Www Taxformfinder Orgindianaform 103 ShortIndiana Form 103 Short Business Tangible Personal Property 2021

Understanding the Indiana Form 103 Short

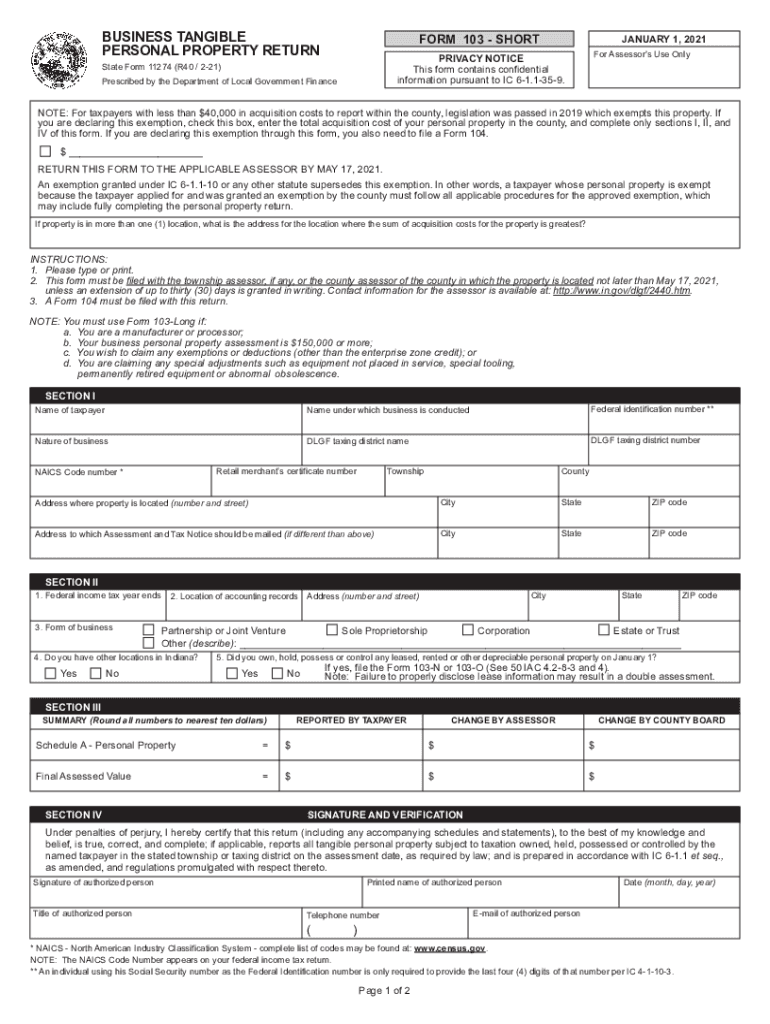

The Indiana Form 103 Short is a tax document used for reporting tangible personal property owned by businesses in Indiana. This form is essential for businesses to declare their property and ensure compliance with state tax regulations. It is specifically designed for businesses that qualify under certain criteria, allowing for a simplified reporting process compared to the longer Form 103. The primary purpose of the form is to assess the value of personal property for taxation, which can include equipment, machinery, and other business assets.

Steps to Complete the Indiana Form 103 Short

Completing the Indiana Form 103 Short involves several steps to ensure accuracy and compliance. First, gather all necessary information about your tangible personal property, including descriptions, purchase dates, and values. Next, fill out the form by providing details such as your business name, address, and the specific property information. Be sure to follow the instructions carefully, as inaccuracies can lead to penalties. Finally, review your completed form for any errors before submitting it to the appropriate county assessor's office by the deadline.

Legal Use of the Indiana Form 103 Short

The Indiana Form 103 Short serves a legal purpose in the assessment of property taxes. By accurately completing and submitting this form, businesses fulfill their legal obligation to report their tangible personal property. This compliance is critical, as failure to submit the form or providing false information can result in penalties, including fines or increased tax assessments. Understanding the legal implications of the form helps businesses maintain good standing with state tax authorities.

Required Documents for Filing the Indiana Form 103 Short

When filing the Indiana Form 103 Short, certain documents may be required to support your claims. These documents can include purchase receipts, previous tax returns, and any relevant financial records that detail the value and ownership of the tangible personal property. Having these documents on hand can streamline the filing process and help ensure that your property is accurately assessed for tax purposes.

Filing Deadlines for the Indiana Form 103 Short

It is important to be aware of the filing deadlines associated with the Indiana Form 103 Short. Typically, the form must be submitted annually by May 15. Missing this deadline can result in penalties or complications with your property tax assessment. Businesses should mark this date on their calendars and prepare their documentation in advance to avoid any last-minute issues.

Who Issues the Indiana Form 103 Short

The Indiana Form 103 Short is issued by the Indiana Department of Local Government Finance (DLGF). This agency oversees the assessment and taxation of personal property in the state. By providing this form, the DLGF facilitates the reporting process for businesses, ensuring that they comply with state regulations regarding property taxes.

Quick guide on how to complete wwwtaxformfinderorgindianaform 103 shortindiana form 103 short business tangible personal property

Prepare Www taxformfinder orgindianaform 103 shortIndiana Form 103 Short Business Tangible Personal Property seamlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and efficiently. Manage Www taxformfinder orgindianaform 103 shortIndiana Form 103 Short Business Tangible Personal Property on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to adjust and eSign Www taxformfinder orgindianaform 103 shortIndiana Form 103 Short Business Tangible Personal Property effortlessly

- Find Www taxformfinder orgindianaform 103 shortIndiana Form 103 Short Business Tangible Personal Property and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Adjust and eSign Www taxformfinder orgindianaform 103 shortIndiana Form 103 Short Business Tangible Personal Property and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwtaxformfinderorgindianaform 103 shortindiana form 103 short business tangible personal property

Create this form in 5 minutes!

How to create an eSignature for the wwwtaxformfinderorgindianaform 103 shortindiana form 103 short business tangible personal property

How to generate an electronic signature for a PDF file online

How to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to generate an e-signature straight from your mobile device

How to make an e-signature for a PDF file on iOS

The way to generate an e-signature for a PDF document on Android devices

People also ask

-

What is the form 103 short and its primary use?

The form 103 short is a simplified document designed for easy completion and submission. It allows users to provide essential information without the complexity often associated with longer forms. Businesses across various sectors utilize the form 103 short to streamline their documentation processes.

-

How does airSlate SignNow support the form 103 short?

airSlate SignNow provides an intuitive platform that facilitates the eSigning and sharing of the form 103 short. Users can easily upload the form, add recipient signatures, and send it for completion, ensuring a fast and efficient workflow. This solution minimizes paperwork and allows for quicker response times.

-

What are the pricing options for using airSlate SignNow with the form 103 short?

airSlate SignNow offers flexible pricing plans tailored to suit different business needs when using the form 103 short. Customers can choose from monthly or annual subscriptions, benefiting from a cost-effective solution that ensures unlimited access to essential features. Check our pricing page for the latest offers and information.

-

Can the form 103 short be integrated with other applications?

Yes, the form 103 short can be easily integrated with a variety of applications and platforms through airSlate SignNow. This functionality enables users to automate workflows and ensure seamless data transfer. Integrations enhance the overall efficiency of managing documents and completing forms.

-

What features make airSlate SignNow the best choice for the form 103 short?

airSlate SignNow includes features like customizable templates, advanced security measures, and real-time tracking that enhance the workflow for the form 103 short. Users can create templates specific to their needs, ensuring a smooth and secure signing experience. These features contribute to efficiency and improved user satisfaction.

-

How can I ensure the security of my form 103 short with airSlate SignNow?

airSlate SignNow prioritizes security, implementing robust encryption and authentication features to protect your form 103 short. Users can share documents confidently, knowing that their sensitive information is safeguarded against unauthorized access. The platform also allows for audit trails and secure document management.

-

Is there a mobile app for managing the form 103 short?

Absolutely! airSlate SignNow offers a mobile app that enables users to manage the form 103 short on the go. This mobile solution allows you to create, sign, and send documents from any device, making it convenient for busy professionals who require flexibility in their workflow.

Get more for Www taxformfinder orgindianaform 103 shortIndiana Form 103 Short Business Tangible Personal Property

- Revocation of general durable power of attorney arkansas form

- Essential legal life documents for newlyweds arkansas form

- Ar legal documents form

- Essential legal life documents for new parents arkansas form

- Arkansas custody child form

- Small business accounting package arkansas form

- Company employment policies and procedures package arkansas form

- Revocation power attorney 497296672 form

Find out other Www taxformfinder orgindianaform 103 shortIndiana Form 103 Short Business Tangible Personal Property

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now