State Form 11274 Indiana 2019

What is the State Form 11274 Indiana

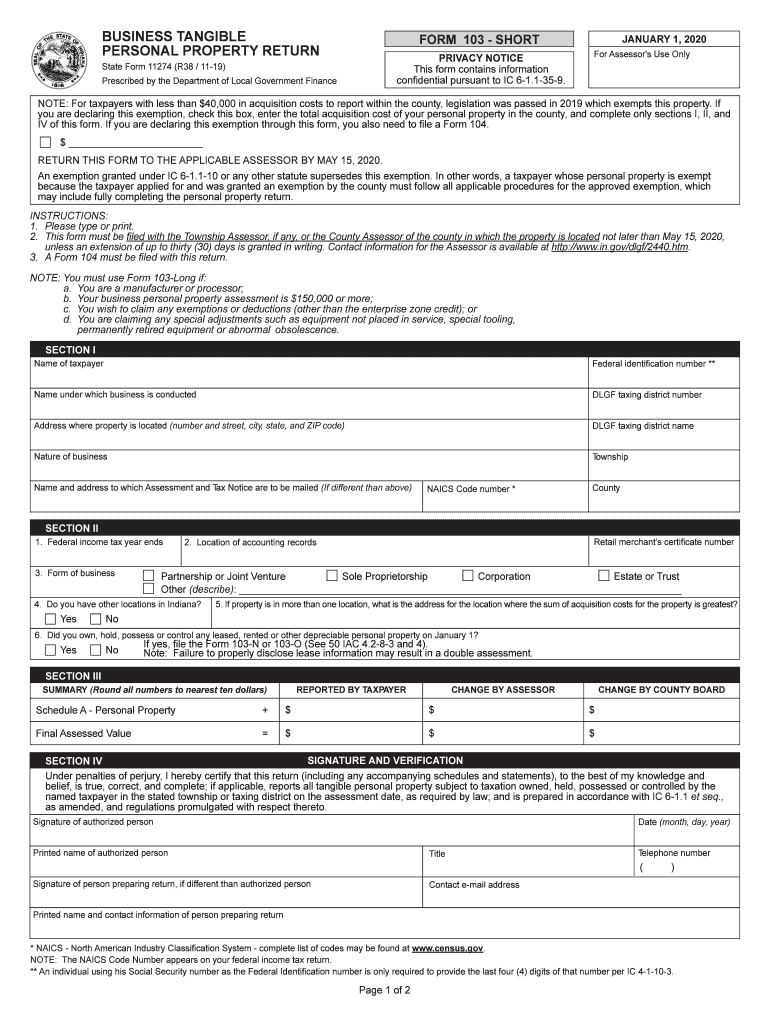

The State Form 11274, also known as the Indiana Property Return Form, is a document used by businesses and individuals to report personal property for tax purposes in the state of Indiana. This form is essential for ensuring compliance with local tax regulations, as it provides the necessary information regarding the value and type of personal property owned. The data collected through this form helps local governments assess property taxes accurately.

How to use the State Form 11274 Indiana

Using the State Form 11274 involves several steps to ensure that all required information is accurately reported. First, gather all relevant details about your personal property, including descriptions, values, and any applicable exemptions. Next, fill out the form carefully, ensuring that all sections are completed. After completing the form, review it for accuracy before submitting it to the appropriate local tax authority. This form can be submitted either online or via traditional mail, depending on local regulations.

Steps to complete the State Form 11274 Indiana

Completing the State Form 11274 involves a systematic approach:

- Gather necessary documents that detail your personal property, such as purchase receipts and previous tax returns.

- Provide accurate descriptions of each item of personal property, including its location and estimated value.

- Complete all sections of the form, ensuring that no fields are left blank.

- Double-check the information for any errors or omissions.

- Submit the form by the designated deadline to avoid penalties.

Legal use of the State Form 11274 Indiana

The State Form 11274 is legally binding when completed and submitted in accordance with Indiana tax laws. It is crucial to provide truthful and accurate information, as any discrepancies can lead to legal repercussions, including fines or audits. The form must be submitted to the local tax authority to ensure compliance with state regulations regarding personal property taxation.

Filing Deadlines / Important Dates

Filing deadlines for the State Form 11274 vary depending on local tax regulations. Typically, the form must be submitted by a specific date each year, often coinciding with the annual tax assessment period. It is important to check with your local tax authority for the exact deadlines to avoid late filing penalties. Mark these dates on your calendar to ensure timely submission.

Required Documents

When completing the State Form 11274, certain documents are required to support your claims. These may include:

- Purchase receipts for personal property items.

- Previous tax returns that document the value of property.

- Any exemption certificates that may apply to your property.

Having these documents ready will facilitate a smoother completion process and help ensure compliance with local tax laws.

Quick guide on how to complete in form 11274 2019

Complete State Form 11274 Indiana effortlessly on any device

Managing documents online has gained traction among companies and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed papers, as you can access the correct format and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without hindrance. Manage State Form 11274 Indiana on any device with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign State Form 11274 Indiana with ease

- Locate State Form 11274 Indiana and then click Get Form to begin.

- Utilize the resources we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in a few clicks from any device of your choice. Modify and eSign State Form 11274 Indiana and ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct in form 11274 2019

Create this form in 5 minutes!

How to create an eSignature for the in form 11274 2019

How to generate an electronic signature for your In Form 11274 2019 in the online mode

How to generate an electronic signature for the In Form 11274 2019 in Google Chrome

How to create an eSignature for signing the In Form 11274 2019 in Gmail

How to create an eSignature for the In Form 11274 2019 from your smartphone

How to generate an eSignature for the In Form 11274 2019 on iOS

How to create an eSignature for the In Form 11274 2019 on Android OS

People also ask

-

What is the state of Indiana form 11274?

The state of Indiana form 11274 is a specific document used for reporting various tax-related information to the Indiana Department of Revenue. It is essential for ensuring accurate tax compliance for businesses operating within Indiana. Understanding how to complete and submit this form can signNowly impact your business's tax obligations.

-

How can airSlate SignNow assist with the state of Indiana form 11274?

airSlate SignNow streamlines the process of sending and eSigning the state of Indiana form 11274. With our user-friendly platform, you can easily fill out the form and share it with clients or colleagues for signatures electronically. This ensures that your documents are processed quickly and efficiently, reducing the risk of delays.

-

Is there a cost associated with using airSlate SignNow for the state of Indiana form 11274?

Yes, using airSlate SignNow involves a subscription fee, which offers various pricing plans to fit different business needs. Our cost-effective solution delivers great value by saving time and reducing paperwork, especially when dealing with documents like the state of Indiana form 11274. You'll find that investing in our service can ultimately save you money in the long run.

-

What features does airSlate SignNow offer for completing the state of Indiana form 11274?

airSlate SignNow offers features such as customizable templates, electronic signature capabilities, and document tracking to facilitate the completion of the state of Indiana form 11274. These tools help ensure that your documents are correctly filled out and securely signed. Additionally, our platform is designed to be intuitive, making it easy for all users to navigate.

-

Can I integrate airSlate SignNow with other applications for handling the state of Indiana form 11274?

Absolutely! airSlate SignNow offers numerous integrations with popular applications, allowing you to manage your workflows seamlessly when handling the state of Indiana form 11274. Whether you're using CRM systems, cloud storage, or accounting software, our platform can help you streamline processes and improve efficiency.

-

What are the benefits of using airSlate SignNow for the state of Indiana form 11274?

Using airSlate SignNow for the state of Indiana form 11274 offers numerous benefits, including increased efficiency, improved accuracy, and enhanced security for your documents. Our eSigning process accelerates the completion of forms while reducing the likelihood of errors. Additionally, your sensitive data is protected with top-notch security measures.

-

How does eSigning the state of Indiana form 11274 work with airSlate SignNow?

ESigning the state of Indiana form 11274 with airSlate SignNow is straightforward. After filling out the form, simply send it to the required signatories via our platform, where they can review and sign electronically. This process is not only faster than traditional methods but also provides a secure record of all transactions.

Get more for State Form 11274 Indiana

Find out other State Form 11274 Indiana

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free