FORM 1041ME INCOME TAX RETURN *2109100* 00 00 2021

What is the FORM 1041ME INCOME TAX RETURN *2109100* 00 00

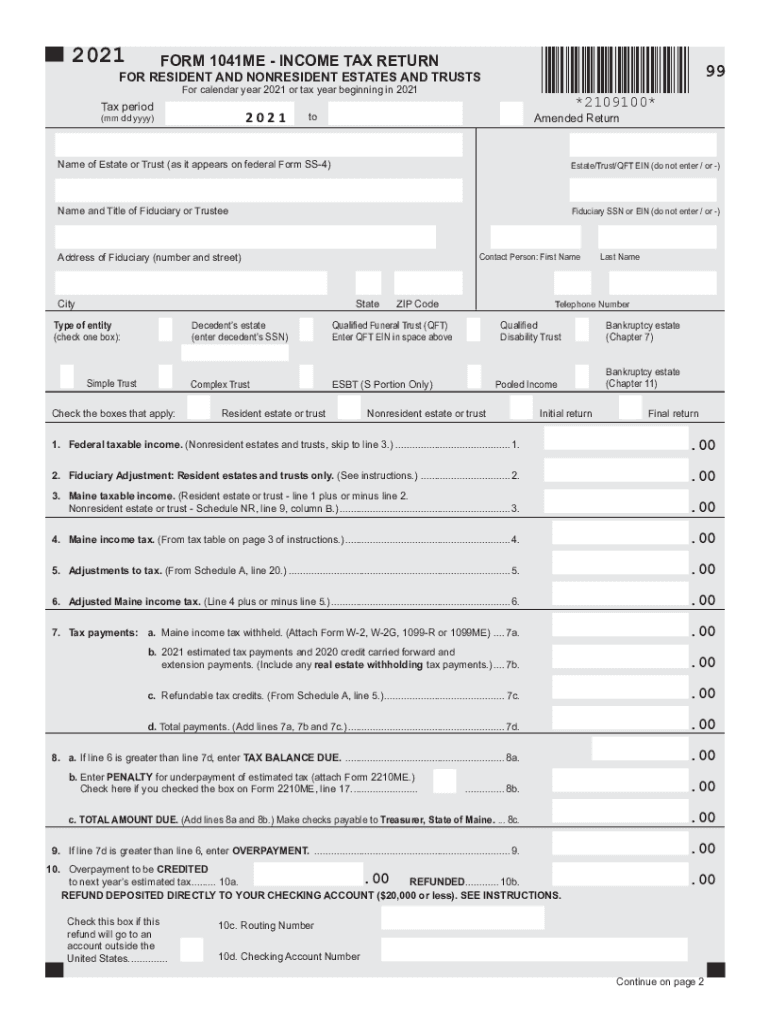

The FORM 1041ME INCOME TAX RETURN *2109100* 00 00 is a tax document specifically designed for estates and trusts in the state of Maine. This form is used to report income, deductions, and tax liability for estates and trusts that generate income during the tax year. It is essential for fiduciaries to accurately complete this form to ensure compliance with state tax regulations, as it reflects the financial activities of the estate or trust.

How to use the FORM 1041ME INCOME TAX RETURN *2109100* 00 00

Using the FORM 1041ME INCOME TAX RETURN *2109100* 00 00 involves several key steps. First, gather all necessary financial documents related to the estate or trust, including income statements, deduction records, and prior tax returns. Next, complete the form by providing accurate information about the income earned and deductions claimed. It is crucial to review the completed form for accuracy before submission to avoid any penalties or delays.

Steps to complete the FORM 1041ME INCOME TAX RETURN *2109100* 00 00

Completing the FORM 1041ME INCOME TAX RETURN *2109100* 00 00 requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents.

- Fill out the identification section with the estate or trust's name, address, and taxpayer identification number.

- Report all sources of income, including dividends, interest, and rental income.

- List allowable deductions, such as administrative expenses and distributions to beneficiaries.

- Calculate the tax owed based on the net income reported.

- Sign and date the form, ensuring that it is filed by the due date.

Legal use of the FORM 1041ME INCOME TAX RETURN *2109100* 00 00

The legal use of the FORM 1041ME INCOME TAX RETURN *2109100* 00 00 is critical for fiduciaries managing estates and trusts. This form must be filed in accordance with Maine state tax laws to properly report income and fulfill tax obligations. Failure to file this form accurately and on time can result in penalties, interest on unpaid taxes, and potential legal issues for the fiduciary responsible for the estate or trust.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the FORM 1041ME INCOME TAX RETURN *2109100* 00 00. Typically, this form is due on April fifteenth of the year following the tax year being reported. If the fiduciary requires additional time, they may file for an extension, but it is important to note that any taxes owed must still be paid by the original due date to avoid penalties.

Required Documents

To complete the FORM 1041ME INCOME TAX RETURN *2109100* 00 00, several documents are required:

- Income statements for the estate or trust.

- Records of deductions and expenses.

- Prior year tax returns, if applicable.

- Documentation of distributions made to beneficiaries.

Quick guide on how to complete form 1041me income tax return 2109100 00 00

Easily Prepare FORM 1041ME INCOME TAX RETURN *2109100* 00 00 on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the appropriate format and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Handle FORM 1041ME INCOME TAX RETURN *2109100* 00 00 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Edit and Electronically Sign FORM 1041ME INCOME TAX RETURN *2109100* 00 00 Effortlessly

- Locate FORM 1041ME INCOME TAX RETURN *2109100* 00 00 and then click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize signNow sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign tool, which takes seconds and has the same legal validity as a traditional ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your requirements in document management in a few clicks from any device you prefer. Edit and electronically sign FORM 1041ME INCOME TAX RETURN *2109100* 00 00 and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1041me income tax return 2109100 00 00

Create this form in 5 minutes!

People also ask

-

What is the FORM 1041ME INCOME TAX RETURN *2109100* 00 00?

The FORM 1041ME INCOME TAX RETURN *2109100* 00 00 is a tax document used for reporting income, deductions, and credits for estates and trusts. It is essential for filing income taxes correctly and ensuring compliance with state tax regulations. This form helps trustees and executors manage tax obligations effectively.

-

How can airSlate SignNow assist with the FORM 1041ME INCOME TAX RETURN *2109100* 00 00?

airSlate SignNow streamlines the process of preparing and submitting the FORM 1041ME INCOME TAX RETURN *2109100* 00 00 by allowing users to eSign documents securely. Our platform simplifies document management and ensures that every step is compliant with tax regulations. You can easily share the form with necessary parties and track submissions in real time.

-

What are the pricing options for using airSlate SignNow for FORM 1041ME INCOME TAX RETURN *2109100* 00 00?

airSlate SignNow offers various pricing plans to accommodate different business needs when dealing with the FORM 1041ME INCOME TAX RETURN *2109100* 00 00. Plans are designed to be cost-effective, providing an affordable solution for document signing and management. Check our website for detailed pricing tiers that fit your usage level.

-

Are there integrations available for airSlate SignNow when handling FORM 1041ME INCOME TAX RETURN *2109100* 00 00?

Yes, airSlate SignNow provides various integrations with popular software applications that can enhance the management of the FORM 1041ME INCOME TAX RETURN *2109100* 00 00. This allows you to leverage existing tools for better efficiency, automating workflows and reducing manual input. Integration options include CRM systems, cloud storage, and accounting software.

-

What are the key benefits of using airSlate SignNow for estate and trust tax preparation?

Using airSlate SignNow for estate and trust tax preparation simplifies the handling of documents like the FORM 1041ME INCOME TAX RETURN *2109100* 00 00 while ensuring security and compliance. The platform's eSigning capabilities eliminate paperwork delays and improve tracking of document status. With easy access from any device, you’ll streamline your tax processes signNowly.

-

Can airSlate SignNow handle multiple users for the FORM 1041ME INCOME TAX RETURN *2109100* 00 00?

Yes, airSlate SignNow supports multi-user access, making it ideal for teams working together on the FORM 1041ME INCOME TAX RETURN *2109100* 00 00. This feature allows various stakeholders to collaborate seamlessly on document preparation and signing. Each user can have customized permissions based on their role, enhancing security and workflow efficiency.

-

Is there customer support available for users of airSlate SignNow for FORM 1041ME INCOME TAX RETURN *2109100* 00 00?

Absolutely, airSlate SignNow provides extensive customer support for users dealing with the FORM 1041ME INCOME TAX RETURN *2109100* 00 00. Our support team is available to assist with any questions or issues you may encounter, ensuring that you can utilize our services effectively. Support options include FAQ resources, live chat, and email assistance.

Get more for FORM 1041ME INCOME TAX RETURN *2109100* 00 00

- Assumed name 497317066 form

- North carolina assumed name form

- Withdrawal of assumed name for corporation north carolina form

- North carolina limited form

- North carolina partnership form

- Landlord tenant closing statement to reconcile security deposit north carolina form

- North carolina name change form

- Name change notification form north carolina

Find out other FORM 1041ME INCOME TAX RETURN *2109100* 00 00

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online