BUSINESS TANGIBLE PERSONAL PROPERTY 2024-2026

Understanding Business Tangible Personal Property

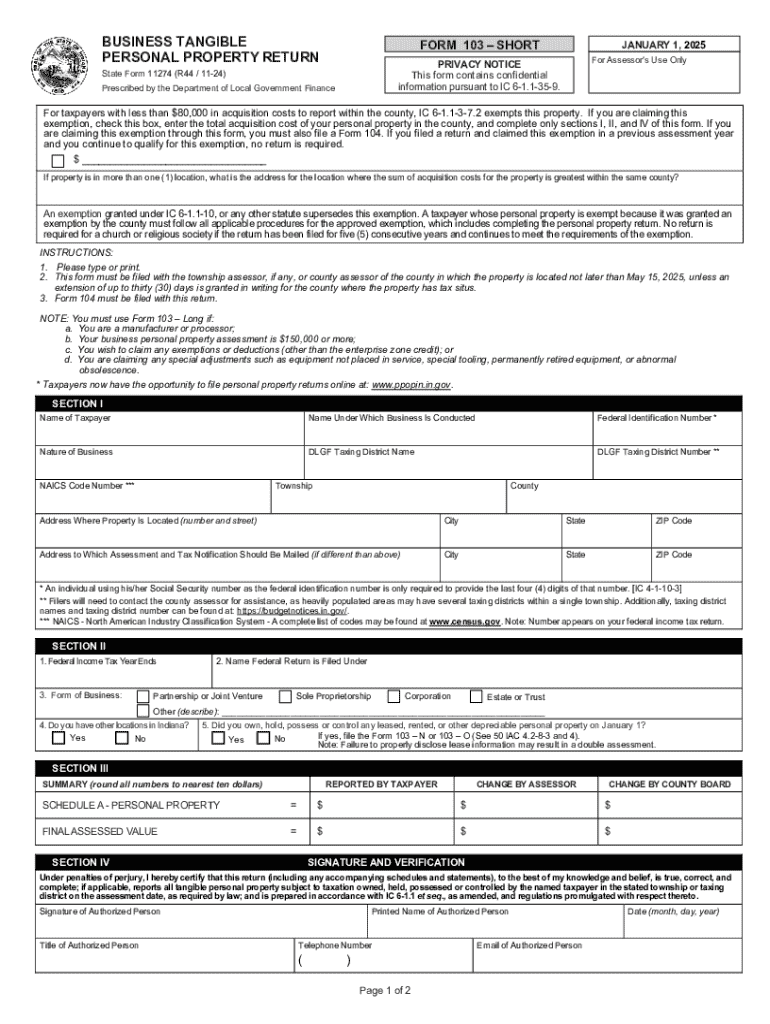

Business Tangible Personal Property refers to physical items owned by a business that are used in the operation of that business. This includes machinery, equipment, furniture, and fixtures. In Indiana, these assets are subject to property tax assessment, which means accurate reporting is essential for compliance with state tax laws.

Steps to Complete the Indiana Form 11274

Completing the Indiana Form 11274 involves several key steps. First, gather all necessary information regarding your business tangible personal property, including acquisition dates, costs, and current values. Next, fill out the form with accurate details about each asset. It is important to ensure that all sections are completed to avoid delays. After completing the form, review it for accuracy before submitting it to the appropriate local assessing official.

Legal Use of the Indiana Form 11274

The Indiana Form 11274 is legally required for businesses to report their tangible personal property to local authorities. This form helps ensure that businesses are compliant with state tax regulations. Failing to file the form or providing inaccurate information can lead to penalties and additional tax liabilities. Understanding the legal implications of this form is crucial for maintaining compliance.

Filing Deadlines and Important Dates

It is vital to be aware of the filing deadlines associated with the Indiana Form 11274. Typically, the form must be filed annually by May 15. Missing this deadline can result in penalties, including late fees or increased assessments. Keeping track of important dates ensures that your business remains compliant and avoids unnecessary financial burdens.

Required Documents for Submission

When completing the Indiana Form 11274, certain documents may be required to support your asset declarations. This includes purchase invoices, asset depreciation schedules, and any previous tax assessments. Having these documents readily available can streamline the filing process and help substantiate the values reported on the form.

Form Submission Methods

The Indiana Form 11274 can be submitted in various ways, including online, by mail, or in person. For online submissions, check with your local assessing office for available electronic filing options. If submitting by mail, ensure the form is sent to the correct address and consider using certified mail for tracking. In-person submissions may require an appointment, so it is advisable to contact the local office beforehand.

Penalties for Non-Compliance

Non-compliance with the filing requirements of the Indiana Form 11274 can lead to significant penalties. These may include fines, increased property assessments, and interest on unpaid taxes. Understanding these potential consequences highlights the importance of timely and accurate filing, ensuring that businesses remain in good standing with tax authorities.

Create this form in 5 minutes or less

Find and fill out the correct business tangible personal property

Create this form in 5 minutes!

How to create an eSignature for the business tangible personal property

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Indiana Form 11274?

The Indiana Form 11274 is a tax form used by businesses in Indiana to report certain financial information. It is essential for compliance with state tax regulations. Understanding how to fill out the Indiana Form 11274 correctly can help avoid penalties and ensure timely submissions.

-

How can airSlate SignNow help with the Indiana Form 11274?

airSlate SignNow simplifies the process of completing and eSigning the Indiana Form 11274. With our platform, you can easily upload, fill out, and send the form securely. This streamlines your workflow and ensures that your documents are handled efficiently.

-

What are the pricing options for using airSlate SignNow for the Indiana Form 11274?

airSlate SignNow offers various pricing plans to suit different business needs. Our plans are cost-effective and provide access to features that facilitate the completion of the Indiana Form 11274. You can choose a plan that fits your budget while ensuring compliance with state requirements.

-

Are there any features specifically designed for the Indiana Form 11274?

Yes, airSlate SignNow includes features tailored for the Indiana Form 11274, such as customizable templates and automated reminders. These features help ensure that you never miss a deadline and that your forms are completed accurately. Our platform is designed to enhance your document management experience.

-

Can I integrate airSlate SignNow with other software for the Indiana Form 11274?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, making it easy to manage the Indiana Form 11274 alongside your other business tools. This integration helps streamline your processes and enhances productivity by allowing you to work within your preferred systems.

-

What are the benefits of using airSlate SignNow for the Indiana Form 11274?

Using airSlate SignNow for the Indiana Form 11274 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to eSign documents quickly and securely, ensuring that your submissions are both timely and compliant with state regulations.

-

Is airSlate SignNow user-friendly for completing the Indiana Form 11274?

Yes, airSlate SignNow is designed with user-friendliness in mind. Our intuitive interface makes it easy for anyone to navigate and complete the Indiana Form 11274 without extensive training. You can quickly learn how to use our platform to manage your documents effectively.

Get more for BUSINESS TANGIBLE PERSONAL PROPERTY

Find out other BUSINESS TANGIBLE PERSONAL PROPERTY

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word