FORM 1041ME INCOME TAX RETURN for RESIDENT 2020

What is the 1041ME Income Tax Return for Residents?

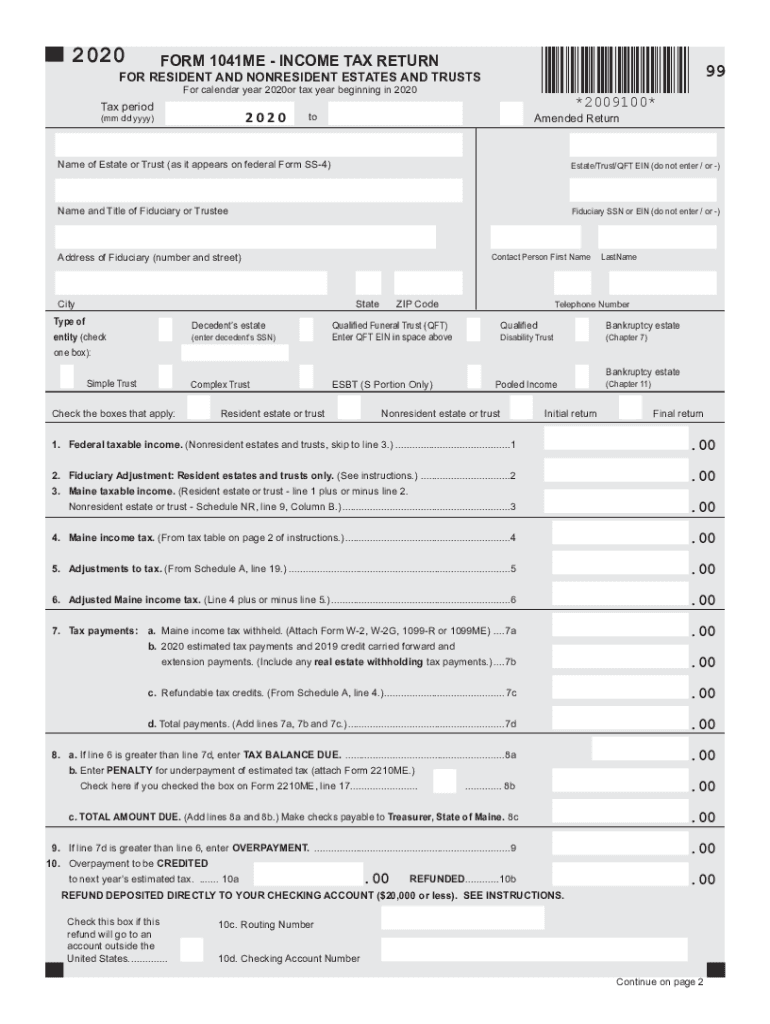

The 1041ME form is the Maine income tax return specifically designed for estates and trusts. This form is essential for reporting the income generated by these entities to the Maine Revenue Services. It allows fiduciaries to accurately report income, deductions, and credits, ensuring compliance with state tax laws. Understanding the purpose of the 1041ME is crucial for those managing estates or trusts, as it directly affects the tax obligations of the beneficiaries.

Key Elements of the 1041ME Income Tax Return

The 1041ME form includes several key components that must be completed to ensure accurate filing. These elements typically include:

- Income Reporting: Details of all income received by the estate or trust during the tax year.

- Deductions: Information on allowable deductions, such as administrative expenses and distributions to beneficiaries.

- Tax Computation: Calculation of the tax owed based on the net income reported.

- Signature Section: Required signatures of the fiduciary or authorized representative to validate the submission.

Steps to Complete the 1041ME Income Tax Return

Completing the 1041ME form involves several important steps to ensure accuracy and compliance. Here’s a step-by-step guide:

- Gather necessary documentation, including income statements and records of deductions.

- Complete the income section by reporting all relevant income sources for the estate or trust.

- Fill in the deductions section, ensuring all allowable expenses are accurately recorded.

- Calculate the total tax owed based on the net income.

- Review the form for completeness and accuracy before signing.

- Submit the completed form to the Maine Revenue Services by the specified deadline.

Legal Use of the 1041ME Income Tax Return

The 1041ME form holds legal significance as it is required for compliance with Maine tax laws. Filing this form correctly ensures that the fiduciary meets their legal obligations to report income and pay any taxes owed. Failure to file or inaccuracies in the form can lead to penalties and interest charges. Therefore, understanding the legal implications of the 1041ME is vital for fiduciaries managing estates and trusts.

Filing Deadlines for the 1041ME Income Tax Return

Timely filing of the 1041ME form is crucial to avoid penalties. The general deadline for submitting the 1041ME return is April fifteenth of the year following the tax year. If the fiduciary requires additional time, they may file for an extension, but it is important to note that any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Form Submission Methods for the 1041ME Income Tax Return

The 1041ME form can be submitted through various methods to accommodate different preferences. Options include:

- Online Submission: Utilizing the Maine Revenue Services e-filing system for a quicker processing time.

- Mail: Sending the completed form via postal service to the designated address provided by the Maine Revenue Services.

- In-Person: Delivering the form directly to a Maine Revenue Services office, if preferred.

Quick guide on how to complete 2020 form 1041me income tax return for resident

Complete FORM 1041ME INCOME TAX RETURN FOR RESIDENT effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the necessary tools to generate, modify, and electronically sign your documents quickly without delays. Manage FORM 1041ME INCOME TAX RETURN FOR RESIDENT on any device with the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to modify and electronically sign FORM 1041ME INCOME TAX RETURN FOR RESIDENT with ease

- Find FORM 1041ME INCOME TAX RETURN FOR RESIDENT and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or hide sensitive information using tools specifically offered by airSlate SignNow.

- Create your signature using the Sign feature, which only takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and electronically sign FORM 1041ME INCOME TAX RETURN FOR RESIDENT to ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 1041me income tax return for resident

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 1041me income tax return for resident

How to make an electronic signature for a PDF online

How to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What is 1041me and how does it work with airSlate SignNow?

1041me is a streamlined solution for filing your IRS Form 1041, designed to simplify tax preparation. With airSlate SignNow, you can easily eSign your 1041me documents, ensuring a secure and efficient filing process. The platform allows you to manage and track your documents seamlessly, improving your overall tax experience.

-

What features does airSlate SignNow offer for 1041me users?

airSlate SignNow provides a variety of features to enhance your 1041me experience, including template creation, secure cloud storage, and real-time collaboration. You can easily customize your 1041me documents for specific needs and ensure all parties can eSign quickly. Additionally, the platform's user-friendly interface makes it easy for anyone to navigate and utilize these features.

-

Is there a cost associated with using 1041me on airSlate SignNow?

Yes, while airSlate SignNow offers a free trial, there may be costs associated with subscription plans that include advanced features for 1041me. Pricing varies based on the features you choose and the number of users. It's best to explore the pricing plans on the airSlate website to find the one that fits your 1041me needs.

-

Can I integrate 1041me with other applications using airSlate SignNow?

Absolutely! airSlate SignNow supports integration with various applications that are beneficial for 1041me tasks. This includes popular services like Google Drive, Dropbox, and CRM systems, allowing you to seamlessly manage your documents and eSignatures in one place.

-

How can airSlate SignNow benefit my business when filing 1041me?

Using airSlate SignNow to file your 1041me can greatly streamline your document processes, saving time and reducing errors. The electronic signing feature accelerates the review and approval process, allowing you to focus more on your core business activities. This efficiency can help improve overall productivity and client satisfaction.

-

Is it secure to use airSlate SignNow for my 1041me documents?

Yes, security is a top priority at airSlate SignNow, especially for sensitive documents like 1041me forms. The platform employs advanced encryption protocols and adheres to compliance regulations to protect your data. You can trust that your eSigned documents are safe and secure at all times.

-

What is the customer support like for airSlate SignNow users of 1041me?

airSlate SignNow provides robust customer support for users, including those utilizing the platform for 1041me. You can access various resources, such as FAQs, video tutorials, and a dedicated support team ready to assist you with your inquiries. This ensures you have the help you need to optimize your use of 1041me.

Get more for FORM 1041ME INCOME TAX RETURN FOR RESIDENT

- Sterling bank dispense error form

- Polhn online courses form

- Change of grade form

- San diego quick assessment record form

- Ii ii ii ii i 111111111111111 form

- Identification number legal business or tax wv gov form

- Annexure s5 covering letter for subscriber registration form

- Korle bu teaching hospital kbth irb consent form

Find out other FORM 1041ME INCOME TAX RETURN FOR RESIDENT

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors