 2025. These integrations help synchronize document workflows and tax calculations, resulting in fewer discrepancies and a streamlined process for managing sales tax.

-

How can airSlate SignNow improve the efficiency of tax document workflows?

airSlate SignNow improves the efficiency of tax document workflows by providing an easy-to-use platform for eSigning and managing documents. By automating routine tasks and enabling collaboration, businesses can focus on understanding and applying discretionary sales surtax information for calendar year 2025 without unnecessary delays.

-

What benefits does eSigning offer regarding discretionary sales surtax documentation?

ESigning through airSlate SignNow offers signNow benefits for managing discretionary sales surtax documentation. It speeds up the signing process, reduces the need for paper, and enhances security and tracking. As a result, businesses can ensure compliance with the discretionary sales surtax information for calendar year 2025 more effectively.

Get more for A County With More Than One Surtax Is Shaded In Gray

- Tenant agrees that failure to comply may at landlords option be deemed a breach of the lease agreement form

- To order telephone service call form

- Us district court for the southern district of illinois justia form

- Amount retained by landlord form

- The reason for the name change is form

- Why is a dupage county employee in this pictureglen form

- Assumed business name application assumed business name application form

- Pronoun agreement on act english tips and practice form

Find out other A County With More Than One Surtax Is Shaded In Gray

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement