FORM 1041ME INCOME TAX RETURN *1809100* Sign 2019

What is the 2018 Form 1041ME Income Tax Return?

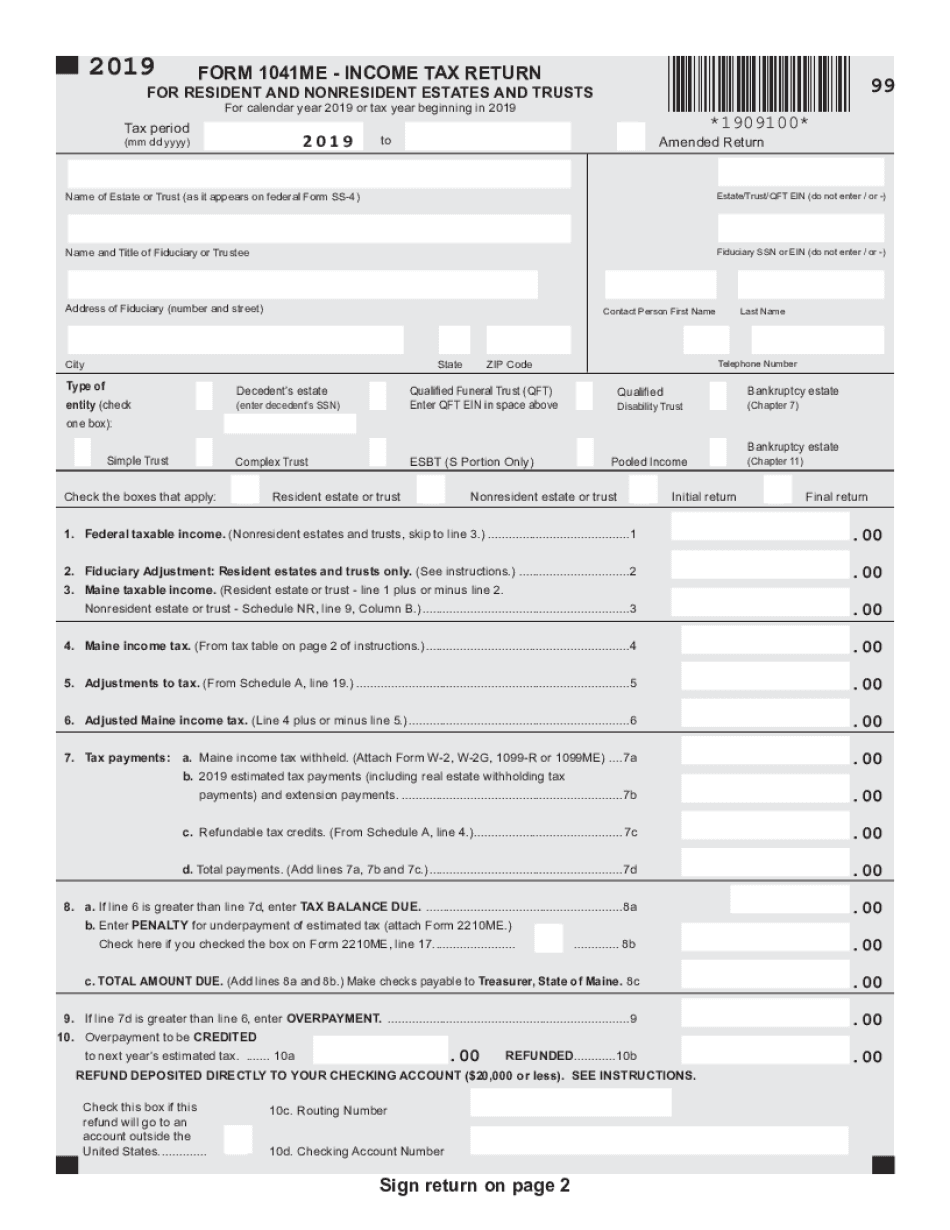

The 2018 Form 1041ME is the Maine income tax return specifically designed for estates and trusts. This form is used to report income, deductions, and tax liability for estates and trusts operating within the state of Maine. It is essential for fiduciaries managing the financial affairs of an estate or trust to accurately complete this form to ensure compliance with state tax laws. The form captures various income sources, including interest, dividends, and capital gains, providing a comprehensive overview of the entity's financial status.

Steps to Complete the 2018 Form 1041ME

Completing the 2018 Form 1041ME involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and records of deductions. Follow these steps for completion:

- Enter the estate or trust's identifying information, including name, address, and federal identification number.

- Report all sources of income on the form, ensuring to include interest, dividends, and any other relevant income.

- Detail allowable deductions, such as administrative expenses and distributions to beneficiaries.

- Calculate the total tax liability based on the reported income and deductions.

- Review the completed form for accuracy before submission.

Filing Deadlines for the 2018 Form 1041ME

Filing deadlines for the 2018 Form 1041ME are crucial for compliance. The form must be filed by the 15th day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year basis, this typically means the deadline is April 15. Extensions may be available, but it is important to file the necessary forms to avoid penalties.

Required Documents for the 2018 Form 1041ME

To complete the 2018 Form 1041ME, several documents are required to substantiate the information reported. These include:

- Income statements, such as Form 1099 for interest and dividends.

- Records of all deductions, including receipts for expenses related to the estate or trust.

- Documentation of distributions made to beneficiaries during the tax year.

Having these documents readily available will streamline the completion process and ensure compliance with Maine tax regulations.

Legal Use of the 2018 Form 1041ME

The 2018 Form 1041ME is legally binding when completed and filed according to Maine tax laws. It serves as an official declaration of the estate or trust's income and tax obligations. Proper execution of this form is essential for avoiding legal issues and ensuring that the fiduciary responsibilities are met. It is advisable to retain copies of the submitted form and all supporting documents for future reference and compliance verification.

Digital vs. Paper Version of the 2018 Form 1041ME

Taxpayers have the option to file the 2018 Form 1041ME either digitally or via paper submission. The digital version offers several advantages, including faster processing times and reduced risk of errors. Electronic filing can also provide immediate confirmation of receipt, which is beneficial for record-keeping. However, some may prefer the traditional paper method for its tangible nature. Regardless of the method chosen, it is essential to ensure that all information is accurate and complete to avoid complications.

Quick guide on how to complete form 1041me income tax return 1809100 sign

Complete FORM 1041ME INCOME TAX RETURN *1809100* Sign effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily access the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle FORM 1041ME INCOME TAX RETURN *1809100* Sign on any device with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to edit and eSign FORM 1041ME INCOME TAX RETURN *1809100* Sign without hassle

- Find FORM 1041ME INCOME TAX RETURN *1809100* Sign and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form: by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or mislaid files, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign FORM 1041ME INCOME TAX RETURN *1809100* Sign and ensure excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1041me income tax return 1809100 sign

Create this form in 5 minutes!

How to create an eSignature for the form 1041me income tax return 1809100 sign

The best way to create an eSignature for a PDF document in the online mode

The best way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the 2018 form 1041me?

The 2018 form 1041me is a tax return form used in Maine for estate and trust income reporting. It allows fiduciaries to report income earned by estates or trusts and calculate their tax liabilities. Completing this form accurately is essential for compliance with state tax laws.

-

How can airSlate SignNow help me with the 2018 form 1041me?

airSlate SignNow provides a seamless platform to efficiently fill out and eSign your 2018 form 1041me. You can easily send the form to clients or stakeholders for their signatures and receive completed forms back promptly. This streamlines the process of tax filing and ensures that you stay organized.

-

Is airSlate SignNow affordable for filing the 2018 form 1041me?

Yes, airSlate SignNow offers a cost-effective solution for eSigning documents, including the 2018 form 1041me. With various pricing plans available, you can choose an option that fits your budget while enjoying all the essential features for document management and eSigning.

-

What features does airSlate SignNow offer for the 2018 form 1041me?

airSlate SignNow offers features that include customizable document templates, secure eSigning, and real-time tracking of document status. These functionalities make it easy to manage the 2018 form 1041me efficiently and keep all parties informed throughout the signing process.

-

Can I integrate airSlate SignNow with other software when handling the 2018 form 1041me?

Absolutely! airSlate SignNow supports integrations with various popular software solutions. This helps you streamline your workflow by automatically filling in relevant information on your 2018 form 1041me from connected applications, saving you time and reducing errors.

-

What are the benefits of using airSlate SignNow for the 2018 form 1041me?

Using airSlate SignNow for the 2018 form 1041me provides several advantages, including enhanced security, improved efficiency, and a better user experience. Securely eSigning documents ensures compliance while saving time and reducing the likelihood of mistakes in your filing.

-

Is there a mobile app for completing the 2018 form 1041me with airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows you to complete and eSign the 2018 form 1041me on the go. This flexibility ensures that you can manage your documents conveniently from anywhere, making it easier to meet your tax deadlines.

Get more for FORM 1041ME INCOME TAX RETURN *1809100* Sign

- Wi tenant landlord form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497430602 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497430603 form

- Letter from landlord to tenant for failure of to dispose all ashes rubbish garbage or other waste in a clean and safe manner in 497430604 form

- Letter from landlord to tenant for failure to keep all plumbing fixtures in the dwelling unit as clean as their condition 497430605 form

- Letter from landlord to tenant for failure to use electrical plumbing sanitary heating ventilating air conditioning and other 497430606 form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497430607 form

- Wi letter tenant form

Find out other FORM 1041ME INCOME TAX RETURN *1809100* Sign

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template