Form IL 1041 Illinois Department of Revenue 2023-2026

What is the Form IL 1041

The Form IL 1041 is a tax document issued by the Illinois Department of Revenue, specifically designed for fiduciaries of estates and trusts. This form is used to report income, deductions, and credits related to the income generated by estates and trusts in the state of Illinois. Understanding this form is essential for fiduciaries to ensure compliance with state tax laws and to accurately report the financial activities of the estate or trust.

How to use the Form IL 1041

Using the Form IL 1041 involves several steps to ensure accurate reporting of income and deductions. Fiduciaries must first gather all necessary financial information related to the estate or trust, including income from investments, rental properties, and any other sources. After compiling this information, the fiduciary completes the form by entering the relevant data in the designated fields. It is crucial to review the completed form for accuracy before submission to avoid penalties or delays.

Steps to complete the Form IL 1041

Completing the Form IL 1041 requires careful attention to detail. Here are the key steps involved:

- Gather financial documents: Collect all income statements, expense receipts, and other relevant financial records.

- Fill out the form: Input the necessary information, including the estate or trust's name, address, and taxpayer identification number.

- Report income: Detail all sources of income, including dividends, interest, and rental income.

- Claim deductions: Include any allowable deductions, such as administrative expenses and distributions to beneficiaries.

- Review and sign: Double-check all entries for accuracy and sign the form before submission.

Filing Deadlines / Important Dates

Filing deadlines for the Form IL 1041 are crucial for compliance. Generally, the form must be filed by the 15th day of the fourth month following the close of the estate's or trust's tax year. For estates and trusts operating on a calendar year basis, this typically means the deadline is April 15. Fiduciaries should also be aware of any extensions that may be available, as well as any specific dates for estimated tax payments if applicable.

Required Documents

To successfully complete the Form IL 1041, certain documents are required. These include:

- Income statements from all sources, such as W-2s, 1099s, and K-1s.

- Records of expenses incurred by the estate or trust.

- Documentation of distributions made to beneficiaries.

- Any prior year tax returns that may provide relevant information.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the Form IL 1041 can result in significant penalties. These may include fines for late filing, interest on unpaid taxes, and potential legal repercussions for fiduciaries who do not meet their obligations. It is important for fiduciaries to understand these penalties and take proactive steps to ensure timely and accurate filing.

Quick guide on how to complete form il 1041 illinois department of revenue

Effortlessly prepare Form IL 1041 Illinois Department Of Revenue on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly and without delays. Manage Form IL 1041 Illinois Department Of Revenue across any platform using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The easiest way to modify and electronically sign Form IL 1041 Illinois Department Of Revenue without hassle

- Find Form IL 1041 Illinois Department Of Revenue and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which is quick and holds the same legal standing as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form IL 1041 Illinois Department Of Revenue while ensuring exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form il 1041 illinois department of revenue

Create this form in 5 minutes!

How to create an eSignature for the form il 1041 illinois department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

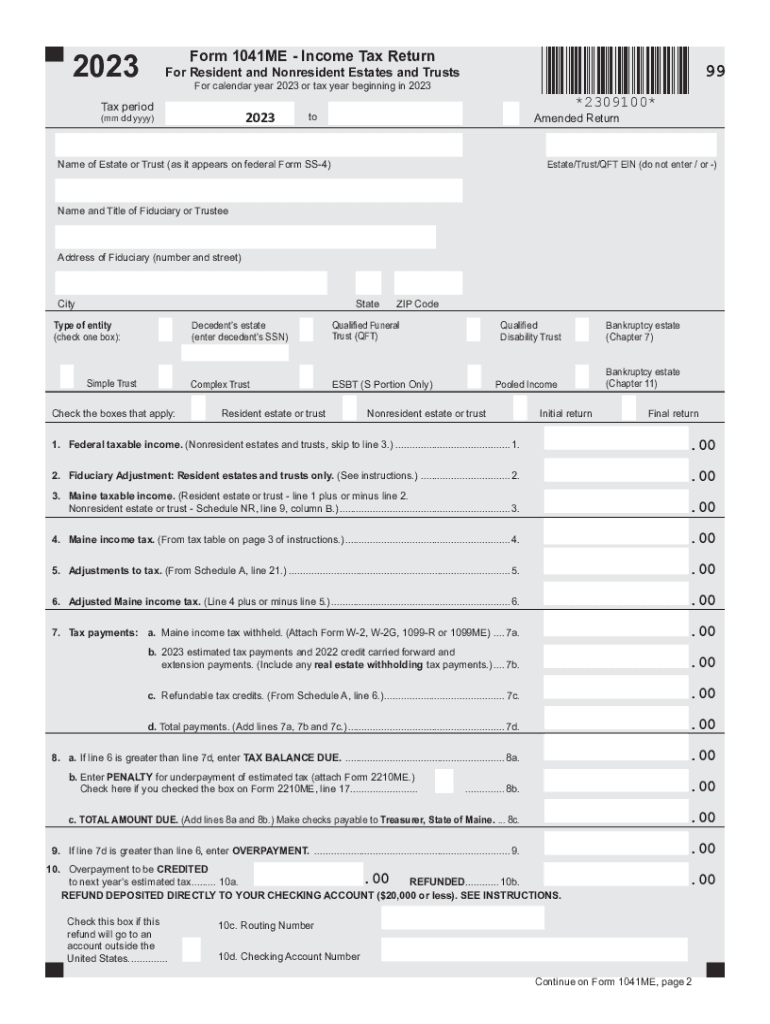

What is the Maine 1041ME form used for?

The Maine 1041ME form is an income tax return specifically for estates and trusts in Maine. It helps in reporting the income generated by the estate or trust, which is essential for tax compliance. By using airSlate SignNow, you can easily eSign and send your Maine 1041ME securely and efficiently.

-

How can airSlate SignNow help me with my Maine 1041ME documentation?

airSlate SignNow simplifies the process of preparing and submitting your Maine 1041ME form. With our easy-to-use platform, you can quickly generate, customize, and eSign your documents, ensuring that your tax filings are both accurate and timely. This streamlines your workflow and saves you valuable time.

-

What are the pricing plans available for using airSlate SignNow for Maine 1041ME?

airSlate SignNow offers a variety of pricing plans to suit different business needs, including options suitable for individual users and enterprises. Each plan provides access to features that can enhance your experience with documenting and eSigning the Maine 1041ME form. Explore our website for current pricing and find the plan that best fits your requirements.

-

Can I integrate airSlate SignNow with other applications for processing Maine 1041ME?

Yes, airSlate SignNow integrates seamlessly with various applications, including cloud storage and CRM systems. This allows you to streamline your processes for managing the Maine 1041ME form and other related documentation. With these integrations, you can enhance your productivity and keep all your files organized.

-

What are the benefits of using airSlate SignNow for Maine 1041ME eSigning?

Using airSlate SignNow for your Maine 1041ME eSigning offers numerous benefits, including enhanced security, reduced turnaround time, and improved accuracy. Our electronic signature technology is legally binding and simplifies the signing process, making tax submissions easier. This can lead to a more efficient workflow for you and your team.

-

Is airSlate SignNow compliant with Maine 1041ME regulations?

Yes, airSlate SignNow is compliant with federal and state regulations regarding electronic signatures. This ensures that when you sign your Maine 1041ME form using our platform, it meets the legal requirements necessary for tax submission. Feel confident that your documentation is secure and compliant with the law.

-

How does airSlate SignNow enhance collaboration on Maine 1041ME forms?

With airSlate SignNow, you can invite multiple parties to review and eSign the Maine 1041ME form, facilitating collaboration among stakeholders. Our platform provides real-time notifications and updates, so everyone stays informed throughout the process. This collaborative feature helps ensure that your tax documents are handled efficiently.

Get more for Form IL 1041 Illinois Department Of Revenue

- Of county idaho as my attorney in fact to act as form

- Control number id p011 pkg form

- Control number id p012 pkg form

- Identity theft idaho state tax commission form

- Section 39 4510idaho state legislature form

- Control number id p017 pkg form

- Control number id p020 pkg form

- Business formsidaho secretary of state

Find out other Form IL 1041 Illinois Department Of Revenue

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure