Fiduciary Income Tax 1041MEMaine Revenue Services 2022

Understanding the Fiduciary Income Tax 1041ME

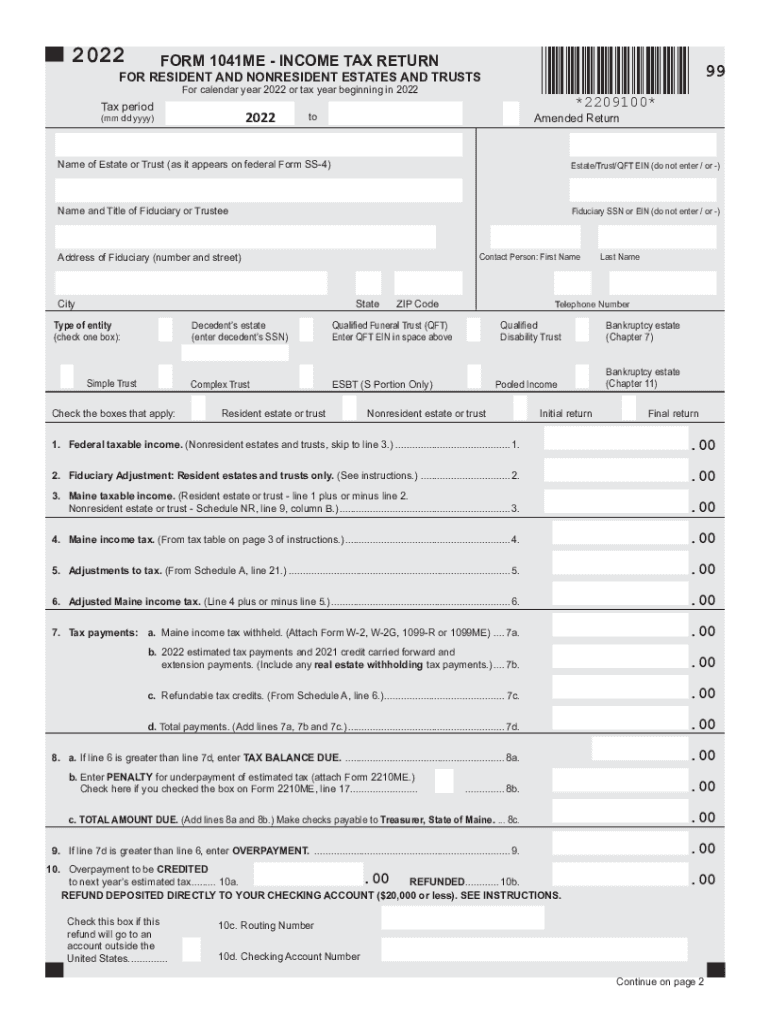

The Fiduciary Income Tax 1041ME is a crucial form for reporting income generated by estates and trusts in Maine. This form is specifically designed for fiduciaries, such as executors or trustees, who manage the financial affairs of an estate or trust. The 1041ME form allows fiduciaries to report income, deductions, and credits, ensuring compliance with Maine tax laws. Understanding its purpose is essential for accurate tax reporting and fulfilling legal obligations.

Steps to Complete the Fiduciary Income Tax 1041ME

Completing the Fiduciary Income Tax 1041ME involves several key steps:

- Gather all necessary financial documents related to the estate or trust, including income statements, expense receipts, and previous tax returns.

- Accurately report all sources of income generated by the estate or trust, such as dividends, interest, and rental income.

- Detail any deductions that the estate or trust may qualify for, including administrative expenses and distributions to beneficiaries.

- Complete the 1041ME form, ensuring all information is accurate and complete to avoid penalties.

- Submit the completed form to the Maine Revenue Services by the designated deadline.

Filing Deadlines and Important Dates

Filing deadlines for the Fiduciary Income Tax 1041ME are critical to ensure compliance and avoid penalties. Typically, the form is due on the 15th day of the fourth month following the close of the tax year. For estates and trusts that operate on a calendar year, this means the form is usually due by April 15. It is essential to keep track of these dates to ensure timely submission and avoid late fees.

Required Documents for Filing

When preparing to file the Fiduciary Income Tax 1041ME, several documents are necessary:

- Income statements for the estate or trust, including Form 1099s and K-1s.

- Records of all expenses incurred during the tax year, such as maintenance costs and professional fees.

- Previous tax returns, if applicable, to provide context for the current year's filing.

- Documentation of distributions made to beneficiaries, which may affect tax liabilities.

Legal Use of the Fiduciary Income Tax 1041ME

The legal use of the Fiduciary Income Tax 1041ME is essential for maintaining compliance with state tax laws. This form must be filed accurately to reflect the financial activities of the estate or trust. Failure to file or inaccuracies can result in penalties, including fines and interest on unpaid taxes. Understanding the legal implications of this form helps fiduciaries fulfill their responsibilities and protect the interests of the beneficiaries.

Examples of Using the Fiduciary Income Tax 1041ME

Practical examples of using the Fiduciary Income Tax 1041ME can illustrate its application:

- A trustee managing a family trust must report income generated from investments and property rentals, detailing deductions for maintenance expenses.

- An executor of an estate needs to report income received from the sale of estate assets and any distributions made to heirs.

These examples highlight the importance of accurate reporting and compliance with Maine tax regulations.

Quick guide on how to complete fiduciary income tax 1041memaine revenue services

Effortlessly Prepare Fiduciary Income Tax 1041MEMaine Revenue Services on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides you with all the features necessary to create, edit, and electronically sign your documents quickly and without delays. Manage Fiduciary Income Tax 1041MEMaine Revenue Services on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to Edit and Electronically Sign Fiduciary Income Tax 1041MEMaine Revenue Services with Ease

- Obtain Fiduciary Income Tax 1041MEMaine Revenue Services and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important sections of the documents or conceal sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Verify all details and click on the Done button to save your modifications.

- Decide how you wish to share your form, via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Fiduciary Income Tax 1041MEMaine Revenue Services and ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fiduciary income tax 1041memaine revenue services

Create this form in 5 minutes!

How to create an eSignature for the fiduciary income tax 1041memaine revenue services

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Maine tax trusts and how do they work?

Maine tax trusts are specialized trust arrangements designed to help individuals manage their tax obligations effectively. They allow for strategic planning and asset protection, helping clients reduce their taxable income while ensuring compliance with state laws. By leveraging Maine tax trusts, you can improve your financial planning and optimize tax savings.

-

How can airSlate SignNow help with Maine tax trusts documentation?

airSlate SignNow simplifies the process of managing documents related to Maine tax trusts by enabling users to eSign and send documents securely. Our platform ensures that all necessary trust documents are legally binding and easy to track. This helps streamline your workflow and minimizes the hassles of paperwork.

-

What features does airSlate SignNow offer for managing Maine tax trusts?

Our solution offers features such as customizable templates, secure eSigning, real-time tracking, and document storage, all of which are essential for managing Maine tax trusts. These tools ensure that you can easily create, send, and manage trust documents without any hassle. Additionally, our user-friendly interface makes it accessible to everyone.

-

Are there any integrations for airSlate SignNow that are beneficial for Maine tax trusts?

Yes, airSlate SignNow integrates seamlessly with various applications that can enhance your management of Maine tax trusts. By connecting with tools like CRM systems, cloud storage solutions, and accounting software, you can streamline your processes and improve efficiency. This enables better collaboration and data management regarding your trust accounts.

-

What are the pricing options for using airSlate SignNow for Maine tax trusts?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those focused on managing Maine tax trusts. You can choose from monthly or annual subscriptions that fit your budget and requirements. Our cost-effective solution ensures you receive excellent value while handling essential trust documentation.

-

How secure is airSlate SignNow for handling Maine tax trusts?

The security of your documents is our top priority at airSlate SignNow, especially when dealing with sensitive information related to Maine tax trusts. We employ state-of-the-art encryption and security protocols to protect your data. Additionally, our compliant practices ensure that all eSigned documents meet legal standards and safeguard your information.

-

What benefits do businesses get from using airSlate SignNow for Maine tax trusts?

Using airSlate SignNow for Maine tax trusts provides numerous benefits, including increased efficiency, reduced paperwork, and improved accuracy in document handling. Our eSigning capabilities save time and enhance collaboration, ensuring all parties are on the same page. Ultimately, this leads to better management of tax obligations and trust assets.

Get more for Fiduciary Income Tax 1041MEMaine Revenue Services

- Lease subordination agreement south dakota form

- Apartment rules and regulations south dakota form

- Agreed cancellation of lease south dakota form

- Amendment of residential lease south dakota form

- Agreement for payment of unpaid rent south dakota form

- Commercial lease assignment from tenant to new tenant south dakota form

- Tenant consent to background and reference check south dakota form

- Residential lease or rental agreement for month to month south dakota form

Find out other Fiduciary Income Tax 1041MEMaine Revenue Services

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT