Indiana Form 103 2012

What is the Indiana Form 103?

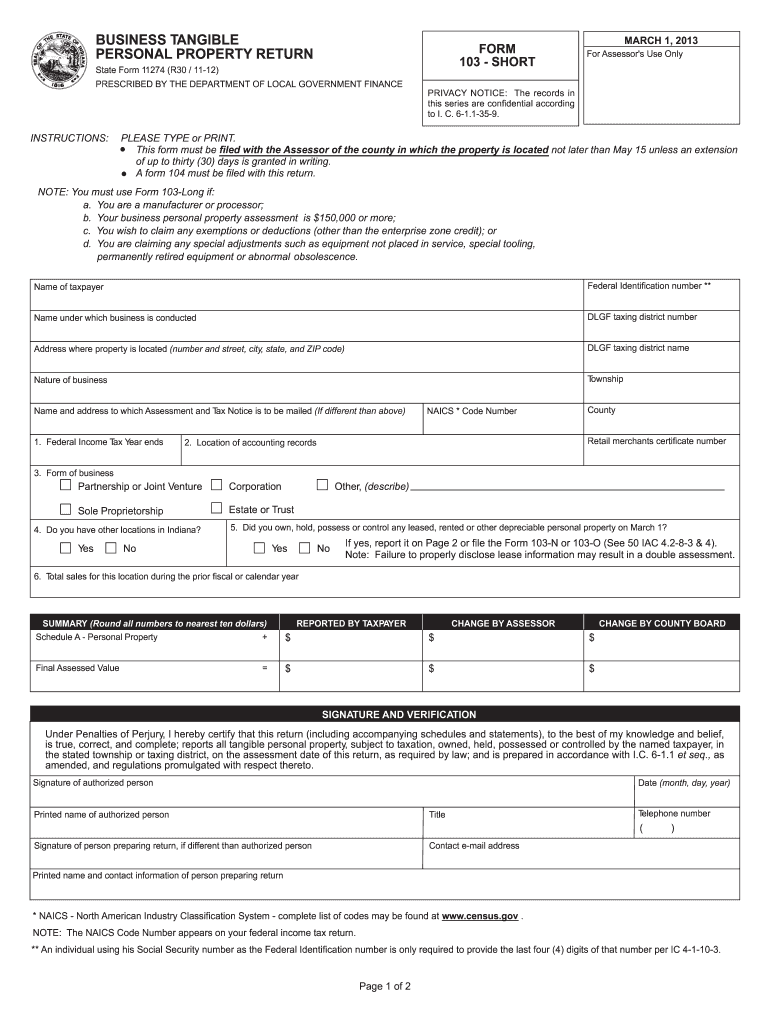

The Indiana Form 103, also known as the business tangible personal property return form 103 short, is a crucial document for businesses operating in Indiana. This form is used to report tangible personal property owned by businesses for tax purposes. Tangible personal property includes items such as machinery, equipment, furniture, and other physical assets that are not real estate. Filing this form accurately ensures compliance with Indiana tax laws and helps determine the assessed value of a business's personal property.

Steps to complete the Indiana Form 103

Completing the Indiana Form 103 involves several key steps to ensure accuracy and compliance. Here is a simplified process:

- Gather necessary information about your business assets, including descriptions, purchase dates, and values.

- Access the Indiana Form 103 through the Indiana Department of Local Government Finance website or other authorized sources.

- Fill out the form, ensuring all sections are completed with accurate and up-to-date information.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either electronically or via mail, depending on your preference.

Legal use of the Indiana Form 103

The Indiana Form 103 must be used in accordance with state laws governing personal property taxation. It is essential for businesses to understand the legal implications of submitting this form. Accurate reporting is critical, as discrepancies can lead to penalties or audits. The form serves as a legal declaration of the business's assets and their values, which are used by the state to assess property taxes. Compliance with the filing requirements ensures that businesses maintain good standing with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Indiana Form 103 are typically set annually. Businesses are required to submit their forms by May 15 of each year. It is important to be aware of any extensions or changes to these deadlines, as late submissions can result in penalties. Keeping track of these dates helps ensure that businesses remain compliant and avoid unnecessary fines.

Form Submission Methods (Online / Mail / In-Person)

Businesses have multiple options for submitting the Indiana Form 103. The form can be filed electronically through the Indiana Department of Local Government Finance's online portal, which is often the most efficient method. Alternatively, businesses may choose to print the completed form and submit it via mail. In-person submissions may also be accepted at designated state offices. Each method has its own advantages, and businesses should select the one that best suits their needs.

Key elements of the Indiana Form 103

The Indiana Form 103 includes several key elements that must be completed for accurate reporting. These elements typically include:

- Business identification information, such as name, address, and tax identification number.

- A detailed list of tangible personal property, including descriptions and values.

- Declarations regarding any exemptions or special circumstances that may apply.

- Signature and date fields to certify the accuracy of the information provided.

Quick guide on how to complete indiana form 103

Complete Indiana Form 103 effortlessly on any device

Online document management has gained popularity among companies and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, enabling you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Indiana Form 103 on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Indiana Form 103 with ease

- Find Indiana Form 103 and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize relevant parts of the documents or obscure sensitive details using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, laborious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Indiana Form 103 and ensure clear communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct indiana form 103

Create this form in 5 minutes!

How to create an eSignature for the indiana form 103

The way to generate an eSignature for a PDF online

The way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

The way to generate an eSignature for a PDF on Android

People also ask

-

What is the purpose of the business tangible personal property return form 103 short?

The business tangible personal property return form 103 short is used to report the value of personal property owned by a business to tax authorities. This simplified form helps streamline the reporting process, allowing businesses to comply with tax regulations efficiently.

-

How does airSlate SignNow help with the business tangible personal property return form 103 short?

airSlate SignNow simplifies the completion and submission of the business tangible personal property return form 103 short by providing an intuitive eSigning platform. Users can easily fill out the form, obtain necessary signatures, and submit it electronically, ensuring a faster and more efficient process.

-

What features does airSlate SignNow offer for managing forms like the business tangible personal property return form 103 short?

airSlate SignNow offers features such as customizable templates, secure cloud storage, and collaborative editing, tailored specifically for forms like the business tangible personal property return form 103 short. These features enhance usability, allowing teams to work together seamlessly.

-

Is airSlate SignNow cost-effective for small businesses needing the business tangible personal property return form 103 short?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses managing forms like the business tangible personal property return form 103 short. With its flexible pricing plans, businesses can choose a solution that fits their budget while streamlining their document processes.

-

Can I integrate airSlate SignNow with my existing systems for the business tangible personal property return form 103 short?

Absolutely! airSlate SignNow offers various integration options with popular software and platforms, making it easy to incorporate the business tangible personal property return form 103 short into your existing workflows. This integration helps maximize efficiency and minimize disruptions.

-

How secure is the process of using airSlate SignNow for the business tangible personal property return form 103 short?

Security is a top priority at airSlate SignNow. When using the business tangible personal property return form 103 short, users can trust that their documents are protected with industry-standard encryption, ensuring sensitive business information remains confidential and secure.

-

What are the benefits of using airSlate SignNow for the business tangible personal property return form 103 short submissions?

Using airSlate SignNow for the business tangible personal property return form 103 short provides several benefits, including reduced processing times, improved accuracy, and enhanced compliance with tax regulations. This leads to fewer errors and a smoother submission process overall.

Get more for Indiana Form 103

- I n st r u ct ion s th is w or k she e t is de sign e d t o be u se d by pe r son s con t e m pla t in g a divor ce form

- Pennsylvania deed formsquit claim warranty and special

- Grantor does hereby remise release and forever quitclaim and by these presents do remise release form

- Warranty deed south carolina bar form

- Sample llc operating agreement everything you need to know form

- Executory contracts in texas real estate lone star land law form

- Correction deed 481372329 form

- Estate to five 5 individual beneficiaries form

Find out other Indiana Form 103

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later