Forms & Publications NM Taxation and Revenue Department 2020

Understanding the NM Form PIT 1 Reference Instructions

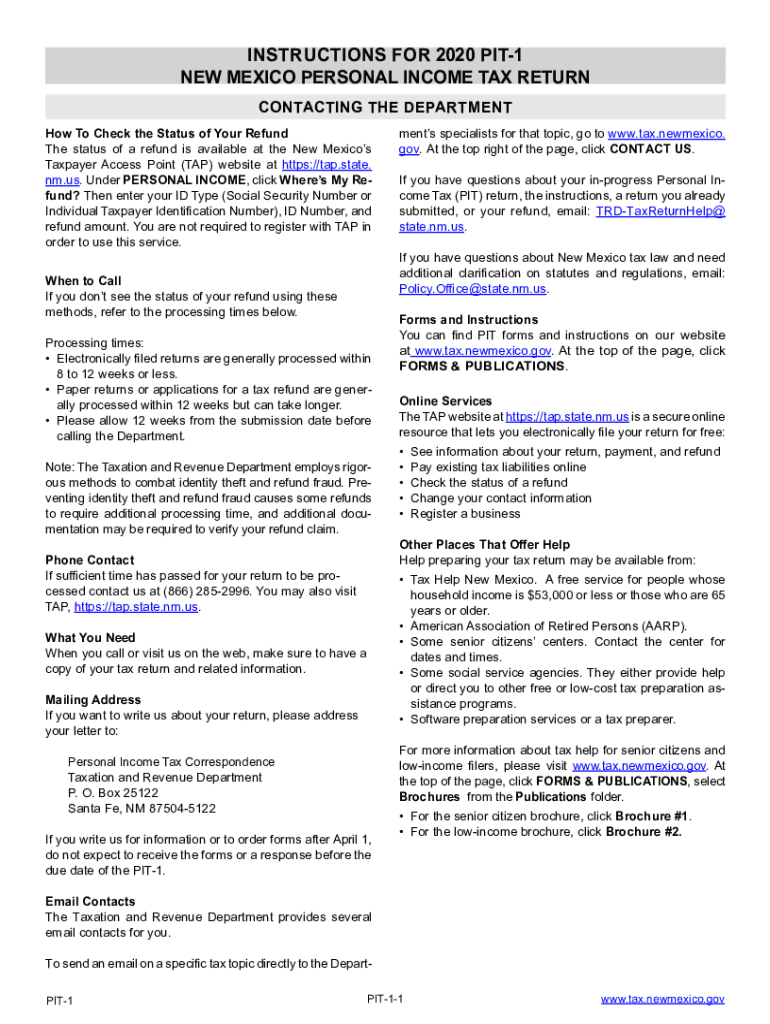

The NM Form PIT 1 reference instructions are essential for individuals and businesses in New Mexico to accurately report their personal income taxes. This form is used to calculate the state income tax owed based on various income sources. Familiarizing yourself with the specific requirements and sections of the PIT 1 can help ensure compliance with state regulations.

Steps to Complete the NM Form PIT 1

Completing the NM Form PIT 1 involves several key steps:

- Gather necessary documentation, including W-2s and 1099s, to report all sources of income.

- Fill out personal information, such as your name, address, and Social Security number.

- Report your total income, including wages, interest, dividends, and any other taxable income.

- Calculate your deductions and exemptions to determine your taxable income.

- Apply the appropriate tax rates to your taxable income to calculate your total tax liability.

- Complete any additional schedules or forms as required, depending on your tax situation.

Legal Use of the NM Form PIT 1

The NM Form PIT 1 is legally binding when completed accurately and submitted on time. It is essential to ensure that all information is truthful and complies with the New Mexico Taxation and Revenue Department's guidelines. Misrepresentation or errors can lead to penalties or legal consequences. Utilizing a reliable electronic signature solution can enhance the security and legitimacy of your submission.

Filing Deadlines for the NM Form PIT 1

Filing deadlines for the NM Form PIT 1 are crucial for compliance. Typically, the form must be submitted by April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check for any updates or changes to filing deadlines each tax season to avoid late fees or penalties.

Form Submission Methods for the NM Form PIT 1

The NM Form PIT 1 can be submitted through various methods:

- Online: Use the New Mexico Taxation and Revenue Department's online portal to file electronically.

- Mail: Send the completed form to the appropriate address provided in the instructions.

- In-Person: Visit your local Taxation and Revenue Department office to submit the form directly.

Key Elements of the NM Form PIT 1

Understanding the key elements of the NM Form PIT 1 is essential for accurate completion:

- Personal Information: This section requires your name, address, and Social Security number.

- Income Reporting: Report all sources of income, including wages and investment income.

- Deductions and Credits: Identify any deductions or credits you may qualify for to reduce your taxable income.

- Signature: Ensure you sign and date the form to validate your submission.

Quick guide on how to complete forms ampamp publications nm taxation and revenue department

Effortlessly prepare Forms & Publications NM Taxation And Revenue Department on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a perfect sustainable alternative to conventional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage Forms & Publications NM Taxation And Revenue Department on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and electronically sign Forms & Publications NM Taxation And Revenue Department seamlessly

- Find Forms & Publications NM Taxation And Revenue Department and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight essential sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and carries the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Forms & Publications NM Taxation And Revenue Department and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct forms ampamp publications nm taxation and revenue department

Create this form in 5 minutes!

People also ask

-

What are pit 1 instructions in airSlate SignNow?

Pit 1 instructions refer to the specific guidelines and procedures for using airSlate SignNow effectively. These instructions provide users with detailed steps to send, eSign, and manage documents efficiently within the platform.

-

How much does airSlate SignNow cost when following pit 1 instructions?

The cost of airSlate SignNow varies depending on the subscription plan you choose. By utilizing pit 1 instructions, you can find the most cost-effective solution that meets your business needs while ensuring you maximize the features available.

-

What features are highlighted in the pit 1 instructions for airSlate SignNow?

The pit 1 instructions highlight key features such as document send, eSigning capabilities, and team collaboration options. Understanding these features ensures you can leverage airSlate SignNow to its fullest potential.

-

Are there any benefits to following pit 1 instructions while using airSlate SignNow?

Yes, following pit 1 instructions provides a clear pathway to utilizing airSlate SignNow's features effectively, resulting in improved efficiency and reduced errors. Businesses can streamline their document management processes by adhering to these guidelines.

-

Can airSlate SignNow integrate with other applications as per pit 1 instructions?

Absolutely! According to the pit 1 instructions, airSlate SignNow can easily integrate with various tools like Google Drive, Salesforce, and more. This integration capability enhances productivity and workflow management for users.

-

What types of documents can I manage using pit 1 instructions in airSlate SignNow?

You can manage a wide range of documents using airSlate SignNow, including contracts, agreements, and forms. The pit 1 instructions guide you through the process of uploading, sending, and eSigning any document type efficiently.

-

Is there support available if I encounter issues following pit 1 instructions?

Yes, airSlate SignNow offers comprehensive customer support if you encounter any issues while following pit 1 instructions. Help is readily available via their support page, ensuring you can resolve concerns quickly.

Get more for Forms & Publications NM Taxation And Revenue Department

- Amendment to lease or rental agreement nevada form

- Warning notice due to complaint from neighbors nevada form

- Lease subordination agreement nevada form

- Apartment rules and regulations nevada form

- Nevada cancellation form

- Amendment of residential lease nevada form

- Agreement for payment of unpaid rent nevada form

- Commercial lease assignment from tenant to new tenant nevada form

Find out other Forms & Publications NM Taxation And Revenue Department

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form