Fill IoFORM 103 SHORT BUSINESS TANGIBLEFill Fillable FORM 103 SHORT BUSINESS TANGIBLE 2022

Understanding Indiana Form 11274

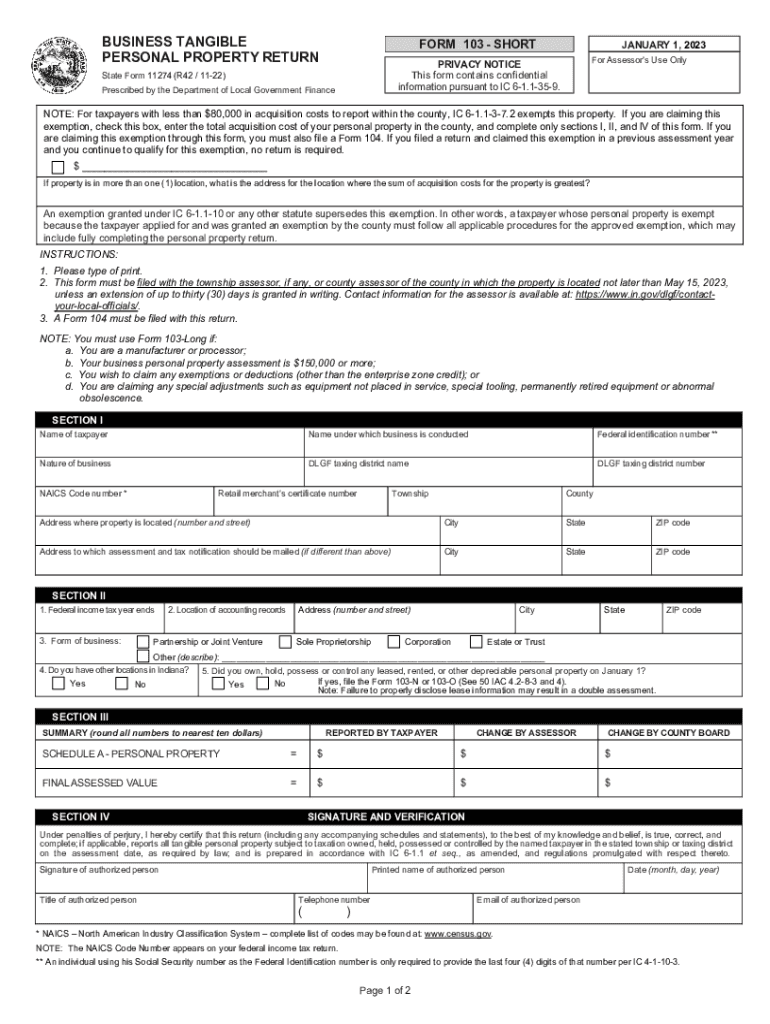

Indiana Form 11274, commonly known as the property return, is essential for property owners in Indiana. This form is used to report property assessments to the local tax authorities. By accurately completing this form, property owners ensure that their property is assessed fairly, which can affect property taxes. Understanding the requirements and implications of the form is crucial for compliance and financial planning.

Steps to Complete Indiana Form 11274

Filling out Indiana Form 11274 involves several key steps:

- Gather necessary information, including property details and ownership documentation.

- Access the form, which is available in both printable and digital formats.

- Fill in the required fields, ensuring accuracy in property descriptions and values.

- Review the completed form for any errors or omissions.

- Submit the form to the appropriate local tax authority, either online or via mail.

Legal Use of Indiana Form 11274

The legal use of Indiana Form 11274 is grounded in state property tax regulations. This form serves as an official declaration of property ownership and value, which local authorities use to determine tax liabilities. Proper completion of the form is necessary to avoid penalties and ensure compliance with state laws.

Filing Deadlines for Indiana Form 11274

It is important to be aware of the filing deadlines associated with Indiana Form 11274. Typically, property owners must submit the form by a specific date each year, often aligned with local tax assessment schedules. Missing the deadline can result in penalties or inaccurate assessments, impacting property tax obligations.

Required Documents for Indiana Form 11274

When completing Indiana Form 11274, property owners should have several documents ready:

- Proof of property ownership, such as a deed or title.

- Previous property tax statements for reference.

- Any documentation related to property improvements or changes.

Form Submission Methods for Indiana Form 11274

Indiana Form 11274 can be submitted through various methods, providing flexibility for property owners:

- Online submission via the Indiana Department of Revenue's website.

- Mailing the completed form to the local tax authority.

- In-person submission at designated local government offices.

Quick guide on how to complete fillioform 103 short business tangiblefill free fillable form 103 short business tangible

Complete Fill ioFORM 103 SHORT BUSINESS TANGIBLEFill Fillable FORM 103 SHORT BUSINESS TANGIBLE effortlessly on any device

Managing documents online has become increasingly favored by both businesses and individuals. It offers an ideal environmentally friendly solution to traditional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without any delays. Manage Fill ioFORM 103 SHORT BUSINESS TANGIBLEFill Fillable FORM 103 SHORT BUSINESS TANGIBLE on any device with airSlate SignNow apps available for Android or iOS, and enhance any document-related process today.

The simplest way to modify and eSign Fill ioFORM 103 SHORT BUSINESS TANGIBLEFill Fillable FORM 103 SHORT BUSINESS TANGIBLE with ease

- Locate Fill ioFORM 103 SHORT BUSINESS TANGIBLEFill Fillable FORM 103 SHORT BUSINESS TANGIBLE and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight key sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and has the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Fill ioFORM 103 SHORT BUSINESS TANGIBLEFill Fillable FORM 103 SHORT BUSINESS TANGIBLE and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillioform 103 short business tangiblefill free fillable form 103 short business tangible

Create this form in 5 minutes!

People also ask

-

What is state form 11274 and how does it relate to airSlate SignNow?

State form 11274 is a specific document that can be efficiently managed using airSlate SignNow. Our platform allows users to upload, send, and eSign this form seamlessly, ensuring compliance and efficiency in handling important paperwork.

-

How much does it cost to use airSlate SignNow for state form 11274?

airSlate SignNow offers competitive pricing plans that cater to various business needs. The costs start at a low monthly fee, ensuring that you can manage state form 11274 and other documents affordably without compromising on features.

-

What features does airSlate SignNow provide for state form 11274?

With airSlate SignNow, you can easily create, send, and eSign state form 11274, among other documents. Our platform offers customizable templates, workflow automation, and secure storage, making document management straightforward and efficient.

-

Can I track the status of my state form 11274 with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for your state form 11274. You will receive notifications at every stage of the signing process, allowing you to stay updated on its progress and ensure timely completion.

-

Is airSlate SignNow compliant with legal standards for state form 11274?

Absolutely! airSlate SignNow is compliant with the necessary legal standards, ensuring that the eSignature process for state form 11274 holds up in court. Our platform uses advanced security features to protect your documents and maintain their integrity.

-

What are the benefits of using airSlate SignNow for state form 11274?

Using airSlate SignNow for state form 11274 enhances efficiency by reducing paperwork and speeding up the signing process. This cost-effective solution improves your workflow and allows you to manage documents anywhere, anytime.

-

What integrations does airSlate SignNow offer for managing state form 11274?

airSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage state form 11274 efficiently. You can easily connect it with applications like Google Drive, Salesforce, and more to centralize your document management efforts.

Get more for Fill ioFORM 103 SHORT BUSINESS TANGIBLEFill Fillable FORM 103 SHORT BUSINESS TANGIBLE

- Nv landlord notice form

- Letter from tenant to landlord about sexual harassment nevada form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children nevada form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure nevada form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497320660 form

- Letter from tenant to landlord for failure of landlord to return all prepaid and unearned rent and security recoverable by 497320661 form

- Nevada codes form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497320663 form

Find out other Fill ioFORM 103 SHORT BUSINESS TANGIBLEFill Fillable FORM 103 SHORT BUSINESS TANGIBLE

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement