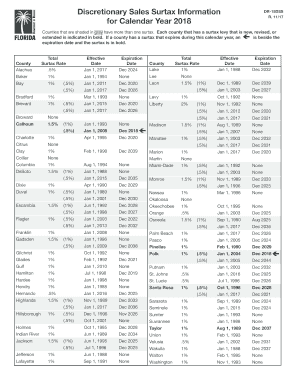

Counties that Are Shaded in Gray Have More Than One Surtax 2017

What is the counties that are shaded in gray have more than one surtax?

The counties that are shaded in gray have more than one surtax refer to specific regions within the United States that impose additional local taxes on top of the standard state tax. These surtaxes are typically levied to fund local initiatives, such as education, infrastructure, or public services. Understanding these surtaxes is essential for residents and businesses operating in these areas, as they can significantly impact overall tax liabilities.

How to use the counties that are shaded in gray have more than one surtax

Using the counties that are shaded in gray have more than one surtax involves understanding the specific tax obligations for residents and businesses. Taxpayers should first identify if they reside or operate in one of these counties. Next, they should consult local tax authorities or resources to determine the applicable surtax rates and requirements. Utilizing digital tools, such as eSignature solutions, can streamline the process of filling out and submitting necessary forms, ensuring compliance with local regulations.

Steps to complete the counties that are shaded in gray have more than one surtax

Completing the counties that are shaded in gray have more than one surtax typically involves the following steps:

- Identify the specific county and its surtax rates.

- Gather all required financial documents and information.

- Access the appropriate surtax form, ensuring it is the correct version for your county.

- Fill out the form accurately, including all necessary details.

- Review the completed form for any errors or omissions.

- Sign the form electronically using a trusted eSignature solution.

- Submit the form to the appropriate local tax authority by the specified deadline.

Legal use of the counties that are shaded in gray have more than one surtax

The legal use of the counties that are shaded in gray have more than one surtax requires compliance with both state and local tax laws. Taxpayers must ensure that they are using the correct forms and following the guidelines set forth by their local tax authorities. Additionally, the IRS has recognized the validity of eSignatures for certain tax forms, making it easier for taxpayers to file electronically while maintaining legal compliance.

IRS Guidelines

The IRS provides specific guidelines regarding the filing of tax forms, including those related to counties that are shaded in gray have more than one surtax. Taxpayers should familiarize themselves with these guidelines to ensure their forms meet federal requirements. The IRS has also updated its policies to accommodate electronic signatures, allowing for a smoother filing process during periods of increased health concerns, such as the COVID-19 pandemic.

Filing Deadlines / Important Dates

Filing deadlines for the counties that are shaded in gray have more than one surtax can vary based on local regulations. It is crucial for taxpayers to be aware of these dates to avoid penalties. Generally, local tax authorities will publish annual deadlines for surtax filings, which may align with federal tax deadlines or differ based on local policies. Keeping track of these important dates ensures timely and compliant submissions.

Required Documents

To complete the counties that are shaded in gray have more than one surtax, taxpayers typically need to provide several key documents. These may include:

- Proof of income, such as W-2s or 1099 forms.

- Previous tax returns for reference.

- Documentation of any deductions or credits applicable to local surtaxes.

- Identification information, such as Social Security numbers.

Having these documents ready can facilitate a smoother filing process and help ensure compliance with local tax laws.

Quick guide on how to complete counties that are shaded in gray have more than one surtax

Your instructional manual on how to prepare your Counties That Are Shaded In Gray Have More Than One Surtax

If you’re wondering how to finalize and submit your Counties That Are Shaded In Gray Have More Than One Surtax, here are a few concise recommendations to simplify tax filing.

Initially, you simply need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a user-friendly and robust document management solution that enables you to modify, generate, and finalize your tax documents effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures, and return to adjust details as necessary. Enhance your tax handling with advanced PDF editing, electronic signing, and seamless sharing.

Follow the steps below to finish your Counties That Are Shaded In Gray Have More Than One Surtax in no time:

- Create your account and start working on PDFs in minutes.

- Utilize our library to find any IRS tax form; explore various versions and schedules.

- Click Get form to access your Counties That Are Shaded In Gray Have More Than One Surtax in our editor.

- Complete the mandatory fields with your information (text, numbers, checkmarks).

- Use the Sign Tool to add your legally valid eSignature (if necessary).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Leverage this guide to electronically file your taxes with airSlate SignNow. Keep in mind that submitting by mail can increase return errors and delay refunds. Additionally, prior to e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct counties that are shaded in gray have more than one surtax

FAQs

-

How do I fill out form 26QB for TDS in case of more than one buyer and seller?

Hi,Please select Yes in the column of Whether more than one Buyer/seller as applicable, and enter the Primary Member details in the Address of Transferee/Transferor & no need of secondary person details.The reason to include this is to know whether the agreement includes more than one buyer/seller, so the option is enabled.Hope it is useful.

-

What is the procedure to fill out a form for more than one post in AAI 2018?

Hello dear AAI JOB aspirantFill up different posts of present recruitment 02/2018 by using different email IDs but phone number can be same.

-

Is there any permission form that green card holders need to be fill out to stay for more than six month in India?

Although 6 months stay may not be an immediate problem, if your situation looks ike you take up residence in India for some reason, you may lose your green card. So, I strongly suggest reading this PDF document from USCIS:https://www.uscis.gov/sites/defa...

-

If you played one of those $10,000 a spin slot machines in Vegas would that mean that anytime it won anything even one credit I would still have to fill out a tax form?

Yes, although they can set the machine to accumulated credit mode, and a staffer will sit by recording each jackpot on a form, then quickly resetting the machine so it’s ready to go again. You get a single W2G at the end of the session.It’s close to impossible to play extremely high-limit machines at any decent speed by feeding it currency and stopping for traditional hand-pays.

-

I do have a EIN number and LLC DE that sell online. People say that if you are incorporated in DE as a LLC than the only thing you pay is 300$ for a year and a fill out a form 1040NR. Do I have to get register to some other permits or do I have to pay any other tax?

For the sales tax issues here, check out www.taxjar.com. They’ve got this nailed.You do NOT need to file a 1040NR. You only need to file a 1040NR if you are subject to US federal income tax. That’s the case only where you have your own people on the ground in the US operating your business.Here’s more detail on how this works: Non-US Entrepreneurs: You Can Sell Products into the US without Paying US Tax - U.S Tax Services

-

Are some IPs more prone to blocking than others? How do I find out / obtain the ones that are not?

No. An IP is simply an address. Just as renaming the street you live on or renumbering the houses isn't going to improve the speed and quality of the postal system that serves your house, changing your IP won’t improve your connection. You’d have to actually do something to improve the network(s) the data is crossing.(Needing to change IPs might be a consequence of making such improvements, but it won't improve your connection on its own.)

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

Create this form in 5 minutes!

How to create an eSignature for the counties that are shaded in gray have more than one surtax

How to make an electronic signature for your Counties That Are Shaded In Gray Have More Than One Surtax online

How to generate an eSignature for your Counties That Are Shaded In Gray Have More Than One Surtax in Google Chrome

How to create an eSignature for putting it on the Counties That Are Shaded In Gray Have More Than One Surtax in Gmail

How to generate an electronic signature for the Counties That Are Shaded In Gray Have More Than One Surtax from your smart phone

How to make an electronic signature for the Counties That Are Shaded In Gray Have More Than One Surtax on iOS

How to create an eSignature for the Counties That Are Shaded In Gray Have More Than One Surtax on Android OS

People also ask

-

What are the benefits of using airSlate SignNow for e-signatures?

airSlate SignNow provides an easy-to-use platform for e-signatures and document management. By utilizing this tool, businesses can streamline their workflows, enhance document security, and improve turnaround times. Counties That Are Shaded In Gray Have More Than One Surtax can greatly benefit from quick and efficient solutions for managing multiple surtaxes.

-

How does airSlate SignNow integrate with other software?

airSlate SignNow offers seamless integrations with various popular applications and platforms, including CRMs and project management tools. This flexibility allows businesses in Counties That Are Shaded In Gray Have More Than One Surtax to continue using their favorite software while enhancing their document management capabilities.

-

What pricing plans does airSlate SignNow offer?

airSlate SignNow provides several pricing plans to cater to different business needs and sizes. By choosing the right plan, businesses, including those located in Counties That Are Shaded In Gray Have More Than One Surtax, can maximize their e-signing capabilities without overspending.

-

Is airSlate SignNow compliant with legal regulations?

Yes, airSlate SignNow complies with electronic signature laws, ensuring that your e-signatures are legally binding. This is particularly crucial for businesses in Counties That Are Shaded In Gray Have More Than One Surtax, as they must meet regulatory standards when managing multiple surtaxes.

-

Can airSlate SignNow assist with document tracking and management?

Absolutely! airSlate SignNow allows you to track document status and manage paperwork efficiently. Companies in Counties That Are Shaded In Gray Have More Than One Surtax will find this feature invaluable in keeping up with various surtax documents and deadlines.

-

How user-friendly is the airSlate SignNow platform?

The airSlate SignNow platform is designed for ease of use, regardless of technical skill levels. Its intuitive interface makes it accessible, which is essential for businesses in Counties That Are Shaded In Gray Have More Than One Surtax looking to implement a straightforward solution for their e-signing needs.

-

What support does airSlate SignNow provide to its users?

airSlate SignNow offers robust customer support, including tutorials, FAQs, and live chat assistance. This support is especially beneficial for users in Counties That Are Shaded In Gray Have More Than One Surtax who may have questions about navigating e-signatures and surtax-related documentation.

Get more for Counties That Are Shaded In Gray Have More Than One Surtax

Find out other Counties That Are Shaded In Gray Have More Than One Surtax

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast